How To Collect Unpaid Invoices From Customers in 6 Simple Steps

Unpaid invoices can impact your cash flow and ability to pay suppliers and cover overheads.

So what happens when an invoice deadline has passed, and you’re still waiting for payment?

You need to have systems in place to ensure you get paid. Keeping cash flowing through your business is key to both survival and growth.

In this guide, we’ll explore the true cost of an outstanding invoice and what you can do to collect unpaid invoices from your customers.

The Actual Cost of an Unpaid Invoice

The true cost of a late payment is far more than the value of the unpaid invoice.

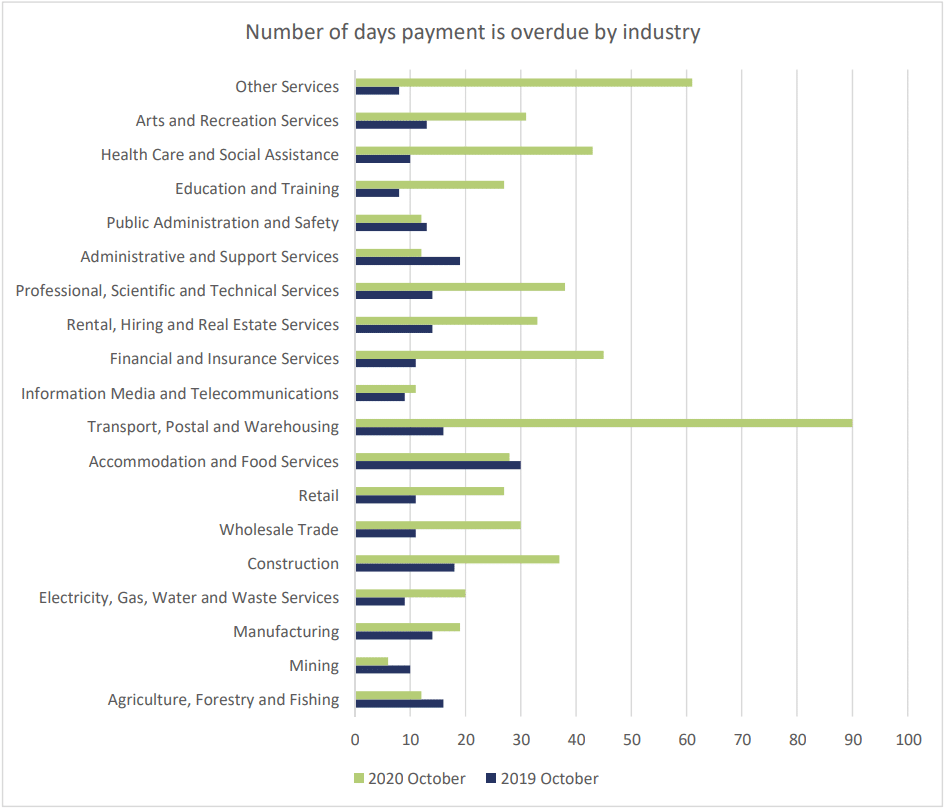

According to the Australian Small Business and Family Enterprise Ombudsman, late payments have significantly increased over the last year. On average, SMEs are forced to wait 37 days past due date to receive payment.

When an invoice is overdue, you’re forced to waste time and energy chasing the payment rather than investing those resources into activities that will grow your business.

There’s also the additional admin cost and the loss of opportunity due to funds being tied up that could be invested in new stock, marketing, and other revenue-generating initiatives.

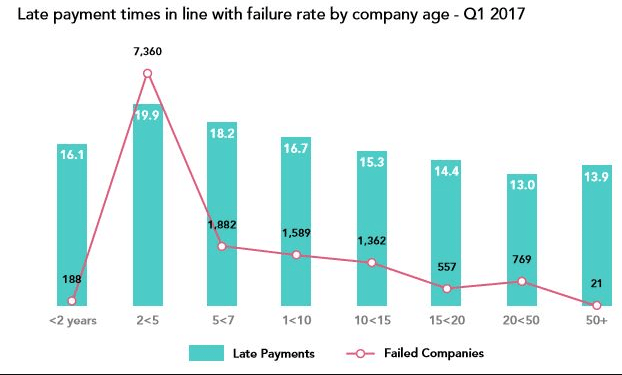

A 2017 study showed a strong correlation between average late payment times and company failure rate:

Image Source: Myob

Unpaid invoices are a serious issue that should be a priority for your business.

6 Simple Steps To Collect an Unpaid Invoice

If your customer hasn’t paid you on time, you need to act. The longer an invoice goes unpaid, the less likely it is that you will be able to collect the total amount owed.

Here’s the six-step process you can use to collect payment without damaging your reputation or destroying your relationship with the client.

1. Charge a Late Payment Penalty

Charging a penalty fee for late payment can motivate clients to pay faster. It can also help you to recoup some of the expenses and time spent chasing the invoice.

If you plan to charge a penalty fee, you need to include the amount and the date it will go into effect in your contract with the client. You can’t charge a penalty fee if it hasn’t already been agreed with the customer at the start of the contract.

It’s also worth considering an early payment discount to encourage your customers to pay faster. For example, many companies offer a 2% discount if the invoice is paid within 10 days of being raised.

2. Follow Up in Writing

If the payment deadline is approaching and the invoice is still outstanding, your first step should be a polite email reminder.

There are many reasons why a client may not have paid yet. A friendly reminder may be all that is required to prompt payment. It can also be an opportunity to foster a deeper relationship with the client and seek out opportunities for more work.

3. Send a Statement of Outstanding Cost

If you haven’t received a response and the invoice is still unpaid, the next step is to send another email or letter containing a statement of outstanding cost.

You should explain that the invoice is now overdue and inform the client of any penalty fee if applicable.

If you are still working on a project for the client, you may want to reprioritise your work schedule. You should give any outstanding work for the client a low priority until you have received payment for the goods/services you have already supplied.

4. Call the Client

It’s much harder to avoid a request for payment over the phone than it is to ignore an email or letter.

Ask if the client has received your previous payment requests and if there is an issue with paying the invoice. Speaking to the client directly over the phone will help you understand the situation and your client’s intentions.

You may find that the client has cash flow issues that prevent them from paying the invoice in full. If this is the case, you should agree on a documented payment plan that details how much the client will pay over what period.

If the client ignores your calls or doesn’t agree to a payment plan, it’s time to raise the stakes.

5. Get Outside Help

If the unpaid invoice is still outstanding, your best option is to seek outside professional help. There are two options to help you collect the money owed to your business.

If the unpaid invoice is still outstanding, your best option is to seek outside professional help. There are two options to help you collect the money owed to your business.

Debt Collection Agency

Debt collection agencies are experts at recovering payments from debtors. You can free yourself from the headache of chasing the payment and focus on the growth of your business. The agency will have tried-and-tested methods for recouping the money owed.

You may find that informing the client that you plan to pass the unpaid invoice onto a debt collection agency prompts payment.

If you do require professional assistance, Integral Collections is a subsidiary of ScotPac that specialises in business debt recovery. We provide tailor-made solutions to achieve the best possible outcome while protecting your business reputation.

Invoice Finance

Large companies are some of the worst offenders when it comes to late payments. According to a report by Xero, Australian SMEs shoulder $115 billion worth of debt on behalf of large companies are corporations.

If you sell to large companies, Invoice Finance can help you access the money you are owed quickly, rather than waiting for your client to pay. You can use your unpaid invoice as collateral to receive up to 95% of the invoice value upfront as a cash advance.

Once the customer has paid, you receive the remaining balance less fees. Depending on the terms of the arrangement, the finance company may also manage the collections and account management.

Read our guide What is Debtor Finance? to learn more about Invoice Finance, including the different types of solutions.

6. Seek Legal Advice

When you have exhausted all other alternatives, your last option is to hire a lawyer. The exact legal action you will need to take will depend on the type of business your client is registered as – pursuing a legal case against a sole trader is different to a claim against a company.

