A cash flow action plan for the festive season

Prepare your business cash flow for the New Year

For many businesses there is no more challenging time in the year than the festive season for the management of cash flow. Being a key trading period, demands on cash are high but collections can also be problematic as payables staff take annual leave. Add to this, the traditional sales slow down in the first few months of the new year and business tax due in late February, and it is a period of heightened risk which if left unmanaged can cause cash flow issues that can affect trading performance when demand does return in the new year.

Knowing the potential problems is important to managing them, so here are the five most common problems encountered which can cause blowouts in payables and receivables and increase financing costs.

- Slow debt turn – Slowing payments from customers can have serious issues on a business’ ability to grow sales and profitability, and may lead to breakdowns in supplier relationships.

- Overtrading risks – Many businesses, faced with a glut of new orders can expose themselves to the risk of overtrading, where a business undertakes a level of trading which cannot be sustained by the required level of finance and ultimately leads to a business running out of working capital.

- Lending restrictions – It is well documented that access to funding from traditional funding sources remains difficult at present, and further restrictions at inopportune times can impact on trading or mean valuable opportunities may be lost.

- Inventory Management – Significant amounts of much-needed cash can be locked up in unsold inventories

Debtor Insolvency risk – Being a period of cash flow strain for many businesses, debtor insolvencies can cause serious cash flow issues and the risk of bad debt.

To help your business prepare and minimise any issues here is a quick 10 point checklist:

- Invoice early and often and consider requesting deposits where possible

- Deal with potential late payers now and take the time to review credit reports or consider credit insurance

- Investigate solutions to improve receivables management in the quiet period

- Use the Christmas period as a way of improving your customer and supplier relationships to put your business on a firmer footing for the new year

- Clear overstocks and inventories now and invest in accuracy of sales forecasts

- Prioritise new work – what investments can be delayed until cash flows are stronger?

- Consider the efficacy of offering early settlement discounts to prompt early payment

- Examine outgoings and shut down if necessary to minimise cost

- Consider if working capital finance is required to provide cash flow support

- Produce cash flow forecasts to assist with identifying precise periods of high cash usage

Check out our article How to Create a Cash Flow Forecast where we show you how to analyse the financial health of your business.

Everything Australian Companies Need to Know About Corporation Tax

Handling taxes is notoriously complex for Australian businesses. It can be overwhelming for SMEs, especially if you lack a dedicated, in-house accounting team.

But it’s vital to understand relevant tax laws, what your company tax rate is and how to properly report this information. This ensures you stay in the clear with the Australian Tax Office (ATO), while avoiding unnecessary penalties and headaches.

Here’s everything you need to know about corporation tax.

CHANGES TO THE CORPORATE TAX RATE OVER THE YEARS

The corporate tax rate has fluctuated over the past 45+ years.

Trading Economics explains, it was at 45% between 1973 – 1979. It jumped up to 46% from 1979 – 1986, and rose again to reach its highest at 49% from 1986 – 1988. It has since dropped considerably.

Here’s a breakdown of what the corporate tax rate has been from the late 80s to today:

- 39% – 1988 – 1993

- 33% – 1993 – 1995

- 36% – 1995 – 2000

- 34% – 2000 – 2001

- 30% – 2001 – present

WHAT IS THE CORPORATE TAX RATE IN 2019?

The full company tax rate is 30% and should remain there for the foreseeable future. This applies to companies, corporate unit trusts and public trading trusts.

Today’s companies pay considerably less for corporation tax than organisations in the past. In fact, it’s now 19% lower than it was at its peak between 1986 – 1988. 30% is actually a record low for Australia.

But as Shane Wright of The Sydney Morning Herald reports, Australia’s corporate tax is still one of the highest in the world. As of January 2019, it was the third highest globally, with only Costa Rica and Chile having higher rates.

For comparison, Australia’s prime competitors such as the United States, Britain, New Zealand, Canada and South Korea all had lower rates. The United States, for instance, is currently at 21%.

BASE RATE ENTITIES

Not all companies pay a 30% corporate tax rate, however. Those who are classified as base rate entities are eligible for a lower company tax rate of only 27.5%.

The ATO explains, for the 2017 – 18 income year, a base rate entity is a company that both:

- “Has an aggregated turnover less than the aggregated turnover threshold — which is $25 million for the 2017 – 18 income year.

- 80% or less of their assessable income is base rate entity passive income — this replaces the requirement to be carrying on a business.”

