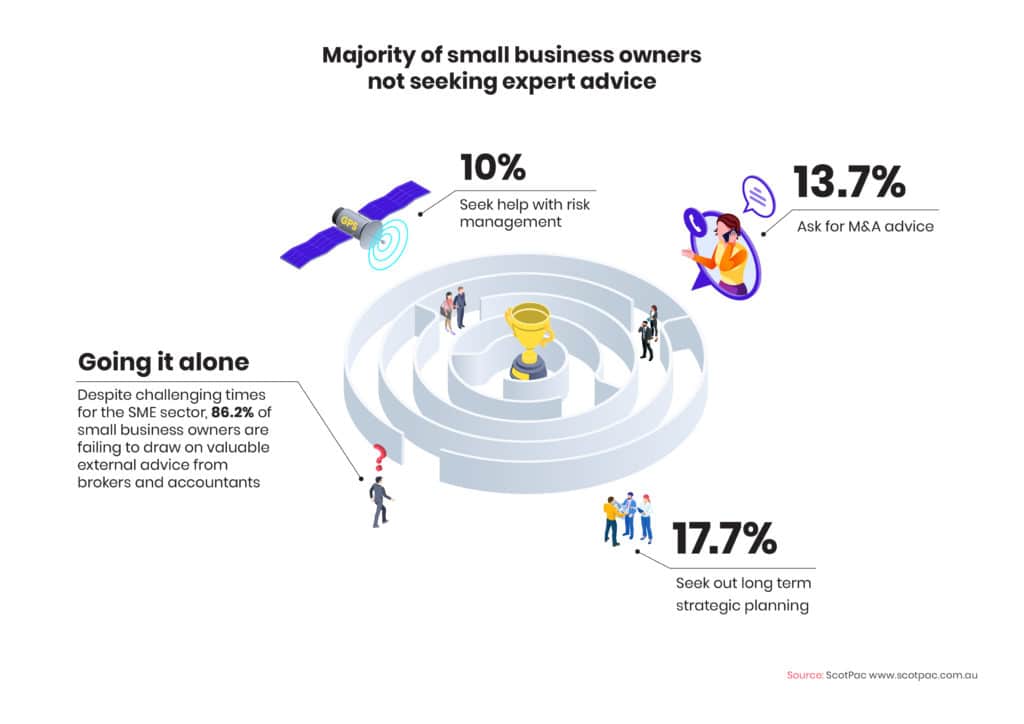

SME Growth Index March 2021 Insight 6: “Going it alone” – the small business owner mindset

Many small businesses appear to be going it alone, failing to draw on valuable external advice despite the unprecedented challenge facing the SME sector.

Fewer than one in five small businesses (17.7%) seek expert advice for long-term strategic planning.

Not even one in seven (13.7%) seek M&A advice and only 10% get expert assistance with risk management.

Overwhelmingly, when small businesses turn to trusted advisors it is for tax and compliance advice – this was nominated by 93.2% of respondents.

Asset acquisition and disposals (34.1%) and succession planning (26.8%) are also identified as key areas of interest where SMEs look beyond their own team for guidance.

Almost one in three small businesses (30.4%) turn to external advisors such as accountants, bookkeepers and brokers for help separating their personal and business assets.

This is arguably such a dominant issue due to SME owners’ over-reliance on using personal property as security to fund their business.

Recent joint research from accounting platform Xero and market research firm Forrester shows small businesses represent more than 90% of all global businesses, yet only 26% of them consult trusted advisors.

Their findings indicate that those who thrived throughout the pandemic were the ones leaning on expert advice. This aligns with previous SME Growth Index findings.

Results this round indicate small business owners have a strong desire to get back to “business as usual” yet in many cases they are uncertain about how to achieve such an outcome.

With so many small businesses feeling uncertain, and two-thirds of SMEs seeking transformation (by restructuring), such undertakings should be supported by advice from experts and fuelled by some investment in the business.

Long-term strategic planning remains a low priority for many SMEs, particularly those who say they are in a declining or static business phase. East & Partners found that this group of static or declining SMEs is characterised by a higher level of primary bank funding (22.7%) relative to growth SMEs (only 15.8% of whom use primary bank to fund growth), indicating a pressing need for these businesses to “shop around” and explore other more appropriate business funding solutions.

Relieved, exasperated, unsupported – how business owners are feeling

Confidence is crucial for ensuring the small business sector successfully recovers from the pandemic-led recession.