At this stage, it’s essential to consider the potential costs. You need to determine whether the expenses and energy invested in recovering the debt will exceed the value of the unpaid invoice.

For smaller invoices, it’s sometimes more cost-effective to walk away and put processes in place to ensure the situation cannot happen again. For larger invoices, your debt collection agency may be able to offer legal advice and recommend a course of action.

You can learn more about the legal route and what is involved on the Australian Government Business website.

How to Avoid Unpaid Invoices

You can save time and money by preventing unpaid invoices before they become a drain on your resources.

Before entering into a contract, spend some time researching the new client to ensure they are a legitimate company with a good reputation.

It’s also important to set out your payment terms and expectations to prevent problems when the contract is complete. Explain when you will raise an invoice and how long the client will have to settle the bill. You should also make it clear if you plan to charge late fees.

Being upfront at the start of a relationship provides a solid foundation to grow the partnership.

Getting Paid Early with ScotPac

Now you know the actual cost of outstanding invoices and the steps you can take to collect money owed to your business.

The best solution is often to avoid overextending with a customer that is spending beyond their means. Here at ScotPac, we provide credit check services as part of our Invoice Finance facilities to ensure that your customers can pay for the goods and services you provide.

If you’re frustrated by late-paying customers, speak to our friendly team of business finance experts. We can help you collect your unpaid invoices and provide a cash injection to boost your working capital in less than 24 hours.

How To Get a Cash Flow Loan

A cash flow loan can protect your working capital and provide the cash injection you need to plug a gap in your business finances. It’s a fast and convenient way to cover an unexpected bill or fund a period of rapid growth.

But there are lots of different types of cash flow loans. Some are more affordable and accesible than others.

In this guide, we’ll explore the different cash flow loan options, what you need to qualify, and how to apply.

What Is a Cash Flow Loan?

A cash flow loan is a broad term that covers a range of finance products designed to support working capital requirements by leveraging a company’s expected future earnings.

This type of financing is beneficial for growing businesses, those with no real estate collateral, and companies that need to raise funds quickly. Cash flow loans are usually repaid using incoming cash flows rather than set monthly repayments.

How Do Cash Flow Loans Work?

In simple terms, a cash flow loan allows a business to access funding based on the value of its future earnings.

The finance company will use projected sales revenue, accounts receivables, or historical performance to determine how much you can borrow. Because the funding is based on future earnings, you can often access cash flow financing even if your credit score isn’t perfect or you don’t have a long trading history.

According to a recent survey, 37% of Australian SMEs have found it more challenging to access funding since the start of the Covid-19 pandemic, with 26% saying they had been rejected for finance.

Cash flow loans are much easier to qualify for than a traditional business loan. The application process is much faster, there’s no need for real estate collateral, and you can get approval and receive funding in as little as 24 hours.

When Is a Cash Flow Loan Useful?

A cash flow loan can be beneficial if you:

- Need fast funding to cover an unexpected cost

- Want to fund a growth project without damaging working capital

- Experience seasonal sales

- Need to cover cash flow gaps caused by extended payment terms/late-paying customers

- Want to negotiate bulk purchase discounts with suppliers

- Need to cover payments to suppliers due to spike in demand

What Do You Need To Qualify for a Cash Flow Loan?

Unlike a traditional business loan, cash flow loan providers typically do not require any real estate collateral. You don’t need to risk your home to secure funding.

You will need to provide up to date financial statements to show the financial health of your business. Because the funding is based on your future cash inflows, the lender will focus on your accounts receivables and your cash flow forecast to see if you qualify.

With Invoice Finance, the lender will want to see the payments history of your customers to see if they pay invoices on time.

4 Best Cash Flow Loan Options

There are several different cash flow loan products available to Australian businesses. The right solution for you will depend on your unique circumstances and the reason for seeking funding.

Let’s take a look at the pros and cons of the four best cash flow loan options so you can see which is the best fit for your needs.

1. Business Line of Credit

A line of credit can provide flexible access to funding to support working capital requirements. The lender will approve a credit limit that you can draw down as and when you need.

As you make repayments and clear the balance, funds become available again. You are only charged interest on the amount borrowed, but some lines of credit are subject to a monthly facility fee.

However, a line of credit is typically secured using real estate collateral.

An alternative solution is to combine a line of credit with an Invoice Finance facility. You can use your unpaid sales invoices as collateral for the line of credit. As you raise new invoices, the line of credit increases. This means your access to credit rises in line with the growth of your business.

2. Trade Finance

Trade Finance is a type of cash flow financing designed to support import/export and domestic trade transactions.

If you buy from overseas, a Trade Finance facility can provide funding to pay your supplier and cover the cash flow gap while the goods are shipped and sold.

If you export to overseas customers, Trade Finance can provide the funding you need to pay your suppliers, manufacture goods, and cover the period it takes for your customer to pay.

This type of cash flow loan can benefit companies that struggle with capital being tied up in the supply chain for extended periods. For example, if you need to cover an upfront payment to a supplier, a Trade Finance facility can provide funding to cover a cash flow gap of up to 180 days.

3. Invoice Finance

If your business suffers from cash flow gaps due to extended payment terms or slow-paying customers, Invoice Finance can provide fast access to capital. Instead of waiting 30+ days for your customer to pay, you can get a cash advance of up to 95% of the invoice value.

When your customer pays, you get the remaining balance of the invoice less fees. This type of cash flow loan is one of the most popular in Australia. There’s no need for real estate collateral, and a facility can be approved and put in place in as little as 24 hours.

There are some drawbacks to Invoice Finance that make it unsuitable for some businesses. For example, the amount you can borrow is limited to the value of your accounts receivable.

You will also lose a percentage of your profit margin in fees. If you operate on a high volume low margin strategy, this could affect your bottom line.

If you want to learn more about this type of cash flow lending, read our guide, What is Invoice Finance?.

4. Merchant Cash Advance

If you sell direct to consumers, a merchant cash advance can provide a fast injection of working capital. This type of cash flow loan can be a good alternative for businesses that don’t qualify for Invoice Finance.

You can receive a cash advance based on the value of your future credit and debit card sales. The finance company will look at your historical and projected card sales to determine how much you can borrow.

The advance and interest are repaid as a percentage of your card sales. When you process a card transaction, a percentage of the sales value is automatically deducted. This means you don’t need to worry about making monthly repayments, but your daily cash flow will be lower until the advance, plus interest, is repaid.

A merchant cash advance can be a convenient cash flow loan option for some businesses, but it is also one of the most expensive types of business finance. You can learn more about this type of financing by reading our guide, The Pros and Cons of a Merchant Cash Advance.

What To Look For in a Cash Flow Finance Product

There are pros and cons to each type of cash flow loan, so it’s important that you choose the most suitable option for your company. For example, a line of credit can be difficult to qualify for if you don’t have real estate collateral, while a merchant cash advance can be an expensive way to fund your business.

You should also determine whether regular access to funding or a one-off lump sum will benefit your company more. For example, the flexibility of a revolving line of credit or Invoice Finance facility can be helpful if you experience regular cash flow gaps.

How to Apply for a Cash Flow Loan

While traditional bank loans and lines of credit are subject to strict lending requirements, cash flow loans are generally much more accessible.

The first step to applying for a cash flow loan is determining which product suits your needs. Our dedicated team of business finance experts at ScotPac are on hand to help you find the right cash flow financing solution.

We have over 30 years of experience helping Australian SMEs with simple funding solutions to complex business challenges. Give us a call or fill in our online application form, and we’ll work with you to get the funding your business needs to thrive.

3 tips for fast growth SMEs and 3 tips for businesses who are struggling

New financial year has highlighted two speed economy – finance tips for SMEs who are thriving and those who are struggling.

Australia has a tale of two economies right now, depending on the state or sector, prompting the nation’s largest non-bank SME lender to provide tips for business owners trying to manage cashflow in these two very different environments.

ScotPac senior executive Craig Michie said while these business scenarios were very different, there were common actions for business owners to take.

When it comes to managing fast growth or getting through difficult trading conditions, business owners must communicate clearly with their finance providers.