Base rate entity passive income can include royalties and rent, corporate distributions, gains on qualifying security and interest income.

The bottom line is that you can expect to pay a 30% corporate tax rate unless you qualify as an eligible base rate entity. In that case, you would only pay 27.5% until 2020. However, that is set to change in the near future.

UPCOMING CHANGES FOR BASE RATE ENTITIES

Initiatives to lower the corporate tax rate will be taken in the near future, meaning corporate tax for base rate entities will drop over the next few years.

Companies who qualify will still pay 27.5% from 2018 – 20, but the aggregated turnover threshold will increase from $25 to $50 million AUD. After that, they’ll pay 26% with an aggregated turnover threshold of $50 million AUD from 2020 – 21. The following year, they’ll only pay 25% with an aggregated turnover threshold of $50 million from 2021 – 22.

In other words, corporation tax is decreasing for base rate entities over the next few years and will drop a total of 2.5% between 2017 – 18 and 2021 – 22.

CORRECTLY FILING TAXES

Besides understanding what your company tax rate is, you need to know the basics of filing.

The Australian Government’s website, Business.gov, explains, “A company business structure is taxed as a separate legal entity that does its own tax return.”

They must lodge an annual company tax return, which includes company income, deductions and the income tax it’s liable to pay. Business.gov also points out companies must lodge their own tax return, and if an associated trust is involved, then they must lodge their own tax return as well.

Note: “As a director, if you draw wages as an employee or receive dividends from the company, you must report this as income when you lodge your own individual return. You may also need to lodge a fringe benefits tax return, if you receive fringe benefits.”

It’s important to get all your ducks in a row to ensure everything is reported properly. It’s also crucial that it’s done on time.

PENALTIES FOR NOT LODGING ON TIME

Tax returns for Australian businesses cover the time between 1 July and 30 June and are due by 31 October. Not filing on time is what’s known as a Failure to Lodge (FTL), which can potentially lead to penalties. The cost of the penalties can vary and is primarily determined by the size of your company.

Here’s how that breaks down.

The ATO says, “For a small entity, FTL penalty is calculated at the rate of one penalty unit for each period of 28 days (or part thereof) that the return or statement is overdue, up to a maximum of five penalty units.”

This becomes larger for a medium entity with turnover of more than $1 million and less than $20 million AUD, where the penalty is multiplied by two. And it increases again for a large entity with turnover of $20 million or more, where the penalty is multiplied by five.

So the larger your company, the more severe the penalty.

It should be noted that the ATO is fairly understanding and accommodating when it comes to FTL. Organisations generally aren’t penalised when it’s an isolated incident, and warnings will be given either over the phone or in writing before incurring a penalty.

That said, it’s still extremely important to stay on top of corporation tax and take measures to ensure it’s taken care of by 31 October.

If there’s an issue where you have difficulty meeting the deadline or fulfilling your tax obligations, you should contact the ATO via this link. A registered agent can work with you to figure out a solution.

RETAINING RECORDS

There’s one last thing to point about in terms of meeting ATO compliance standards.

You must retain your corporate tax records for five years. This is a required tax law, and the ATO can potentially penalise you for not retaining records for this length of time.

So be sure to keep everything on file so information can be quickly retrieved. Having both physical, paper documents as well as digital versions is ideal.

SME TAX TIPS

The information above covers the fundamentals of corporation tax and what you need to know to correctly file your taxes.

Here are some ways to simplify things and streamline the process.

STAY ON TOP OF RECORDS

Keeping organised, accurate records is vitally important. That’s something managing director at Australian Invoice Finance, Greg Charlwood, can’t stress enough.

You need an efficient, well-run filing system that provides you with a detailed snapshot of your company’s earnings at all times. Not only does this save time come when lodging and prevent frustration, it can be a godsend in the event of an ATO audit. It ensures that you’ve always got a paper trail and earnings can be easily traced.

Investing in a comprehensive corporate tax software like ONESOURCE is perfect for SMEs and offers a straightforward, cloud-based solution.

WRITE OFF BAD DEBTS

Charlwood also mentions it’s a good idea to write off bad debts before 30 June rolls around. If you’ve incurred a bad debt or partial bad debt because of a client failing to pay in full, it can be claimed as a deduction if it was included in your company’s assessable income.

In the event that a client doesn’t pay or doesn’t pay in full, this can help offset your costs.