Yet in the March 2021 SME Growth Index small business owners display a distinctly cautious tone.

When asked how they felt about running their business now, compared to their feelings in early 2020 before the pandemic hit Australian shores, SMEs are slightly more likely to express negative sentiments than positive ones.

Overall, 43.9% of small businesses say they are more positive, relieved or enthusiastic about 2021, while 55.3% are less positive, exasperated, uncertain or feel they are lacking support.

The sentiment breakdown was:

- 8% are more positive now about their business

- 4% are relieved

- 2% are exasperated

- 4% are less positive

- 2% are uncertain

- 6% feel they didn’t get enough support

- only 6.7% feel enthusiastic

These sentiments show SMEs are still cautious about business survival, which aligns with the fact that their intentions to close or sell (if conditions don’t improve) are higher now than in H2 2020.

Smaller the business, bigger the headache?

Generally the findings this round show the larger the business the higher the level of positivity about business outlook.

It is the smaller end of the small business sector that seems to be hurting the most.

Revenue uncertainty is more marked at the smaller end of the SME sector, with $1m-$5m revenue SMEs across all states feeling the brunt from the pandemic more so than their $5m-$20m counterparts.

As well as showing greater uncertainty about revenue growth, smaller SMEs are more likely than large SMEs to:

- have been declined from lending product

- experienced suppliers reducing payment terms

- faced difficulty meeting tax payments

- be looking to close or sell their business if current conditions don’t improve

Three times as many small SMEs as large ones had to seek new funding because they couldn’t rely on equity in their home to fund their business.

Larger SMEs are more likely than their smaller counterparts to have experienced cash flow issues in 2020 but they are also more likely to have introduced new funding options to deal with these issues.

These larger SMEs are also more likely than small SMEs to:

- be looking to restructure

- have a plan for recovery

- seek to enter new markets

- work with trusted advisors

Whatever the size of the small business, there are many good reasons for either the business owner, or their trusted accountant, bookkeeper, broker or business advisor, to be initiating conversations that help plot a road to post-pandemic success.

Perfect storm lashes SMEs – so what can they do to recover?

Despite SMEs showcasing their resilience during the COVID-19 pandemic, there are warning signs ahead for 2021 and beyond – and businesses must take decisive action to succeed.

The March 2021 ScotPac SME Growth Index highlights the uncertainty, with one in three small businesses saying they will have to sell (20%) or close (14.2%) unless conditions significantly improve.

As the JobKeeper stimulus package becomes a distant memory and businesses deal with events such as severe flooding across eastern Australia and ongoing fallout from domestic and international border closures, there is no room for complacency.

SME owners are a tough cohort, though, and the Index shows they are already plotting ways to rebound. Here are some strategies that are on the agenda as they seek to kick-start growth.

Put restructuring on the radar

In tough markets, discussions with your accountant or the Australian Taxation Office are a smart move. The SME Growth Index reveals that a fifth of businesses say they will make arrangements with the ATO to better manage their cashflow, and the tax office is coming to the party with initiatives such as providing tax-free cash flow boosts of between $20,000 and $100,000 to eligible businesses, delivered through credits in the Business Activity Statement system.

Clearly, change is in the air, with the Index showing that two-thirds (64.6%) of businesses plan to examine ways to restructure their operations this year.

Another factor that may help on the financial front is the Federal Government’s new small business restructuring laws that are designed to help businesses reset balance sheets and return to profitability. Eligible SMEs with liabilities under $1 million and who are up to date with their tax lodgements can stay in charge of the business while working on a turnaround plan with an expert.

Implement cost-cutting measures

SMEs need to be lean, but not mean, as they pore over expenses relating to everything from staff numbers to operational costs. Of the 1253 small businesses that East & Partners polled for the Index, one in five (21.6%) has plans to reduce costs in an effort to boost their overall financial position.

Among the options are changes to the workplace, with one in five businesses overall – and one in four larger SMEs – indicating that they’ll move head office or downsize. While that could be disruptive, many businesses know as a result of the pandemic that working from home is now a feasible option that can minimise their office footprint and associated costs.

While smart budgeting is crucial, businesses should strike a balance between conserving cash and investing in growth. A lack of investment runs the risk of a business becoming less relevant in its market.