Also, SMEs trying to secure working capital for the business would be well served by looking at the assets on their balance sheet to find additional capital, Mr Michie said.

Three tips for managing growth

1. Find a flexible source of funding

Fast growth businesses need strong cashflow, as they have more cash held up in their debtor’s ledger, Mr Michie said.

“It’s important to find a source of funding that grows as your business grows. With invoice finance, as your debtors grow, so does the line of credit you can access.

“Another consequence of fast growth can be a demand on the business to put in place more capital assets, such as vehicles and equipment. In these situations, asset finance can help a business get the assets they need to support their rapid growth,” he said.

2. Negotiate with suppliers

If your need for goods places demands on suppliers that outstrip the terms they can give you, you’ll need a good line of communication to see if you can renegotiate terms.

“One option for fast growth businesses to have up their sleeves is to use trade finance. This ensures they can pay suppliers up front so they can meet their increased demand for product,” Mr Michie said.

3. Cashflow forecasting is a MUST

“It’s not unusual for a small business to spend months winning big new clients, then realise they had not accounted for the cashflow implications of winning new business,” he said.

“Putting in place a 13-week rolling cashflow forecast – which really would only take an hour with your accountant to set up, helps fast growth businesses avoid cashflow issues.”

Three tips for getting through tough conditions

1. Talk to your funder and the ATO

Mr Michie said it’s crucial for businesses struggling through adverse trading conditions (including the recent three state lockdown, and with NSW still facing uncertainty) to get into a dialogue with their financiers.

“Do this early in the piece to get the best outcome. Talk to your funder about whether it’s possible to restructure or to put in place moratoriums,” he said.

He said SMEs should not put off talking to the ATO about their position.

“Too many businesses make the mistake of thinking a problem ignored is a problem solved – getting on the front foot with tax obligations is vital if you want your business to be a going concern.”

2. Look to your balance sheet for capital

Mr Michie said an SME trying to find more capital can look to the assets on its balance sheet to see what’s available to secure working capital for the business.

“To raise much-needed funds for the business, balance sheet assets can be a hidden resource for many SMEs – your debtor’s ledger, unencumbered plant and equipment and even inventory can be used to bring working capital back into the business.”

3. Again, cashflow forecasting is a MUST

Having in place a running 13-week cashflow forecast lets a business owner spot any cashflow gaps on the horizon, with enough time to do something about it. This could include pulling levers such as reassessing your cost base, negotiating with creditors to defer payments or change terms, or running a blitz on aged receivables.

This is just as important for businesses navigating difficult trading conditions as it is for fast growth businesses.

“Cashflow forecasting gives a business owner better control, because they have a very accurate view of how the business is trading,” Mr Michie said.

ScotPac is Australia and New Zealand’s largest non-bank business lender, providing funding to small, medium and large businesses from start-ups to enterprises exceeding $1 billion revenues. For more than 30 years ScotPac has helped thousands of business owners succeed, by unlocking the value from their business assets. Whether it is purchasing stock, investing in vehicles and equipment, improving cash flow or accessing additional working capital, ScotPac can help.

For more information contact:

Kathryn Britt

Director, Cicero Communications

[email protected]

0414 661 616

How to Access Working Capital Without a Loan | ScotPac

Every business needs working capital to thrive and grow. But cash flow can easily become stretched due to unexpected costs, late-paying customers, and periods of rapid growth.

Business owners used to turn to bank loans and credit cards from traditional lenders to access funding. But these financing solutions typically involve restrictive loan debt and strict lending criteria.

Fortunately, there are many ways to raise capital without taking on loan debt or worrying about repayments. If you want to improve your cash flow, consider using the following business financing strategies.

Liquidate Surplus Inventory

On average, 80% of profits are generated by 20% of business inventory. Not only does excess inventory take up space, but it also ties up capital that could be re-invested into your business.

This is a particular concern for retailers and wholesalers. Releasing the capital tied up in excess inventory can be an effective way to raise funding from within your business.

You can run clearance sales to sell off surplus inventory at a discounted price or consider combining slow-moving items with high turnover products in a bundle deal. If you need to raise capital quickly, you could consider using a surplus stock buyer to liquidate excess inventory in bulk.

Encourage Clients to Pay Faster

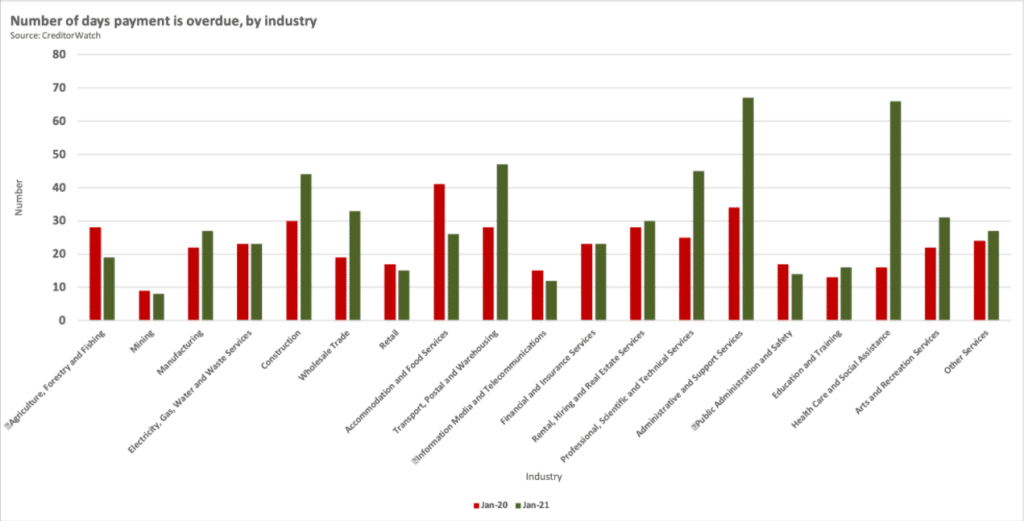

Slow paying customers are an issue for every industry sector in Australia. Over the course of the COVID-19 pandemic, average invoice payment times extended even further:

Image Source – Creditorwatch

You can increase working capital by encouraging your customers to pay you faster. For example, many businesses offer an early payment discount to encourage your clients to pay sooner. You can also add late charges to your payment terms as a disincentive.

Invoice Finance

If your business experiences cash flow gaps due to extended payment terms or slow-paying customers, Invoice Finance can be a fast and effective way to raise capital. Instead of waiting 30+ days after raising an invoice for your customers to pay, you can receive up to 95% of the invoice value as an immediate cash advance. Then, when your customer pays the invoice, the remaining balance is transferred to your account, less fees.

Invoice Finance can be a great way to release capital already in the business, rather than selling equity or taking on loan debt. This type of financing is generally much more flexible and accessible than traditional bank financing. You can choose from a confidential Invoice Discounting facility or a full-service Debt Factoring solution that includes collection and account management services.

You can find out more about the different types of Invoice Finance by reading our guide Invoice Discounting vs Factoring.

Asset Finance

Asset Finance is a flexible funding solution that can be used to support working capital needs. There is a range of asset funding options that enable you to release capital from the assets your business already owns.

For example, if your business owns property, equipment, or vehicles, you can use those high-value assets as collateral to access immediate funding. This type of funding is also known as asset refinancing. The lender will inspect the asset and provide a valuation. When you receive the cash advance, you temporarily transfer ownership of the asset to the lender. You will still be able to use the asset, and the ownership will be transferred back to your company when the finance is fully repaid.

Although this type of financing does not involve loan debt, you will need to make regular repayments over the arrangement term.

Merchant Cash Advance

A merchant cash advance is a form of cash flow lending that enables a business to access an immediate cash advance based on expected credit card sales. The amount you can borrow is determined by the value of your average monthly sales taken by card.

The cash advance is repaid automatically, so there are no set monthly repayments. When a customer pays by card, a percentage of the sales value is automatically sent to the finance company. The lender will continue to take a percentage of card sales until the principal and interest are paid off.