DEDUCT STARTUP COSTS

This only applies to newer businesses with a turnover of less than $10 million AUD. But if your company falls into this category, you can claim a tax deduction for certain costs including:

- Accounting and legal advice when setting up your business

- Borrowing fees

- Government fees you paid to register your business

While this may not have a huge impact, it should still be helpful and lower your overall corporation tax.

STAYING COMPLIANT AND GETTING IT RIGHT

There’s a lot involved with Australian corporate tax. And it’s easy for SMEs to be confused and overwhelmed sorting through all of the details.

What’s most important is knowing what tax percentage you owe annually, whether you’re eligible for a base rate entity, correctly lodging corporate taxes on time and retaining tax information for five years.

Do that, and you should have a firm grasp on corporation tax, and your company should be in good shape.

What do you find most confusing about corporation tax? Please let us know about your experience, call us on 1300 207 345, or click here for us to get in touch.

Business Finance – Are you seeing the full picture ?

“I would consider debtor finance if it wasn’t so expensive. My business can’t afford it.”

This is a view often expressed by business owners and decision makers who don’t properly understand this type of finance and they are often taken aback by the response “Are you sure your business can afford not to do it ?”

In headline terms, debtor finance may not be the cheapest form of commercial finance available, but it’s important to properly understand the enabling role it can play in the development and growth of a business and the alternatives available, before reaching any conclusions about whether it costs too much.

Growing businesses are cash hungry, and without the availability of working capital to meet increasing staff and material costs, the danger is that profits that look good on paper can in reality be tied up in stock and debtors. There is then insufficient cash available to meet wages and supplier payments as they fall due.

As a line of credit that grows in tandem with turnover, debtor finance is an ideal solution for businesses experiencing strong growth. A typical facility will advance 80% of the value of the receivables, so $400,000 would be available against a ledger of $500,000; $800,000 would be available against a ledger of $1,000,000 and so on.

At Scottish Pacific our facilities also come with the option of additional services such as risk assessments on potential new customers, collections, including follow up calls, reminder letters and statements. These facilities provide more than just a line of credit, they encompass an outsourced solution that small business owners, in particular, value very highly as it allows them to concentrate on growing their businesses without having to perform these functions themselves and incur the extra cost of recruiting additional staff.

Used wisely, a debtor finance facility can add significant value. With more cash available, stock can be purchased in larger quantities and paid for more quickly in exchange for discounts thus improving gross margin. Used in this way, debtor finance can actually pay for itself.

To summarise:

- The funding available through a debtor finance facility grows in line with sales

- Businesses are able to access the extra cash required to fulfil an increasing order book

- Real estate security is generally not required

- Additional complimentary ledger management services are available

- Used wisely, facilities may pay for themselves

- Facilities can provide a valuable alternate source of finance in turnaround and start up situations.

So what are the alternatives ?

By far the most common is an overdraft facility secured by real estate security. In headline terms this alternative is likely to be the cheapest and will work well provided the working capital requirement does not exceed the value of the real estate security. In the boom times and pre the Global Financial Crisis, it was possible that security values might increase in line with sales even in a high growth business, but the landscape has changed dramatically since 2007.

What comes into question then is the opportunity cost to a business that has to turn away orders because it is bumping up against the overdraft limit and how is its relationship with its bank being affected. The business is growing and there’s nothing wrong with it other than the credit available is insufficient for the size it has grown to, but the bank may not see it that way.

So in summary, factors to consider when looking at an overdraft facility are:

- The secured overdraft, in headline terms, is likely to be the cheaper option

- Real estate security is required

- The facility size is limited by the value of the real estate

- The credit available is not linked to the performance of the business

Other alternatives such as unsecured overdraft facilities, raising private equity or offering early settlement discounts all typically work out more expensive than debtor finance, without the option of the additional services. Ultimately the key is to find the right fit for the business, so that the finance arrangements not only support the current needs of the business, but will also enable it to grow without undue constraint. Debtor finance is one of the few forms of finance with that level of flexibility and should always be considered as a viable alternative for businesses looking to optimise their working capital facility requirements.

Revenue Growth for Australian Businesses on the Rise

REVENUE GROWTH FOR AUSTRALIAN BUSINESSES ON THE RISE

The March 2019 Scottish Pacific SME Growth Index Report made many interesting discoveries about the current state of Australian businesses. While some findings were discouraging like increased difficulty accessing funding due to property downturns and the Royal Commission, others were quite encouraging.

One in particular was the fact that revenue growth was rising — a positive sign for Australian SMEs and business owners.