Embrace a working capital finance facility

Non-bank lending options should be in the mix for businesses, with the end of JobKeeper in March 2021 increasing the pressure to find reliable sources of funding. The Index reveals that 685 of the 1253 respondents are planning to invest in their own growth over the next six months, so cash flow will be more important than ever.

Significantly, the research shows that one in six businesses (15.2%) intends to use a working capital finance facility to replace stimulus funds. Invoice finance, also known as debtor finance or receivables finance, is expected to be one option that is on the table. Such a facility is ideal for businesses that sell goods or services on credit terms, letting them receive an advance on invoices already owed, while their funding can grow in line with sales. No property security is required and businesses can get an immediate cash injection to increase cash flow and cover costs such as wages and supplier payments.

Invoice finance also offers SMEs the option of full management of accounts receivables, which allows smaller entities to focus on their growth rather than wasting time chasing outstanding invoices.

While there are a range of facility available, what’s clear is that businesses should be talking to professional advisers about the best way forward. In such uncertain times, it’s also imperative to act quickly to put funding in place early, so if a business has cash flow problems it can move promptly to take advantage of new sources of funding.

While the government has tried to encourage SME access to funding through loans under its SME Guarantee Scheme, with the loan limit increasing from $1 million to $5 million, there are still questions as to whether SMEs will embrace the idea after slow initial take-up of the offer. Put bluntly, many of them are reluctant to weigh down their businesses with more debt.

Target and grow new markets

COVID-19 or not, SMEs may have to make some bold moves if they are to prosper. The SME Growth Index reveals that 8.9% of businesses are planning to enter new markets, while 5.1% are eyeing off merger and acquisition opportunities.

This is where financing solutions such as invoice finance and trade finance come into their own. The latter facility uses a revolving line of credit to pay overseas or local suppliers in almost any currency. Having such cash flow certainty gives SMEs more confidence to take on new projects or clients while managing possible extra costs for staff, raw materials and other resources.

Plan to succeed

Confidence and certainty shape as make-or-break factors this year and in 2022 as the pandemic plays out.

It’s worrying that the Index reveals that one in four SMEs (25.9%) are unsure about what measures to put in place to plot their path to recovery. The positive news is that SMEs have choices, whether it be around funding, restructuring, cost-cutting or a range of other measures.

What’s clear, though, is that a do-little is not a viable option in the long-term.

Everything to Know About Cash Flow Loans for Small Business

Updated on 25th November 2024

Cash flow is critical for the financial health of a small or medium-sized business. In fact, when it comes to sustainable success, cash flow is equally as important as profit.

Even a profitable business can experience cash flow gaps that hinder growth due to factors like extended payment terms and seasonal sales cycles.

A cash flow loan can enhance and increase access to working capital and facilitate growth without requiring real estate collateral. Unlike traditional business loans or bank loans, cash flow lending uses projected future cash inflow as security rather than the value of physical assets on your business’s or personal balance sheet.

Loan facilities with this level of flexibility are particularly beneficial in a marketplace where the majority of businesses (60% by recent estimates) fail within the first three years. Especially considering that most of these failures are due to cash flow issues and other financial mismanagement.

So, what do you need to know to determine if a cash flow loan is the right option for your business?

Understanding Cash Flow Loans and Invoice Finance

What Is a Cash Flow Loan?

A cash flow loan is a finance option that relies on your business’s projected and historical cash flow to assess eligibility and determine loan suitability. Various types of cash flow lending exist, but they all fundamentally utilise your anticipated sales revenue to secure immediate funding.

Unlike traditional asset-based loans, which require collateral in the form of property or high-value assets, cash flow loans don’t require physical collateral. This is why they are an attractive option for businesses looking to maintain flexibility in their financing without compromising much-needed access to cash flow.

How Do Cash Flow Loans Work?

In essence, cash flow loans allow you to borrow money against your future earnings. If your business faces cash flow gaps due to seasonal fluctuations or extended payment terms, these loans can quickly boost your working capital today based on future earnings.

Introducing Invoice Finance

One of the most popular forms of cash flow lending is Invoice Finance.

This financial solution enables you to access funds tied up in outstanding sales invoices. Instead of waiting for customers to settle their accounts with you, you can submit your invoice (or invoices) to the finance company providing the loan and receive a cash advance of up to 85% of the invoice value upfront. Once your customer pays the invoice, you receive the remaining balance minus any applicable fees.