This type of financing can be helpful for seasonal retail businesses with fluctuating sales volumes. However, the rates of interest can be high compared to other financing options.

Read our guide on The Pros and Cons of a Merchant Cash Advance to see if this solution could be suitable for your business.

Crowdfunding

Crowdfunding is a way for startups and more established businesses to raise capital. You can offer potential investors an exclusive benefit or product in exchange for funding, or you can offer equity in your company.

It’s become increasingly popular over the last decade, but crowdfunding is not a suitable financing option for every business. Businesses with an innovative product or service and high growth potential tend to do best on crowdfunding platforms.

You’ll need a great marketing campaign to generate interest, and be prepared to wait for a long time before you achieve your funding goals.

Government Grants

There are a number of government grants available to Australian small businesses, entrepreneurs, and exporters. You can essentially get free money to help you grow your business. There are no repayment terms. If you qualify, you could access the funding you need without selling equity or taking on debt.

However, the application process for government grants is often long and difficult. You can expect tough competition, and you will need to prove how you will use the money in your application. In addition, there are usually strict restrictions on how grant funding can be spent.

You can find out about grants and programs for small businesses on the Australian Government Business website.

Angel Investment

Angel investors are individuals that are willing to invest in growing businesses in exchange for equity. The goal for an angel investor is to help a business scale so that the share value increases and they can sell their equity for a profit at a later date.

Many angel investors can also provide connections and mentoring to help the business succeed. This type of business financing typically takes place during the early growth period of a company. You’ll need to be prepared to give up equity in your business and be comfortable with a third-party influencing decision making.

To find an angel investor, you’ll need to be prepared to wait until the right investor comes along and be constantly networking. You’ll also need to have a great pitch and business plan.

Vendor Financing

If you experience cash flow gaps because your payables are due before your receivables, you could increase working capital by negotiating longer payment terms with your suppliers. This type of financing can be most beneficial for businesses that have long sales cycles.

Another way to increase payment times is to use Supply Chain Finance.

Supply Chain Finance is a form of financing that can benefit both the supplier and the buyer in a business transaction. Using a combination of Trade Finance and Invoice Finance, a Supply Chain Finance facility can fund cash flow gaps of up to 180 days. It facilitates early payment for the vendor and longer payment terms for the buyer.

Family and Friends

Friends and family are a source of debt-free capital for many entrepreneurs. For example, Jeff Bezos started Amazon with equity financing from friends and family. In 1994, Bezos held 60 meetings with friends and family to help him raise an initial $1 million to launch the e-commerce company.

If you decide to raise capital this way, it’s important to be professional about the funding arrangement. Make sure everything is documented, and have the agreement reviewed by a legal professional.

Finding the Right Working Capital Solution for Your Business

Accessing capital can be one of the biggest challenges you face as a business owner. But there are plenty of options to help you get the funding you need without taking on loan debt or tying your business down to lengthy repayment terms.

If you need some help determining which option is right for you, contact our team of friendly business finance experts today. We’ll help you get the capital you need with a simple and straightforward funding solution.

5 Best Emergency Business Finance and Loan Options

Almost every company encounters financial problems at some point during the lifespan of the business. In fact, over 60% of small business owners regularly struggle with cash flow issues.

If you’re experiencing a cash flow crisis and you don’t have a rainy day fund, you’ll need emergency funding to help you get your business back on track.

In this guide, we’ll take a look at the types of emergency business loans and financing options available in Australia. You’ll learn the pros and cons of each so you can choose the right solution for your needs.

5 Ways to Finance Your Business During an Emergency

1. Business Credit Card

A business credit card can be a good short term funding solution to help you cover emergency costs. You can avoid any upfront expenses and spread payments over a more extended period.

If your credit score has taken a hit due to a financial crisis, a business credit card can also be an effective way to rebuild your score. Keeping on top of your monthly repayments and clearing your debt will increase your credit score and make your business more attractive to lenders.

However, credit cards typically have high interest rates. If you cannot clear your balance in full each month, it’s easy to slip into a spiral of debt. As interest mounts up, repayments become more and more expensive. Many credit cards are also subject to additional fees that can add to your debt.

Credit card applications are faster than an emergency business loan, but they take longer than other types of emergency business financing.

Pros:

Flexible – You can use the credit card as and when you need it.

Improve Your Credit Rating – Credit cards can be a good way to build up your credit score.

Cons:

Expensive – Credit cards are usually subject to high interest rates.

Easy To Fall Into Debt – Charges and interest can quickly mount up if you don’t clear your balance each month.

2. Invoice Finance

Invoice Finance is the fastest way to access emergency funding if your business sells to other businesses on net terms. Invoice Finance is a type of cash flow financing that enables you to use your outstanding sales invoices as collateral to secure funding.

The finance company will provide up to 95% of the invoice value upfront as a cash advance. When your customer pays the invoice, the finance company transfers the remaining balance to your bank account, less fees.

For example, let’s say you have outstanding invoices totalling $20,000. Rather than waiting 30+ days for your customers to pay, you submit the invoices to the finance company and receive up to $19,000 upfront as a cash advance. Then, when your customers pay, the finance company transfers the remaining $1,000, less fees.

Invoice Finance can be an effective way to ease the pressure of late-paying customers and extended payment terms. According to the Australian Small Business and Family Enterprise Ombudsman, average payment times have doubled due to the impact of the Covid-19 pandemic:

Pros:

Fast Funding – Invoice Finance is one of the quickest ways to raise capital.

No Long Term Debt – By releasing capital tied up in your invoices, you don’t need to take on any new debt.

Cons:

Reduced Profit – The finance company will charge a fee that reduces your profit margin on each sales invoice you choose to fund.

Limited by Invoice Value – You can only access funding up to the value of your outstanding invoices.

Find out more about this type of financing and a more detailed breakdown of the pros and cons by checking out our guide What is Invoice Finance?.

3. Merchant Cash Advance

A merchant cash advance is another type of cash flow financing that allows you to secure funding based on your expected earnings. Rather than using outstanding invoices, the finance company uses the expected value of card sales to provide a cash advance to your business.

You receive a lump sum upfront and repay the amount owed plus interest through a percentage of your future card sales. The funding provider will look at your historical card sales revenue to determine how much you can borrow.

Along with Invoice Finance, a merchant cash advance is one of the fastest ways to raise emergency funding. However, merchant cash advances typically involve high interest rates.

If you need working capital fast and don’t qualify for Invoice Finance, a merchant cash advance can be a good option. If time isn’t a pressing issue, other emergency financing solutions can provide more affordable funding.

Pros:

Fast Funding – Like Invoice Finance, this is one of the fastest ways to raise capital.

No Fixed Monthly Repayments – The amount you repay monthly is determined by the volume of card sales you process.

Cons:

High Interest – Merchant cash advances are one of the most expensive emergency funding options.

Can Hurt Long-Term Cash Flow – With a percentage of your card payments deducted every day, a merchant cash advance can later cause more cash flow problems.

For more information on this type of financing, read our guide, The Pros and Cons of a Merchant Cash Advance.

4. Business Line of Credit

A line of credit works in a similar way to a business credit card. You can use the credit facility when you need it and only pay interest on the amount you have drawn down. As you make repayments, the amount of credit you can access increases again. Some lines of credit are subject to monthly facility fees.

This type of emergency business finance can help you get through a cash flow crisis. The rates of interest are generally cheaper than a business credit card. However, the application process for a line of credit can take time. You’ll need to have a good credit score and trading history to qualify, and many lenders also require real estate collateral.

An alternative solution is to combine Invoice Finance with a line of credit. Here at ScotPac, we provide Invoice Finance solutions linked to a flexible revolving line of credit with no property security required.

Pros:

Flexible – You can use the facility when you need to cover unexpected costs and emergencies

Only Pay Interest on What You Use – Interest is only charged on the amount of credit you have drawn down.

Cons:

Long Application Process – It can take several weeks for a line of credit to be approved and made available.