In this post, we’ll take an in-depth look at this phenomenon and explain why fewer SMEs are in trouble. We’ll also discuss some common cash flow strategies business owners are using to keep up with growth, as well as some other notable trends.

GROWTH IS EXPECTED FOR MANY COMPANIES

Things are looking good for most business owners, with growth being forecasted for many SMEs. “More than 53% say they’ll grow in the first half of 2019, up from 51% six months ago. This is the most positive result recorded in the SME Growth Index since the first half of 2016.”

More specifically, “Growth businesses are forecasting an average 4.9% revenue rise (up from 4.5%).

This is a great sign considering the obstacles many SMEs have recently faced when it comes to obtaining financing. Despite their difficulties, many business owners are managing to keep their companies is good financial health and are moving in a positive direction.

Many experts have the sense that Australia’s more vulnerable businesses that may have been unstable a year or two ago ago have turned a corner. For those who were struggling, the situation has improved and they’re now in a more favorable position. As long as there are no major external factors to disrupt the economy, most SMEs should be in good shape for the foreseeable future.

REVENUE IS CONTRACTING FOR FEWER COMPANIES

Furthermore, there’s a downward trend of revenue contracting. Only 8.5% of SMEs expect their revenue to contract in 2019 with an average of 5.5%. But considering the maximum revenue drop is only 12.2% — 1.5% lower than the previous round — things are looking up for Australian businesses as a whole.

It’s important to note that In 2018, more than 12% of business owners were experiencing diminishing profits. But in March 2019, that number fell by 3.5%, marking a record jump in the number of SMEs who were shifting from a “contracting” to “stable” phase.

And when you combine growth and non-growth SMEs, “total average revenue projections have more than doubled year-on-year since 2016 — from 0.7% to the current 1.8%.” So when you look at the big picture, it’s clear that Australian businesses are trending in the right direction.

CASH FLOW STRATEGIES

Although desirable and critical to the long-term success of a business, growth can also present cash flow issues. To keep up with consumer demand and stay on track, SMEs need a viable means of obtaining steady cash flow.

While 11% of businesses had no formal strategy as to how they would invest in business growth, the vast majority did have a game plan. So how are business owners generating the capital they need to accommodate growth?

Here’s how it breaks down:

- Personal finance – 69%

- Cash flow forecasts – 63%

- Discount for early payments – 56%

- Invoice, trade or important finance – 47%

- Making arrangements with the ATO – 20%

- Increasing overdraft – 13%

It’s clear that many companies are feeling the pressure to grow, given that 69% of business owners used their own credit cards to increase cash flow in March 2019, which was up from just over 66.5% a year earlier.

Offering discounts for early payments has risen considerably and jumped from 50% the previous year to 56% in 2019. This means that many SMEs are willing to come down on their pricing slightly in exchange for quicker payment terms.

Also, the number of business owners making arrangements with the ATO has noticeably risen. While only 16% did this in 2018, one in five did so in 2019.

In terms of cash flow strategies that have remained the same, these include taking out or increasing an overdraft, obtaining funding online and running credit checks. The one strategy that’s declined from 2018 to 2019 was debt collection, with just over 4% of business owners utilising it this year.

Beyond that, there are a few other noteworthy trends that deserve mentioning.

THE AVERAGE NUMBER OF FULL-TIME EMPLOYEES HAS DECREASED

There are a fewer number of full-time employees in Australia. According to the Index, “The average SME respondent’s full-time employee headcount continues to downtrend, falling from 71 in the last round to 69 now — it was 88 in the first round in September 2014.”

This phenomenon is confirmed by The Reserve Bank of Australia, who says there’s been a growing trend of part-time employment throughout much of the country. They also mention that Australia has one of the highest shares of part-time employment among the Organisation for Economic Co-operation and Development (OECD) countries.

Trimming back the number of full-time employees has created more flexibility in the workplace so SMEs can stay nimble with fluctuations in demand and keep labour costs down — both of which can accelerate growth.

A SMALL NUMBER OF SMES ARE INTENTIONALLY REDUCING SALES

1 in 10 SMEs are choosing to lower their overall sales to minimise cash flow issues. For those who can’t come up with a viable means of boosting cash flow, a small percentage are electing to intentionally slow their growth to avoid growing pains.

While this probably isn’t the ideal route for most business owners, it definitely makes sense in certain situations. With that said, it’s important for SMEs to explore all of their options, which brings us to our final point.