Since invoice financing is secured by your accounts receivable rather than projected cash flow, your outstanding invoices serve as the sole collateral for the loan. This means you won’t have to leverage personal assets, such as your home, to secure financing, and makes it a more accessible option for many businesses.

For more details on how Invoice Finance works and how you can apply for it with ScotPac, visit here.

How Much Does Cash Flow Financing Cost?

The cost of cash flow finance varies based on the level of risk perceived by funding provider. Factors such as the volume and value of your invoices, the creditworthiness of your customers, and other considerations play a crucial role in determining the overall cost, fees and the percentage of the invoice value that will be provided.

Generally, though this is not a hard and fast rule, financing a higher number of invoices and working with more creditworthy customers can lead to lower costs.

It’s important to note that different cash flow financing options may have varying costs associated with them as well, depending on how they are structured. Understanding these costs is essential for making informed financial decisions for your business.

How Long Does It Take to Secure Cash Flow Finance?

The application process for cash flow finance is much faster than traditional bank loans. If your financial records are up to date, you can expect approval within just a few days and, moreover, once your application is approved, you may receive the working capital in as little as 24 hours.

Is Cash Flow Finance Right for Your Business?

Many growing businesses face working capital challenges. Whether your business is onboarding new customers, experiencing rapid growth or needing to weather macroeconomic or cyclical sales challenges, cash flow finance may be the right solution.

According to research included in our latest SME Growth Index report, 25% of small and medium sized enterprises said that the loss of a major client or supplier would be a catalyst tipping them into insolvency – which reflects significant working capital constraints.

Cash flow financing can be an effective solution for many businesses experiencing disruptive or debilitating cash flow gaps. It is also an excellent option if you require a quick cash injection to cover unexpected expenses or capitalise on time-sensitive opportunities.

So, how can you know if it is right for you?

One of the most effective strategies for identifying and preparing for potential working capital shortages is to create a cash flow forecast. This tool will enable you to anticipate cash inflows and outflows, helping you make informed financial decisions for the overall benefit of your business.

If you need assistance crafting a cash flow forecast, check out our step-by-step guide here.

Cash Flow Lending vs. Asset-Based Lending

How does cash flow lending compare with asset-based lending?

Both financial options provide essential capital to help your business grow and achieve its objectives. A strategic combination of both financing types can offer the long-term affordability and short-term flexibility necessary for sustainable growth.

Evaluating Asset-Based Lending

With asset-based lending, the amount you can borrow is determined by the value of the assets you are willing and have available to use as collateral. Traditional secured loans can be challenging to obtain if you lack such assets to secure against and ensure access to the loan.

In fact, just under 50% of total outstanding small business loans in Australia are secured by residential property. This slight decrease in previous years indicates not just changes and challenges in the economy, but a corresponding growing trend towards alternative forms of collateral in business financing.

To learn more about secured lending, read our blog on Secured Business Lending and discover if it’s the right solution for your business.

Evaluating Cash Flow Lending

In contrast to asset-based lending, cash flow lending allows you to borrow based on your business’s projected cash inflows. Lenders focus less on the value of your physical assets and more on your ability to repay the principal loan amount with interest. This makes cash flow lending particularly advantageous for businesses that may not have significant assets but have strong revenue potential.

As a general rule of thumb, asset-based lending is more suitable for long-term financing needs, while cash flow lending offers greater flexibility for short-term working capital issues.

Pros and Cons of Cash Flow Financing

As with any funding solution, cash flow financing comes with its own set of advantages and disadvantages:

Pro #1 – Quick Access to Funds

Since no asset valuation is required, cash flow lending can provide capital to cover cash flow gaps or seize opportunities significantly faster. With Invoice Finance, for example, you can access funds within 24 hours of submitting an invoice.

Pro #2 – Avoid Long-Term Debt

Instead of accumulating debt on your books, you can free up capital tied up in accounts receivable. Invoice Finance enhances your cash flow without locking you into a lengthy repayment schedule.

Pro #3 – Easier Accessibility

Invoice Finance is generally more accessible than traditional secured loans. Even small businesses with a limited trading history, a poor credit score, or a lack of high-value assets can still qualify for this funding facility.

Pro #4 – No Property Security Required

You won’t need to use your home as collateral. With secured loans that use personal property as collateral, failing to make repayments could mean you, as the business owner, risks losing your property.