Hard To Qualify For – This type of emergency business finance is usually only available to businesses with a long trading history and strong credit score.

5. Asset Finance

The best way to quickly raise emergency funds for many companies is to release capital from within the business rather than taking on new debt. You can use high-value assets your business owns, such as machinery, vehicles, and equipment, to secure immediate funding.

Asset Finance, or asset refinancing, is a way to release capital tied up in the assets your business already owns. When you apply for Asset Finance, the funding provider will inspect the asset you want to refinance and provide a valuation. This valuation is used to determine how much you can receive as a cash advance.

Once you have received the advance, the ownership of the asset is temporarily transferred to the funding provider. You can still use the asset while it is financed. When you have repaid the advance and interest, ownership of the asset is transferred back to your business.

Read our Client Story to see how Asset Finance helped Australian food icon SPC unlock trapped value and fund new growth.

Pros:

Unlock Value in Your Business – Asset Finance enables you to raise capital from within your business rather than taking on new debt.

Keep Using the Asset – Get immediate funding while still being able to use the asset.

Cons:

Long Application Process – A surveyor will need to value your asset before it can be used to access funding.

Risk of Losing the Asset – If you fail to make repayments, you could risk losing the asset.

Why Small Business Loans Aren’t Suitable For Emergency Business Finance

While business loans are the first option many business owners think of when they need emergency funding, this type of financing is not suitable when you need fast access to capital.

The application process for a business loan can take up to several weeks or months. In an emergency, the extended approval process means bank loans are not practical. Traditional lenders typically also require some form of real estate collateral. If you don’t own your home or don’t want to risk losing it, emergency business loans are not an option.

How to Speed Up the Emergency Business Finance Application Process

Time is a pressing issue during a financial emergency. If you need to secure funding quickly, making sure your accounts and financial statements are up to date can help to speed up the process.

Most emergency business loan lenders will want to see accurate details of your current trading history and review your financial statements. For Invoice Finance, the funding provider will also need to review the payment history of your customers.

Keeping your records up to date makes it easier for lenders to evaluate your business and quickly put a funding facility in place.

Why a DIY approach to small business can be costly – and how to turn your fortunes around

Many small business owners rightly pride themselves on their independence – after all, you want to do it yourself and take on the world (or at least your local market).

However, new research from accounting platform Xero and market research firm Forrester suggests toning down such boldness may be wise because larger SMEs typically perform better than their smaller counterparts as a result of getting external advice.

While a positive mindset is crucial, the latest ScotPac SME Growth Index also highlights the fact that many SMEs are shunning the knowledge of financial advisors. The poll of 1253 small businesses that East & Partners conducted shows that just one in five small businesses (17.7%) seeks expert advice for long-term strategic planning.

In the face of additional challenges confronting SMEs as a result of COVID-19, the Index provides some actions that can make a difference as you navigate the road to recovery during the pandemic.

1. Work with trusted advisors

The research from Xero and Forrester indicates that small businesses represent more than 90% of all global businesses, yet only 26% of them consult trusted advisors such as accountants or other financial experts.

The findings indicate that those who have thrived throughout the pandemic are businesses that lean on expert advice. This aligns with previous SME Growth Index results.

A DIY approach may be short-sighted because experts can provide tips on better understanding your cashflow position and help you take proactive steps to bolster your financial situation. The Index shows that, overwhelmingly, when small businesses turn to trusted advisors it is for tax and compliance advice – this was nominated by 93.2% of respondents. Asset acquisition and disposals (34.1%) and succession planning (26.8%) are also areas where SMEs look for guidance.

However, they fail to take advantage of other areas of potential assistance, with just 13.7% seeking M&A advice and only 10% getting risk-management tips.

The message? Don’t be stubborn – and reach out to experienced advisors as you strive for post-pandemic success.

2. Check out smarter finance solutions

There is no doubt that adopting better working capital solutions can improve cashflow and long-term sustainability for smaller businesses. Yet many SME owners remain trapped with bank funding that relies on equity in their home to fund their business.

East & Partners found that long-term strategic planning remains a low priority for many small businesses, especially those who say they are in a declining or static business phase. This group is characterised by a higher level of primary bank funding (22.7%) relative to growth SMEs (only 15.8% of whom use primary bank funding for growth).

The finding highlights the importance of exploring other more appropriate business funding solutions such as invoice finance, which alleviates waiting times for invoices to be paid and gives businesses an upfront cashflow boost. As an indication of just how crucial this can be, the Index reveals that 72.5% of SMEs are struggling as a result of cashflow issues.

3. Invest in your business

The instinctive reaction of some business owners during crises such as COVID-19 is to hope for the best and bunker down.

However, the SME Growth Index highlights the dangers of being complacent and demonstrates where external advisors can make a difference. One issue occurs when businesses hold on to cash. Brokers and other financial advisors should be having conversations with their clients on the importance of investing in their businesses so they can gain a competitive advantage.

Advisors can also help their clients develop funding strategies that help to manage working capital. SMEs are often in vital need of cashflow solutions, with stock-buying, invoicing and seasonality being major factors in the lifecycle of a business.

Smart investment, built around robust working capital solutions, can be a game-changer.

4. Restructure your business

The Index shows that two-thirds of SMEs are seeking transformation through restructuring efforts, including reassessing their funding options.

Many are planning a comprehensive analysis of their operations at a time when the Australian Government’s new small business restructuring laws are in play and which are designed to make it easier for eligible businesses to reset their balance sheets and return to profitability. Cost-cutting is also on the agenda, including the option for some of shifting head office or downsizing.

5. Consider entering new markets

When one door shuts, another opens. As tough as the pandemic has been on many businesses, it has also created opportunities for smart, agile players in a range of markets.

One option is to export, but the complexities of international markets highlight the importance of getting the assistance of experienced financial advisors with a track record of success.

Trade finance, a facility that uses a revolving line of credit to pay overseas or local suppliers in almost any currency, can be an option for those SMEs targeting new international markets. It can deliver fast funding for stock, inventory and raw materials, so you don’t have to turn away new orders. The line of credit can be used to pay your overseas or local suppliers and close any cashflow gaps.

Don’t go it alone

The message is clear for SMEs that may be spooked by the pandemic. Don’t stand still; be positive; and, perhaps most importantly, seek out external advisors who can help you survive and thrive.

The SME Growth Index clearly shows that many SMEs are nervous because of the impact of the pandemic. When asked how they felt about running their business now, compared to their feelings in early 2020 before COVID-19 hit, 55.3% indicated they are less positive, exasperated, uncertain or feel they are lacking support.

Such trepidation is understandable, but reaching out and getting external advice can mean the difference between success and failure for many SMEs. So take action now.

How ScotPac can help

Do you need additional working capital facilities to support your plans for the new financial year and beyond? Now is the perfect time to talk to us about a review of your solutions and whether we can help to unlock more opportunity in your business. Contact us today for more information.

Secure your cashflow before undertaking EOFY initiatives

MEDIA RELEASE

Some of the popular end of financial year measures businesses undertake could be risky unless SMEs put in place measures to secure adequate cashflow, ScotPac CEO Jon Sutton has warned.

Mr Sutton said measures such as the temporary full expensing extension are there for SMEs’ benefit, but taking advantage of such measures requires good cashflow.

“It’s no good using the instant asset write-off measures to buy a piece of equipment if making that purchase puts a severe dent in your cashflow,” Mr Sutton said.

“Embedding cashflow forecasting into the business and securing funding that ensures good cashflow will help SMEs navigate any risks around their EOFY and new financial year initiatives.

“Putting in place a flexible capital structure, offered by funding options such as invoice finance, means a business can act when opportunities arise.

Tips for EOFY

ScotPac has the following tips for SMEs as the financial year comes to a close:

Tip 1 – Understand the exact cash needs of your business. Having a clear idea of how much cash you need to maintain your business-as-usual activities allows you to:

a. Identify if you have excess cash which may be better invested or even used to take advantage of available incentives such as the instant asset write off; or

b. Identify if there’s a shortfall which will impact your ability to meet obligations as they fall due – this is particularly important when considering outstanding ATO liabilities

Tip 2 – Think about what fixed assets, if any, your business needs now and into the future. Providing you meet the eligibility criteria, your business should be entitled to an immediate tax deduction for the cost of the asset. Remember for this to hit your FY21 tax position, the asset must be installed and ready for use BEFORE 30 June.