DEBTOR FINANCE IS BECOMING A MORE POPULAR OPTION

One issue that’s a growth deterrent to business growth is slow paying clients. Australian businesses ended up spending more time hunting down invoices this year — a cash flow strategy for 14.5% of businesses in 2019 versus just 12% in 2018.

Research from software company Xero found, 62% of SMEs dealt with late or unpaid invoices within the last year. This has a trickle-down effect that places business owners in a tough position where many have difficulty paying their own suppliers as well as their employees.

As a result, there’s a growing interest in debtor finance and invoice finance, where SMEs obtain a line of credit by using outstanding invoices as collateral. In fact, it went from being used by only 7.5% of companies in 2018 to 11% in 2019.

With most invoices approved within 24 hours and business owners able to receive up to 85% of the value of their invoices, it’s proven to be an effective way to boost cash flow and quickly gain access to capital that would otherwise be tied up for several weeks or even months.

A PROMISING TIME FOR AUSTRALIAN BUSINESSES

Data from the March 2019 Scottish Pacific SME Growth Index Report shows that revenue growth is rising for many Australian businesses. The current economic climate looks promising, and SMEs are in a position to thrive.

However, it’s vital that business owners stay on top of growth and develop a viable strategy for obtaining necessary cash flow. For more information on this, please contact Scottish Pacific today.

Do you feel you have enough cash flow to keep up with the current growth of your business? Click here to have us touch base or call today on 1300 207 345

Step out of your comfort zone and grow yourself and your business

The life of a small business owner can be busy and challenging, and at times chaotic. It can be easy to fall into a routine of getting too comfortable, staying the same, and never changing or improving. However, getting stuck in your comfort zone can stop you from seeing and taking new opportunities, and hinder your business growth. We have put together four actions that you can take in order to step out of your comfort zone this year and improve both yourself and your business:

1. Small and steady wins the race

Don’t throw yourself in the deep end by changing your entire routine in order to step out of your comfort zone. Start small. First of all, begin re-defining and visualising what success means to you and your business – write down goals and objectives, and then list actions that will help you achieve these. Next, write down the obstacles that you think you’ll face, and the fears you have about them. Turn each obstacle into a smaller action step that will help you to overcome and prevent your fears. Once you’ve taken action you can celebrate the wins, or work out things that didn’t work. Try and do something minor to start off with, it could be as simple as phoning a potential client or supplier. Yes it can be daunting, however you are opening yourself up to business opportunities that you would never have thought possible. Rather than pushing yourself to make ten cold calls, start small and set yourself a goal of making one call a day. Replace your feelings of fear with feelings of excitement and opportunity.

2. Dare to challenge yourself

As a small business owner, you must challenge yourself in order to grow. Whether it’s trying something you’ve never done before or something that’s never even been done in your industry, every small step out of your comfort zone will help you and your business to move forward. We live in a constantly evolving digital world and it is crucial to embrace technology and stay up to date with new systems and processes. Is it time for your business to update its computing and business software? Could you and your staff benefit from specialised digital training? To run a successful business, it is important to continually look at ways to improve your staff, systems and processes in order to stay on top of the game, even if it does mean stepping outside of your comfort zone.

3. Consider new forms of funding to unlock business growth

If cash flow issues are hindering your business growth and stopping new opportunities from happening, now might be a good time to consider a debtor finance solution as a way to fund your business. Debtor finance is a growing non-bank funding facility in which many SMEs are looking to improve their daily working capital. Debtor finance pays up to 80% of outstanding invoices within 24 hours, helping your business to free up tied up cash and grow your business more quickly.

4. Now press the repeat button

Now that you’ve defined the actions that you need to take in order to grow your business and create new opportunities, it is important that you regularly confront your fears and get in a regular habit of stepping out of your comfort zone. Over time, you will begin to train yourself to be comfortable with discomfort. Your comfort zone will be growing and you will be growing as well. Take time to reflect and look back to the first push from your comfort zone. You will finally see why being stuck there is not beneficial to you. Continue to step outside more and more, and you will be surprised at the success and growth you will achieve for you and your business.

Sydney Masterchef Challenge

Our Sydney staff recently had their very first team building challenge for the year – the famous mystery box challenge. We were placed in small teams and it was game on in the kitchen, we had our chef hats on and were down to business, showing off our culinary skills and cooking up a storm to support local charities.

Aromas were flying in the air and it was hard to resist the temptation of not eating the food right in front of us – but in order to win, we had to prepare 10 serving portions as well as impress the chef judge with a well presented dish to taste.