Con #1 – Reduced Profit Margins

One significant consideration with cash flow lending is that it may reduce your profit margins. Funding providers typically charge fees based on a percentage of the invoice or invoices’ value, which can impact profitability if you are a business that operates on low margins with high volumes.

Con #2- Credit Limits Tied to Invoice Value

The credit limits for cash flow lending are based on your sales revenue. If you require a substantial amount of funding for a significant expense, Invoice Finance may not cover the total needed. For one-off business purchases, other forms of finance, such as Asset Finance or equipment finance, could be a more appropriate funding option.

Cash Flow Financing with ScotPac

Cash flow financing serves as a vital tool for managing working capital and fostering business growth. This flexible funding solution enables you to unlock the true potential of your business, beyond just the value of your physical assets.

If you think cash flow finance could benefit your business, call us today or fill out the form below to get personalised support from the ScotPac team. We’re here to help you find the right solution to meet your unique business needs.

Should You Get an Unsecured Business Loan for Your Small Business?

Updated on 12th November 2024

An external cash injection can be a catalyst for small business growth, especially for small business owners. However, getting a secured business loan can be challenging, particularly if you don’t have assets to use as collateral.

One of the most popular alternatives is to use an unsecured business loan to get the funding you need. You don’t need to provide collateral, and you can access funding much faster than you would with a secured loan from a traditional lender.

Let’s take a look at how unsecured business loans work and if they could be a good funding solution for your business. If you have any questions about applying for unsecured finance for your small business, make sure to reach out to the ScotPac team today.

What Is an Unsecured Business Loan?

An unsecured business loan is a financing solution that allows a business to access funding without using assets as security for the loan.

With a secured business loan, the finance provider requires the borrower to use their property or personal assets as collateral. If the borrower defaults on the loan, the lender can seize the collateral to recoup the loss.

With unsecured business loans, there is no collateral requirement. Instead, the lender will examine the company’s financial reports, credit score, cash flow projections, and other factors to determine the amount the business owner can borrow.

Because there is no security on the loan, the finance provider will usually require a personal guarantee for the debt. This has implications for interest rates and eligibility criteria for unsecured business loans.

The Pros and Cons of Unsecured Business Loans

An unsecured business loan can be a valuable financial tool but may not be suitable for some businesses. Let’s take a look at pros and cons:

Unsecured Business Loan Advantages

Unsecured business loans offer several compelling advantages that make them an attractive financing option for many businesses.

1. Low Upfront Costs

One of the primary benefits of unsecured business loans is the low upfront costs associated with them. Unlike secured loans, which often require extensive asset valuation and legal fees, unsecured loans eliminate these expenses. This allows businesses to access funding without incurring significant initial costs, enabling them to allocate resources more effectively to their operational needs.

2. No Risk to Assets

With an unsecured business loan, there is no risk of losing personal or business assets in the event of default. While this provides peace of mind for borrowers, it’s important to note that lenders may still require a personal guarantee. This means that although your assets are not directly at risk, you may still be personally liable for repayment if the business cannot meet its obligations.

3. Fast Application Process

The application process for unsecured business loans is significantly faster than that of secured loans. Since there is no need for collateral appraisal, businesses can often receive approval within days or even hours. This speed is especially beneficial for businesses facing urgent financial needs or time-sensitive opportunities.

4. No Collateral Required

As the name suggests, unsecured business loans do not require any collateral, making them accessible to a wider range of businesses. This is particularly advantageous for start-ups or small businesses without substantial assets to pledge as security.

5. Funds Can Be Used Flexibly

Unsecured loans offer flexibility in how funds can be used. Borrowers can utilise the capital for various purposes, including alleviating cash flow, inventory purchases, marketing efforts, or new equipment, without restrictions imposed by the lender. This versatility allows businesses to respond quickly to changing needs and opportunities and grow according to their needs.

6. Opportunity to Build Credit

Taking out and successfully repaying an unsecured business loan can help improve a business’s credit score over time. For newer businesses or those with limited credit history, this can be an essential step in building a strong credit profile, which can assist with future loan applications and overall financial health.

Unsecured Business Loan Considerations

While unsecured business loans offer several advantages, it’s important to be aware of some potential challenges. Here’s a closer look at these considerations, along with alternative options that may suit your needs.

1. Funding Limits

Unsecured business loans typically come with smaller funding limits compared to secured loans. This is because they are not backed by collateral. If you are looking to fund a high-value business expense, you might explore options like Asset Finance or Secured Business Loans, which can provide larger amounts.