Tip 3 – if you haven’t already done so, book in with you advisor and chat through your business ambitions for the next 12 months. Partnering with a trusted advisor now will help give you the best chance to position your business for success in FY2022.

Getting on the front foot with ATO

Mr Sutton had a word of caution for businesses who had relied on the ATO’s lenience over the past 12 months with COVID-19, by not keeping up to date with lodgements or not making their BAS payments.

“The ATO has been very lenient during the pandemic, allowing the small business sector a lot of leeway and time to recover,” Mr Sutton said.

“As we move into a post-COVID environment and many businesses return to growth, those with outstanding lodgements or payments need to get on the front foot with the ATO,” he said.

Pro-actively approaching the ATO and working out a payment scheme is much more advisable than simply putting your head in the sand about ATO debts and waiting for them to approach you.

“It all comes back to careful cashflow management – if you have imminent ATO debts, work out how much realistically you can afford to pay and have an open dialogue with them about repayments,” Mr Sutton said.

“Using Invoice Finance funding can work well in these situations – this brings forward payment of your invoices so you have cash in hand. You get 80% of your invoices paid straight away, and the remainder later.

“Now is a great time to assess whether your business could benefit from a self-liquidating revolving line of credit facility, rather than further exposing yourself by taking on more loan repayments,” he said.

ScotPac is Australia and New Zealand’s largest non-bank business lender, providing funding to small, medium and large businesses from start-ups to enterprises exceeding $1 billion revenues. For more than 30 years ScotPac has helped thousands of business owners succeed, by unlocking the value from their business assets. Whether it is purchasing stock, investing in vehicles and equipment, improving cashflow or accessing additional working capital, ScotPac can help.

For more information contact:

Kathryn Britt

Director, Cicero Communications

[email protected]

0414 661 616

SME Growth Index Insight 5: Cash flow woes still high – but not as bad as usual

Cash is always king but never more so than during the pandemic and recovery.

Cash is always king but never more so than during the pandemic and recovery.

Many small businesses are hoarding cash and staying on the sidelines until they feel confident enough to invest in their own growth.

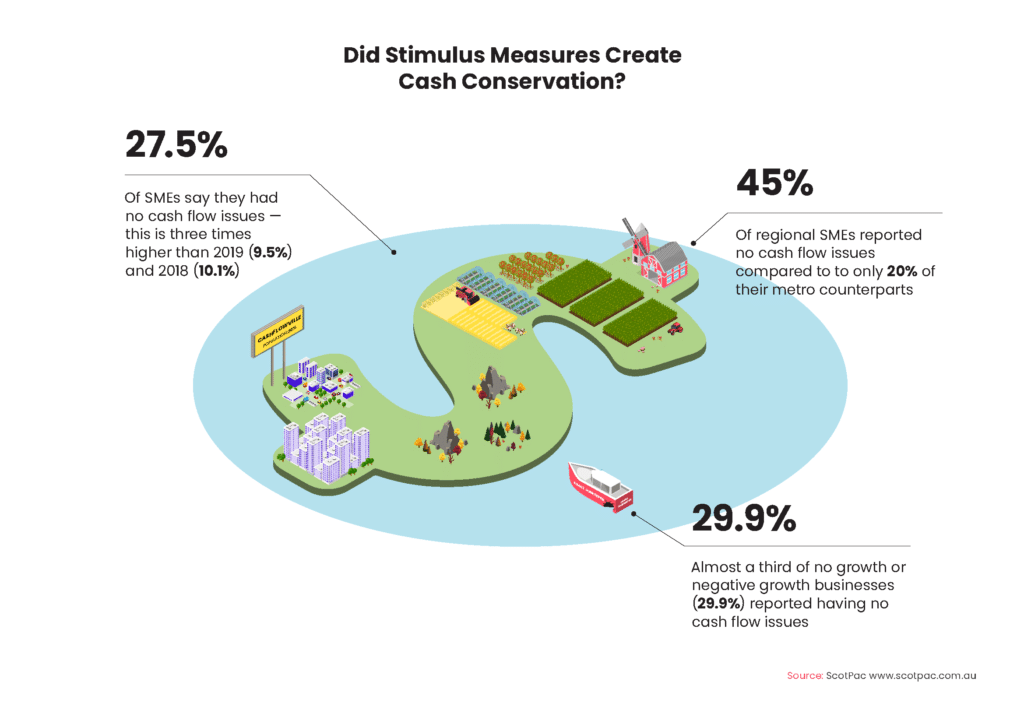

This is a key takeaway from the March 2021 SME Growth Index, with results showing that over the past 12 months substantially fewer small businesses than usual experienced cash flow issues.

This round, 72.5% of small businesses had cash flow problems, compared to the 90% who usually report these issues.

This is perhaps an indication that government COVID-related stimulus measures in 2020 had the desired effect.

However, it still equates to almost three in four small businesses experiencing cash flow issues, despite the low interest rate environment and the extensive SME loan support options available.

This round a full 27.5% of small businesses had no cash flow woes – this compares to the March 2018 result when 10.1% were free of cash flow issues, while in September 2019 it was 9.5% who reported no cash flow concerns.

This prompts the question – did the pandemic stimulus packages actually improve cash flow for many small businesses?

SMEs definitely appear to have been conserving cash during 2020. For some businesses this was facilitated by government support measures, but for others it looks to have been more about stripping out costs and banking whatever cash they could. This trend is quite similar to the retail savings growth that occurred over the same period.

Given the aim for many businesses in 2020 was simply survival, this cash conservation on face value might not seem like an issue – however, there are longer term implications.

If businesses continue to conserve cash within their enterprises, and if they are not actively looking to invest to help their business grow, they run the risk of becoming less relevant in their market.

The finding that a third of SME respondents are trying to grow revenue via new and existing customers doesn’t gel with the fact that so many are not yet looking to invest in their own businesses to facilitate that growth.

If businesses do have cash reserves off the back of stimulus measures and being more conservative to get through the pandemic, it could be prudent to use those cash reserves to engage an expert adviser to guide them on the right strategies and funding for growth and recovery.

Allowing these cash holdings to be strategically unlocked would bode well for forward investment, including possible job hiring and revenue growth.

Who is reporting no cash flow issues?

Of the 1253 SMEs in the research, 345 of them reported having no cash flow issues. Among them:

- 45% of regional SMEs reported no cash flow issues compared to only 20% of their metro counterparts, which concurs with Commonwealth Bank of Australia analysis about the health of regional Australia.

- A large proportion of the SMEs reporting no cash flow issues are those identifying as negative growth businesses. While the cohort is small, this data point lends weight to the hypothesis that it is the “propped up” SMEs who are on top of cash flow, assisted by cash grants, loan payment deferrals, wage subsidies and asset write-offs.

- Very small businesses appear to be hoarding cash. While the data from this round of the Index generally shows smaller sized SMEs as worse off than their larger sized counterparts, that is not the case for this data point – of the SMEs reporting no cash flow issues, the majority are small (SMEs with one to 20 full-time employees).

What causes cash flow woes

Over the years the Index has consistently highlighted cash flow constraints as one of the top barriers to a healthy business, especially for growth SMEs.

Government red tape and compliance issues remain the most pressing cash flow issue for the whole SME cohort over the past 12 months.

Red tape and compliance (44.3%) was nominated by almost twice as many respondents as the two other top cash flow concerns, difficulty meeting tax payments on time (23.9%) and failed credit applications (22.9%).

A further 16.5% of businesses struggled with cash flow when their credit lines were reduced, and 14.6% were unable to take on new work due to cash flow restrictions. These factors may have had the effect of prolonging the COVID downturn for many small businesses.