Thank you to Foodbank, the largest hunger relief organisation in Australia, who helped organise this successful event and also for all Scottish Pacific staff who participated on the day. It was a fun day for all with plenty of laughter as well as some friendly team competition – you have all helped contribute to this good cause and most importantly gifted food to those who need it most!

Get cashflow moving in the transport & logistics business

In the transport industry, whether you are a one-truck owner-operator or a national freight company, one of the chief issues is waiting 30 to 60 days, or longer, for clients to pay.

While you wait for payment, the business has often massive fuel and maintenance bills, staff wages and seasonal demands to contend with, all which can have a huge impact on how much working capital is available to keep things motoring along.

The latest Scottish Pacific SME Growth Index, which polls more than 1200 SME owners around Australia, including a representative number from the transport & logistics sector, found that the level of concern small business has around cash flow is increasing.

Sixty percent of owners and managers of businesses that were growing indicated that cashflow is a barrier to their growth.

Even more owners named access to, and conditions of, credit as the biggest growth barriers.

With banks tightening lending criteria for the small business sector, those transport businesses who have been relying on or seeking a bank overdraft may do well to look at alternative options. Options include moving beyond property secured finance, which can limit the funding a business requires and could put the family home at risk if the house is tied up in business finances.

Strong cash flow management is crucial, and this philosophy is at the heart of the invoice finance funding solution.

When property secured finance becomes too limiting

Invoice finance is a line of credit linked to and secured by the outstanding accounts receivable, for any business that supplies products or services to other businesses on standard trade credit terms of up to 90 days.

Invoice finance does not require real estate security, which effectively quarantines your business borrowing and protects your personal assets from risk because it is secured against business receivables.

A significant portion of operators in the transport & logistics sector already utilise smart funding options that smooth out seasonal highs and lows, ensure there’s money at hand to pay staff and suppliers, and allow management breathing space from dealing with business finance red tape.

For Scottish Pacific, transport & logistics is the biggest industry sector that we fund.

Businesses can draw down up to 80 percent against the value of what they are owed. This provides an up-front cash injection rather than the stressful typical wait for access to the funds.

Many in the transport business hear about the benefits of using invoice finance from their fellow operators – or from their suppliers, who are keen to be paid on time and understand that invoice finance makes this possible.

This was the case for one Scottish Pacific transport client, a family business employing 30 staff and operating across the eastern seaboard, whose supplier tipped them off that many of their other transport clients were using invoice finance.

“When we started almost two decades ago, we self-funded by mortgaging our homes. As the business grew, this funding option became too difficult – and too limiting,” the owner says.

“Invoice finance has made a huge difference to us. As our business grows, our facility grows with us – we don’t have to be constantly refinancing which would mean growing in spurts and starts, not continuously. Our funds go in seamlessly, and the money is chased for us.”

This allows clients to concentrate on keeping trucks on the road.

Move quickly to take on new business

If your property is pledged as collateral for a bank loan, many businesses find it hard to say yes to new opportunities as they cannot raise the extra finance.

This is not the case with invoice finance, which is easily scalable because the size of the facility grows in line with the invoices being generated.

As another transport client says, “the size of our facility grows, guaranteed on the invoices. If an opportunity comes along we can grab it quickly.

“We don’t have to wait for approval to grow, so we don’t lose potential new opportunities while we are waiting to hear whether we can fund them.”

While this transport client is thinking growth, for other operators the current market is incredibly tough, with a flat economy and wages and fuel costs eating into already thin margins.

One client, the owner of a furniture removal business, was really feeling the pinch when his biggest client suddenly extended payment terms – from 7 days to 60!

In this case the client utilised Selective Invoice Finance, allowing a business to pick and choose which invoices they want funded (up to 10 invoices).

This works well for seasonal businesses or those with only occasional requirements for extra working capital who may not want to commit to a long-term finance facility.

For our removalist client, using selective invoice finance to fund just one major invoice a week allowed him to negotiate an increase in margin with his largest customer, which he used to partially offset the cost of the facility.

“The whole thing’s quick and easy. It’s as simple as emailing one invoice to Scottish Pacific, and this has provided our business with the security to pay the bills,” he says.

Finance that helps owners selling a transport business

For transport and logistics owners planning to pass on ownership to the next generation, or to sell the business, having the business finance tied to their real estate can create many challenges.