2. Interest Rates

Due to the nature of unsecured lending, lenders face a higher level of risk, which can lead to higher interest rates compared to secured loans. While this is an important factor to consider, the convenience and speed of obtaining an unsecured loan can sometimes outweigh the cost difference.

3. Credit Score Requirements

Unsecured loans typically require a good credit score since lenders use it as a key indicator of risk.

In summary, while unsecured business loans come with certain considerations, they also offer valuable flexibility and accessibility. By understanding these factors and exploring alternative financing options, you can make informed decisions that align with your business goals.

Is an Unsecured Loan Right for My Business?

An unsecured business loan can be a good option if you would prefer to avoid using your assets as collateral for funding or if you need to quickly raise funds to capitalise on a time-limited opportunity. It’s important to compare unsecured business loans to understand the varying interest rates, eligibility requirements, and personalised financing options available.

But unsecured business loans can be hard to access for new businesses and those with a poor credit score. You should consider the differences in interest rate, eligibility, repayments and application process to ensure it is right for you.

If a secured loan is out of reach, and unsecured business finance is also unsuitable due to a low credit score or short trading history, Invoice Finance can be the best alternative funding solution.

Qualifying for a Business Loan with ScotPac

To qualify for a business loan with us, there are a couple of key criteria you’ll need to meet.

First, your business should have been operating in the same location for at least 12 months, demonstrating stability and commitment to your enterprise. Additionally, we require that your business demonstrates a minimum turnover of $10,000 per month in total sales.

Meeting these requirements not only helps us assess your eligibility but also positions you for a successful partnership as you seek to grow and expand your business.

Secured business loans from ScotPac range from $10,000 to $500,000. Our unsecured loans generally have a limit of $200,000. As a general guideline, we can provide funding of up to 100% of your average monthly sales. However, a strong asset base can assist in increasing the approval rate and loan amount.

Enhancing Business Growth With ScotPac

Cash flow is key to business growth. Here at ScotPac, we’ve helped Australian small businesses to get the funding they need to expand for over 35 years.

If you need external funding to take your business to the next level, speak to one of our Business Loan specialists today. We’ll help you find a solution that enables you to achieve your goals and fits with your existing funding arrangements. Alternatively, if you have questions about unsecured business loans, our lending specialists are here to help.

Give us a call on the number below or fill in our simple online application form. It won’t impact your credit score, and we’ll get back to you shortly with a tailored funding solution for your business.

Best Business Loan Options in Australia

The right business loan can provide the investment you need to grow your business. It can also save you money in interest and fees.

The wrong type of business loan can lock you into expensive repayment terms and stunt the growth of your business for years to come.

Whether you need a cash injection to cover short-term expenses or a long-term funding facility to fuel expansion plans, the best business loan option is the one that is right for your unique business circumstances.

In this guide, we’ll explore the best business loan options in Australia so you can find the right finance solution for your needs.

What Is a Business Loan?

A business loan is a type of financing designed to help businesses manage cash flow and fund growth.

A growing business can often encounter cash flow gaps. Lack of working capital restricts your ability to capitalise on opportunities and maintain growth.

You can use a business loan to increase liquidity for short-term cash flow needs and to spread the cost of significant purchases and expenses over a longer period.

As with a personal loan or credit card, business loans can be secured or unsecured. Interest rates and fees can also vary according to the loan type and funding provider.

The Best Business Loan Options for Australian SMEs

With the rise of alternative lenders, there is a wide range of traditional business loans and innovative funding solutions available to Australian businesses.

To help you find the financing that’s right for you, let’s explore the best business loan options and how they work.

Secured Business Loans

Over 95% of bank loans to small businesses are secured. To be approved for a secured business loan, you will need to provide collateral such as high-value business assets or residential property.

Because the financing is secured against collateral, the interest rates for a secured business loan can be lower. Funding limits are also generally higher. The risk is that you could lose your home or asset if you default on the loan.

The need for collateral means this type of funding is more suited to established businesses and homeowners. The application process for a secured loan is also longer than other types of business financing.

Because the financing is secured against collateral, the interest rates for a secured business loan can be lower. Funding limits are also generally higher. The risk is that you could lose your home or asset if you default on the loan.

The need for collateral means this type of funding is more suited to established businesses and homeowners. The application process for a secured loan is also longer than other types of business financing.