The strain of greater outcomings and fewer incomings was evident, with reduced supplier payment terms causing cash flow issues for 20.8% of respondents and late customer invoice payments creating problems for 20% of businesses.

With JobKeeper no longer in place it is likely that the low number of firms currently reporting cash flow concerns due to bad debts (3.9%), losing key debtors (3.8%) or losing key suppliers (1.6%) may push higher during 2021.

Top cash flow strategies

In the wake of the pandemic small businesses have outlined the strategies they will use to manage their working capital in 2021.

Common strategies range from cash flow forecasting, to making arrangements with the ATO and putting in place cash flow friendly funding such as invoice finance.

From the whole SME cohort, 27.8% plan to focus on cash flow forecasts; this strategy is much more prevalent amongst larger SMEs (it will be utilised by 48.6% of large SMEs, but only 9.1% of small SMEs).

Outside of the response options, respondents wrote in the next two most popular strategies – focusing on existing customers to grow revenue (27.5%) and expanding with new customers (21.8%).

Almost one in five SMEs (17.2%) say they will make special arrangements with the ATO regarding tax payments.

Another common way to manage working capital is to use invoice finance to smooth out cash flow peaks and troughs (a plan nominated by 15.6% of SMEs).

More than one in 10 (11.7%) say they will take out or increase their overdraft, while a similar number (11.6%) will seek out online funding providers.

Of concern is the response by more than one in 10 business owners (11.6%) that they will manage working capital by relying on personal finances such as credit cards.

This confirms that many small businesses have ingrained credit accessibility issues, despite the deluge of COVID-related stimulus measures.

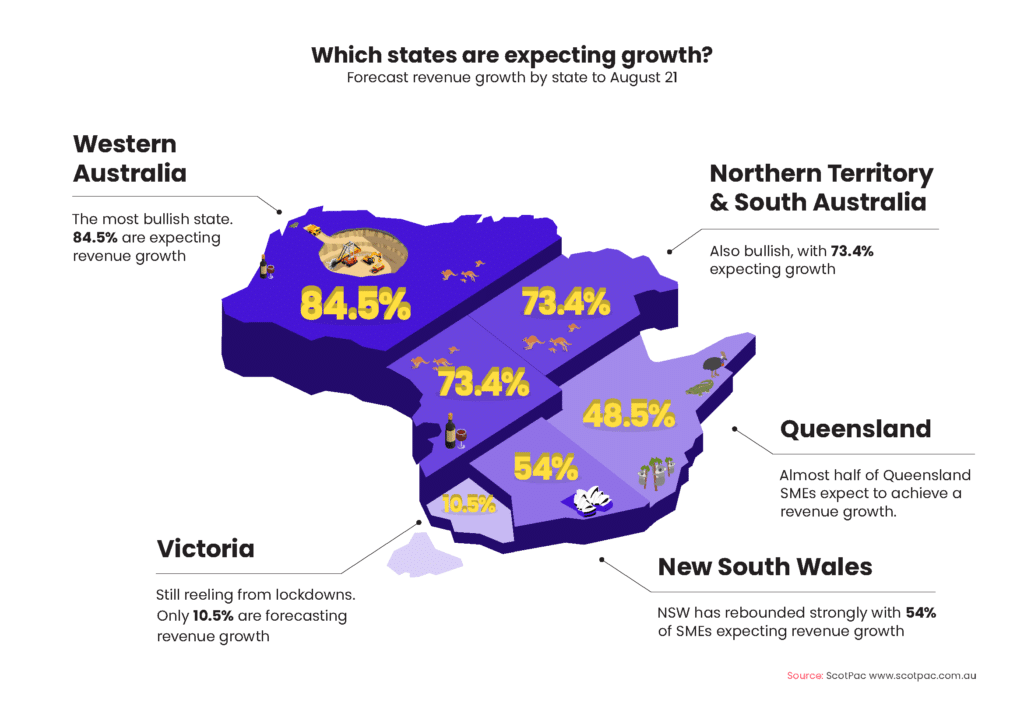

SME Growth Index Insight 4: SME revenue outlook by state and industry

The March 2021 SME Growth Index reveals a record broad distribution range of positive revenue forecasts (from +1.1% to +9.1%) which highlights the fact that states and industries are rebounding at very different rates.

East & Partners analysis of the small businesses at risk of closing or selling shows that twice as many Victorian SMEs are in trouble (58%) relative to Queensland (35%) and NSW (27%).

Victoria has three times as many at-risk businesses as Western Australia (20%) and South Australia and the Northern Territory (18%).

The end of stimulus funding was nominated by a high proportion of these firms as being the trigger point to make them consider exiting or closing.

Victoria

Victoria’s small business sector is still reeling from the impact of lockdowns.

Only one in 10 Victorian SMEs (10.5%) are forecasting revenue growth through to August 2021, but they do expect on average +11.1% growth.

This figure may be less bullish than it appears when considering it comes off the back of poor 2020 revenue growth due to the state’s extended lockdown.

Two-thirds of Victorian SMEs (62.6%) expect revenue to decline, by -6% on average.

More than half of Victoria’s small businesses say without significant improvement in market conditions they will have to either close (30.8%) or sell (27.3%). Fewer than one in five (17.1%) expect they can ride out current market conditions and 24.8% are unsure if they can do so.

NSW

The first state to feel the brunt of the pandemic in early 2020, NSW has rebounded strongly. NSW has 54% of SMEs expecting revenue growth in 2021, by an average +2.7%.

Around a quarter of NSW small businesses (22.9%) expect revenue to decline, by -1.1% on average.

A relatively buoyant number (61.3%) say they are in a position to ride things out if conditions don’t markedly improve.

Only 7.7% say they will close if current conditions continue, while one in five (19.7%) will sell and 11.4% are unsure.

Queensland

Outside of tourism hotspots, Queensland SMEs have been relatively unscathed. It remains to be seen whether this optimism continues given the pre-Easter lockdown in the state (that came after this polling).

Only two in every 100 small businesses in the sunshine state expect revenue to decline over the next six months, forecasting an average decline of -5.8%.

Almost half (48.5%) expect to achieve a revenue increase, a modest +1.3% on average.

A similar proportion (49.3%) expect to survive if current market conditions continue, while 15 in every 100 Queensland SMEs are facing closure and 20 in every 100 may need to sell.

Western Australia

On the back of a buoyant mining and resources industry, the west is the most bullish of the states.

Here, 84.5% of small businesses are expecting positive revenue growth (by, on average, +6.1%) and only 3.6% expect revenue to decline (by a minimal -1%).

This small cohort expecting revenue to decline matches the 4.2% of SMEs in the west who say they will close if the economic outlook doesn’t significantly improve; a further 15.5% will look to sell.

A robust number of WA businesses (74.4%) expect to survive if current market conditions continue.

South Australia and Northern Territory

SMEs in South Australia and the Northern Territory are also bullish, with 73.4% expecting growth (by +3.2% on average) and 8.9% bracing for decline (by -2.3%).

Fewer than one in five businesses in SA and NT believe they will have to close (12.7%) or sell (5.1%) if trading conditions don’t significantly improve.

Almost two-thirds (62%) anticipate they could continue in business under current market conditions.