Unsecured funding can help in this instance, as it takes out of the equation how much security the incoming owner has, and the business will be able to access extra working capital to help smooth the transition period.

Early Settlement Discounts – Don’t settle for less

Much has been written about the advantages and disadvantages of offering early settlement discounts.

The arguments in favour usually focus on the ease of implementation, the benefits of accessing working capital and of reducing customer insolvency risk by obtaining early payment. But the math underlying these arguments often doesn’t add up, and usually assumes businesses operate in a perfect world.

In the real world, early settlement discounts can prove a hit and miss strategy at best. The main problems are as follows:

- There are often cheaper solutions for accessing working capital.

- It is also common practice to stretch out settlement dates beyond the payment terms by a few days – sometimes weeks and still pay the discounted rate. Policing this is expensive and risks alienating the client.

- Customers often short-pay invoices. It is standard practice for customers to take the discount on the total amount of the invoice (which includes tax and shipping), leaving suppliers to pick up the tab.

- The discount may need to be significant in order to receive satisfactory take up, cutting deep into a business’ margins

- Some customers use the early settlement discount to trade for more favourable terms on other fronts such as price, claiming the time value and interest cost to them in paying up front. This means suppliers pay twice.

Indeed, a whole industry has developed around providing advice on taking advantage of early settlement discounts. I quote one headline: “Don’t forgo early payment discounts: the returns are astounding”. This online article notes that that taking advantage of early settlement discounts is particularly a good strategy for low-margin companies.

This being the case, the logic flows that, on the flipside, discounts are a particularly poor strategy for low-margin suppliers. Discounts cost money so when costs blow out, low-margin businesses are hit hardest.

Having to endure all of the above complexities might be acceptable if supplier discounts were the only option available to business to improve cash flow, or even if it were the cheapest option available, but it’s not. One such alternative is debtor finance.

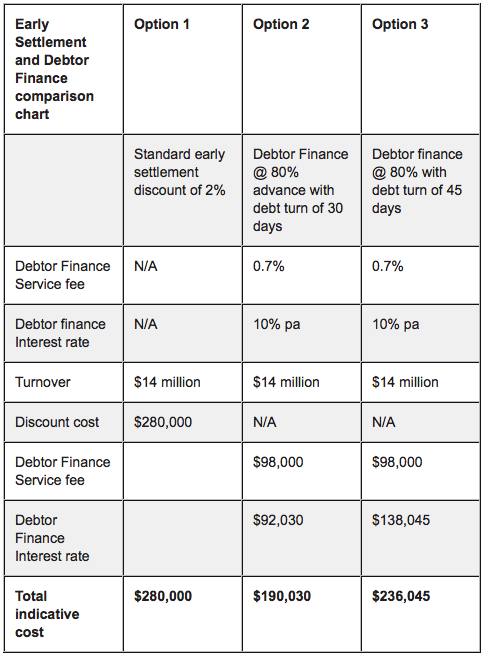

The table below shows that debtor finance is often a much cheaper, more efficient working capital alternative to discounts. The table provides three scenarios comparing the costs and savings of using a debtor finance facility with debt turns of 30 days and 45 days over a 12-month period to those of supplier discounts of 2 per cent.

Early Settlement and Debtor Finance comparison chart

These figures do not even include the time and cost of policing and administration, which can be more expensive still. Allocating payments to a debtor for a short-paid invoice, then chasing for the balance can be time consuming and aggravating to the debtor to the point where it is not efficient to do so, which in effect amplifies the discount granted .The GST, for example, proved a huge windfall to the Federal government and the main gain was to be had through ease of policing and savings on administration. A facility such as debtor finance offers similar “lever-style” efficiencies and financial gains for business.

This does not mean there isn’t a place for early settlement discounts. The main benefit is to reduce customer insolvency risk – to get your money ahead of other people in case there’s not enough money to go around. Unfortunately, there is no guarantee that early settlement discounts will solve this problem. But if a business has a debtor finance facility in place, it will have more headspace to focus on retrieving the funds and generating more revenue in the event of a default, rather than diverting valuable resources to putting out cash flow fires.

Nor does debtor finance preclude the use of settlement discounts. A business can easily use debtor finance to fund a percentage of invoices while focusing on one or two big, easy to process debtors that may lend themselves to an early settlement discount (typically companies that aren’t solid credits).

If in doubt as to whether your supplier discounts are working in your favour, always do the math – and don’t forget the administration costs.