Unsecured Business Loans

As the name suggests, unsecured business loans typically do not require any collateral. While that means they can be more accessible, the lender is taking on more risk, and interest rates can be higher. Funding limits are generally smaller than secured business loans.

Unsecured business loans are suitable for new businesses that don’t have a long trading history. They can also be ideal for more established companies that don’t want to use assets as collateral for funding. Even though unsecured loans do not require collateral, you may be required to provide a personal guarantee to cover the debt if the business is unable to make repayments.

Read our guide Why Consider Unsecured Funding? to find out why this type of financing is increasingly popular with Australian SMEs.

Equipment Finance

Equipment Finance is a type of business loan that helps companies purchase the machinery, vehicles, and equipment they need without the significant upfront cost. For most Equipment Finance solutions, you do not need to provide any additional collateral, and the funding can be used to purchase new and second-hand assets.

You can spread the cost of high-ticket items over a more extended period. Your business can use the asset during the financing term. Depending on the financing terms, you will take full ownership of the asset at the end of the contract.

Invoice Finance

Insufficient cash flow is the number one cause of business failure in Australia. Invoice Finance is a funding solution that helps companies manage cash flow and avoid the stress caused by late-paying clients and extended payment terms.

With an Invoice Finance facility, you can release the capital tied up in your unpaid sales invoices. You can get an immediate cash advance of up to 95% of the invoice value upfront, rather than waiting 30+ days for your customer to pay.

New and smaller businesses can benefit most from a debt factoring facility where collections and account management is outsourced to the finance company. For more established companies with dedicated collections departments, an invoice discounting facility may be more suitable.

Read our guide on the difference between factoring and discounting to determine which is right for your business.

Line of Credit

A line of credit can be an excellent way to support cash flow over an extended period. The finance provider will agree on a credit limit, and your business can withdraw funds as needed.

Interest is only charged on the funds withdrawn, but the facility may involve a monthly line fee and transaction fees.

A line of credit is sometimes combined with an Invoice Finance facility. It can be an effective funding solution if your business regularly experiences cash flow gaps due to extended payment terms.

The credit limit is linked to your accounts receivable. As you grow your customer base and raise new invoices, the limit increases. When your customers pay the invoice, the outstanding balance is repaid.

Trade Finance

Trade Finance is a versatile form of financing that can help companies that engage in international and domestic trade. The funding facility can support the working capital requirements of both parties in a business transaction.

If you import goods from an international supplier, Trade Finance can be used to pay for the goods upfront and support cash flow needs during the period where goods are shipped, received, and sold.

For exporters, Trade Finance can provide a cash flow boost to cover working capital requirements while goods are manufactured, shipped, and paid for by the customer.

Read our guide What is Trade Finance to see how a funding facility could benefit your business.

Merchant Cash Advance

A merchant cash advance is a type of business financing that allows you to access a cash advance secured against a percentage of your future card sales. The funding provider will analyse your historical credit and debit card sales to determine how much funding you can access.

Once the funding agreement is in place, a percentage of your card sales will automatically be used to repay the cash advance and interest.

This form of funding is suitable for businesses that process a large number of credit and debit card transactions and suffer from seasonal sales fluctuations. However, merchant cash advances typically have high interest rates compared to other types of business finance.

Read our guide The Pros and Cons of a Merchant Cash Advance to see if your business could benefit from this type of funding.

What’s the Best Loan for Your Business?

It’s vital that you choose the right type of financing. Make sure you understand the repayment terms, interest rates, and funding duration to make an informed decision. You should consider the following factors:

The Amount Required

Before you start comparing loans, you should have an accurate estimate of how much you will need to borrow.

If you need to pay for a significant one-off business expense, Equipment Finance or a secured loan could be the best option to get the funding you need.

For more flexible funding to support working capital, Invoice Finance or a line of credit could be a more suitable financing option.

Your Working Capital Needs

Your current cash flow can be an important factor when considering business loan options.

If your business suffers from cash flow gaps, a line of credit or an Invoice Finance facility can be a better fit for your needs. You can access funding when you need it, and you won’t pay interest on the remaining unused balance.

For a sizable one-off expense, Equipment Finance or a business loan will provide the most affordable rates over the duration of the repayment terms.

Your Business Lifecycle

The lifecycle of your business will impact which types of funding you will be able to access. Generally, companies with a short trading history or poor credit rating will struggle to meet the strict lending criteria of traditional lenders.