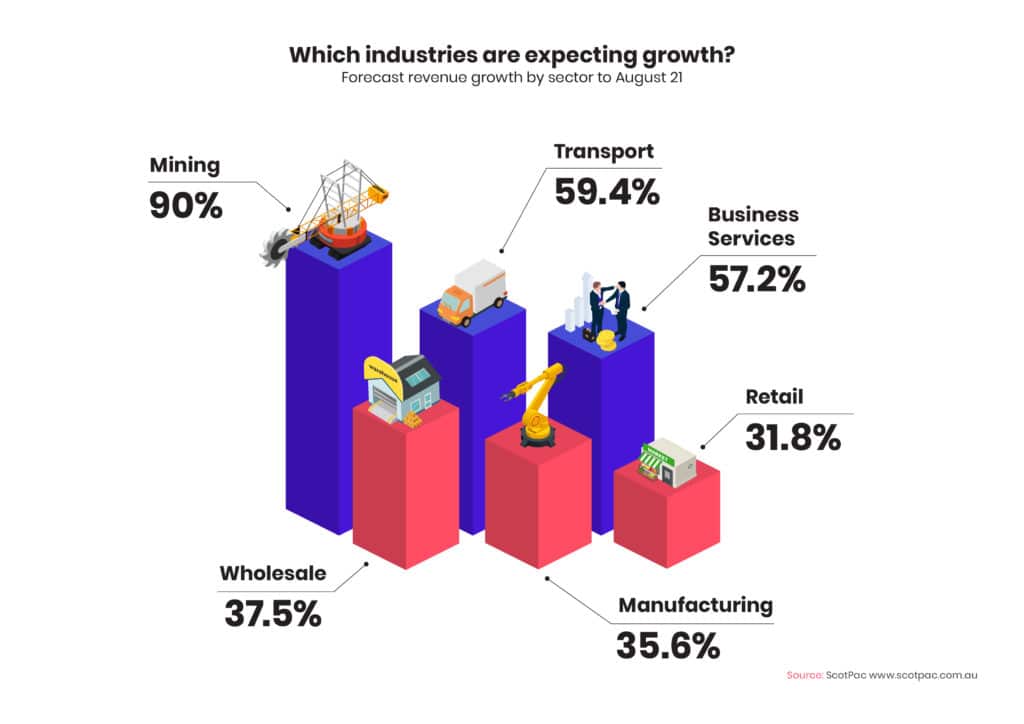

Industry variations in revenue and business stability

The SME Growth Index looks at six major industry sectors – mining, manufacturing, wholesale, retail, transport and business services.

Sector analysis shows that even if business conditions don’t markedly improve, a vast majority of SME respondents in the mining, business services and transport sectors believe they could ride out current conditions without having to sell or close.

This confidence was expressed by 85.6% of mining enterprises, 82.1% of business services SMEs and 72.3% of transport businesses.

In contrast, more than one in three retailers (36.3%) say they will close without conditions significantly improving, one in three (33.1%) say they will sell and a large cohort (22.9%) remain unsure. Only a small number of retailers (7.6%) are confident they will not have to close or sell.

Manufacturing is evenly poised: one in three (36.6%) are confident they can survive; 18.8% are looking at closing, 27.2% selling and 17.3% are unsure whether they’ll be able to ride out current conditions.

A more robust 43.8% of wholesalers believe they can survive if current conditions continue, with 13.3% expecting to close, 25.8% to sell and 17.2% unsure of their future.

Industry sector revenue forecasts were:

Mining: 90% of mining SMEs expect revenue growth (by a bullish average of +8.5%), only 5.6% are forecasting a decline (by an average of just -0.4%).

Transport: 59.4% expect revenue growth (average +3.6%), 9.9% anticipate a decline (of -2%) and 30.7% are forecasting revenue to remain unchanged.

Business services: 57.2% forecast an uptick in revenue (by +5.5%), 8.7% forecast decline (by -0.7%) and 34.1% expect no change.

Manufacturing: this small business sector is evenly poised, with 35.6% forecasting revenue growth (by a reasonably flat +1.1%), 32.7% expecting revenue decline (by -3.9%) and 31.7% anticipating no change.

Wholesale: this sector also has a relatively even sentiment balance, with 37.5% forecasting growth (by +2.1%), 28.9% forecasting decline (by -2.2%) and 33.6% expecting no revenue change.

Retail: this is the only industry where more small businesses are expecting revenue to decline rather than grow. There are 31.8% forecasting revenue growth (of +1.8% average), 38.9% predicting a decline (-5.3% average) and 29.3% anticipating unchanged revenue.

Stimulus impact on small businesses tripled in the past year

MEDIA RELEASE

Cash conservation led to a significant fall in SMEs reporting cashflow issues – however cashflow woes still impact three in four businesses

There’s been a dramatic drop in the number of businesses reporting cashflow issues, with three times as many SMEs as usual saying they had no cashflow problems in the past year.

This result, in ScotPac’s SME Growth Index, points to business owners holding on to their cash in the face of extraordinary economic conditions and uncertainty around border closures.

ScotPac CEO Jon Sutton said it also was a marker of the impact of federal and state government support initiatives to help the small business sector with pandemic recovery.

The 2021 first half results of the SME Growth Index, Australia’s longest-running in-depth research on small business growth prospects, found 27.5% of the 1253 businesses polled experienced no cashflow issues in the past 12 months (72.5% said they had cashflow problems). In the 2018 and 2019 rounds of research, a much smaller figure of only 9.5% to 10% of small businesses reported having no cashflow issues.

Fast payment would create game-changing cashflow boost for SMEs

If SMEs never had to wait for payment, they estimate they would hold an average 42.8% additional working capital in their business, Mr Sutton said.

“Fledgling businesses (five years or under) have on average 59% of their working capital tied up in unpaid invoices, while for older businesses it is 36%.

“This reinforces the importance of prompt payment for small businesses, and for business owners to look for funding solutions that can smooth out cashflow if they are having to wait for payment.”

Main causes of cashflow woes

Mr Sutton said despite governments making a concerted effort to ease the pressure on the SME sector, “government red tape and compliance” was the main cause of cashflow issues reported by small businesses (reported by 44% of respondents). This issue has consistently topped the list of small business cashflow concerns since the first SME Growth Index in 2014.

Other common causes of cashflow woes were trying to meet tax payments on time (24%), being declined from a lending product (23%), suppliers reducing payment terms (21%), customers paying late (20%) and having their credit lines reduced (16.5%).

One in seven SMEs were unable to take on new work due to cashflow restrictions – this may have had the effect of prolonging the COVID downturn for many sectors.

“It’s telling that three quarters of small businesses experienced cashflow issues despite the low interest rate environment and extensive SME loan support options available,” he said.

“Cash conservation moves by small business owners is understandable given the year they’ve had. The concern is that conserving cash means they are not actively looking to invest in their business to grow, so they run the risk of becoming less relevant in their market.”

Strategies SMEs plan to use to control cashflow

In the wake of the COVID-19 pandemic, the research found that small businesses are planning new strategies to manage working capital.

More than one in four businesses plan to focus on cashflow forecasts. This sensible strategy was much more prevalent for large ($5-20m revenue) SMEs, with 49% planning cashflow forecasting as opposed to only 9% of smaller SMEs (in the $1-5m revenue bracket).

The other main cashflow strategies nominated by small businesses were:

- One in six intend to use invoice finance to smooth out revenue peaks and troughs

- One in nine will look to online funders

- One in nine will rely on their personal finances (such as credit cards) for business expenses

- One in 10 will look to a new or expanded overdraft

Mr Sutton said it was a red flag for the SME sector if businesses continued to conserve cash rather than put in place funding strategies that could drive growth.

“SMEs said they are trying to grow revenue via new and existing customers – but so many also indicated they are not looking to invest in the business to grow that revenue,” he said.

“In the pandemic aftermath, there has been a markedly low uptake of the government’s bank loan initiatives, with business owners understandably unwilling to add more debt on to already over-leveraged balance sheets.

“However, the result of this reticence is that many businesses have looked at funding and kicked the can further down the road, instead of sourcing more appropriate business funding solutions.

“If businesses do have cash reserves off the back of stimulus and being more conservative to get them through the pandemic, a great use for those cash reserves is to see an expert adviser to guide you into wise decisions about rebounding, growth and how to fund it.”

ScotPac is Australia and New Zealand’s largest non-bank business lender, providing funding to small, medium and large businesses from start-ups to enterprises exceeding $1 billion revenues. For more than 30 years ScotPac has helped thousands of business owners succeed, by unlocking the value from their business assets. Whether it is purchasing stock, investing in vehicles and equipment, improving cash flow or accessing additional working capital, ScotPac can help.

For more information contact:

Kathryn Britt

Director, Cicero Communications

[email protected]

0414 661 616