Five Facts on Factoring and Debtor Finance

Poor cash flow is one of the main reasons for business failures. For small and medium sized businesses, the real key to success is maintaining a good flow of cash through the business enabling it to purchase raw materials, new equipment and – at the simplest level – paying staff wages. However, many firms struggle when asked to make large capital outlays and then wait between 30 and 90 days before receiving payment from clients. This problem is further exaggerated by the inflexibility of the banks to provide higher levels of funding to firms with low fixed asset bases.

However, times have changed from the days when the bank was the first port of call for funding. The overdraft, which is based on how a firm has performed historically, is under pressure as new more flexible forms of finance have emerged. One such alternative is factoring, also known as debtor finance, invoice finance, invoice discounting and receivables finance.

So why is factoring becoming the preferred finance option for an increasing number of Australian entrepreneurs? The following five facts will answer that.

1. Factoring is a more flexible form of finance

So what is factoring? In its simplest terms, factoring provides a flexible source of finance by allowing businesses to unlock the funds tied up in unpaid invoices – leading to an immediate injection of cash. This is also referred to as discounting, though factoring offers an added service to collect, manage and administer the debt.

On receipt of an invoice from a client, a factor will typically pay up to 80% of its value within 24 hours. The factor then carries out the credit control on each invoice, on behalf of their client, sending out statements and chasing payment until it is paid. The remaining 20%, less a service fee, is handed over to the client once payment is received.

Another great advantage of factoring is the flexibility. The amount of funding available is based on the sales you make not on the value of your historic balance sheets. Not only that but if your firm is doing well, then the amount of funding available increases because it is linked to your sales.

2. Cash flow and late payment hinder business growth

Cash flow is a huge problem for many companies. When you have to pay your temporary workers weekly, long before you can even invoice your clients, cash flow problems are bound to follow. Added to this, businesses now have to pay GST and other taxes monthly or quarterly. When the twin problems of cash flow and late payment converge, it is no wonder that many firms are looking towards alternative funding solutions like factoring to help keep their business moving forward.

3. More business advisors are recommending factoring

According to the Institute for Factors and Discounters Australia and New Zealand, debtor financing turnover for Australia in the March 2012 quarter was $14.7 billion – an increase of 3.2% on the March 2011 quarter. Invoice discounting turnover was $13.5 billion and factoring turnover was $1.2 billion. Most banks offer discounting and there are a number of non-bank financiers, including Scottish Pacific, who provide the additional factoring service.

4. Factoring offers value for money

Compared to bank funds, the cost of money advanced through factoring is highly competitive. What is often forgotten in a straight comparison of charges is that factoring includes a full sales ledger management service. This also means that users of factoring can make enormous related savings not only by removing the burden of chasing payment, the cost of accounts receivable staff, but also the savings in terms of stationery and telephone calls etc.

Businesses can also enjoy the benefit of reducing late payments, and further savings can be made with suppliers by taking advantage of early payment discounts.

5. Factors work alongside their clients

It is not unusual for businesses, before they become factoring clients, to be concerned that they might lose control of their finances. Many are also worried that the establishment of a relationship with a factor will cause alarm among their customers, who might interpret this as a sign that they are in financial difficulties. This is something of a hangover from old times. With a reputable factor, the client benefits from having a dedicated credit controller who, in effect, becomes an extension of the client’s team.

The factor, such as Scottish Pacific, works with the client to manage the sales ledger – chasing invoices and taking on the responsibility of collecting payments. A good working relationship with a client’s customers is just as important to the factor as it is to their client. Factors are more than aware of the importance of good client relationships. It is not in their interests to upset any relationships. The fact that the two have this interest in common means that the factor has to work closely with the client to fully understand the situation, their business and their customers.

Luke Priddis Charity Golf Day

March 6th saw the annual Luke Priddis Foundation Charity Golf day being held at the beautiful Penrith Golf Course in NSW and Scottish Pacific participated by sponsoring a hole at the event.

Luke Priddis is a well known ex NRL footballer who has first-hand experience with Autism after his son was diagnosed with the condition at a very early age. The foundation is about supporting parents and giving these beautiful children the skills to understand emotions. Most parents of Autistic children had never been told by their child ‘I love you’ or hugged for affection.

Sydney based Business Development Manager, Jodie Wootton, is a passionate supporter of the foundation, and not even a broken foot could stop her from taking to the course on the day.

Although our team didn’t place too well on the score card, a great day was had by all and Scottish Pacific are proud to support this extremely worthy cause.