If your business doesn’t qualify for a secured business loan, there are a range of affordable options that you can still access. Invoice Finance and Equipment Finance are available to start-ups and small businesses.

How Soon Do You Need Funding?

It can take up to 3 months for a traditional business loan application to be processed. An unsecured loan or alternative funding option can provide a cash advance in as little as 24 hours.

It’s always recommended that you don’t rush into a business loan. Even if you need the funding quickly, make sure you understand the financing terms and evaluate your options before entering into an agreement.

ScotPac Business Financing

Bank loans aren’t the only option when it comes to business financing. There are more funding options available to Australian businesses than ever before.

We have over 30 years of experience helping Australian businesses get the financing they need. If you’re looking to fund the growth of your business, speak to one of our team of friendly business finance advisors today. We’ll help you understand your options and find a financing solution that works for you.

Growth Finance: What Are Your Options?

A growing business is cash hungry. One of the biggest challenges business owners face is that cash flow doesn’t always keep up with growth. The more sales you make, the more capital you need.

Growing businesses need capital to expand and survive. Larger businesses are generally more successful for longer. A company with 1-4 employees has a 69% survival rate over four years. For companies with 5-19 employees, the chances of survival increases to 78%.

If you want to hire new employees, purchase new equipment, or expand to multiple locations, you need growth finance to support your plans and cash flow needs.

What Is Growth Finance?

Growth finance is an umbrella term for the debt and equity funding sources a business can use to support expansion and growth. You can use growth financing to access the capital you need to take advantage of opportunities to grow your business and increase sales revenue.

A growth financing solution should be linked to the potential for growth and cash flow needs of the business. You may need to use a combination of short and long-term financing solutions from traditional and alternative lenders to support growth plans.

Key Considerations for Growth Financing

A documented growth strategy and financial plan are the first things you should focus on before seeking financing.

You need to establish:

- How much capital you need

- How quickly you need it

- Whether you need a one-off lump sum or continual access to credit

- When you will be able to repay the sum owed

It’s important to be realistic and accurate about the costs involved, how quickly you can achieve your goals, and when you will be able to repay the capital to the funding provider.

Create a Cashflow Forecast

A cash flow forecast can help you anticipate the amount of financing you will need and how repayments and costs will impact cash flow. It will show you what you can afford to invest without growth financing and how much working capital you need to keep your business operational over the coming months.

Plans for expansion and growth usually result in business costs increasing before sales and revenue catch up. It’s always recommended to include a surplus to pay for unexpected costs. Many growth plans take longer than initially expected to generate additional revenue.

Read our guide How to Create a Cash Flow Forecast for a detailed step guide on how to create a forecast for your business cash flow.

Calculate Return on Investment

Calculating return on investment (ROI) is essential for ensuring sustainable business growth.

When you’re considering growth financing, you need to account for the finance’s total costs and the percentage return on investment you can expect over a set period. Most businesses calculate growth financing ROI over a period of 3 – 5 years.

Establish the total investment cost, including any financing fees and interest, determine the increased revenue and net profit for each year, and use those figures to calculate your percentage ROI.

For example, let’s say that you are looking to introduce a new service. You need to purchase equipment, hire new staff, and invest in marketing to promote your new service to potential customers.

The total cost of investment, including financing repayments, is $300,000.

Once the new service is operational, you should generate an additional $450,000 in revenue and $75,000 net profit each year.

Over four years, the additional revenue and net profit will have paid for the total growth financing investment, and the business will start to see a positive ROI.

When you’re calculating ROI, it’s recommended that you use a range of sales revenue estimates to account for unexpected issues that could cause revenue to be lower than expected.

Growth Finance Options

Growth finance covers a wide range of funding options. Here’s a shortlist of the most widely used growth financing solutions in Australia.

1. Invoice Finance

Invoice Finance is a way to release the capital tied up in your outstanding sales invoices. If your business offers net payment terms, it can take up to 90 days to receive payment from your customers.

With an Invoice Finance facility, you can access up to 95% of the invoice value upfront as a cash advance.

Instead of taking on debt, Invoice Finance releases capital tied up in existing assets – your accounts receivables. It keeps cash flowing into the business so that you can invest in your growth plans.

Invoice Finance is particularly well-suited to growing businesses. Unlike a static business loan, the funding facility limit grows in line with your sales revenue. The faster your business grows and increases sales, the more capital you can access through Invoice Finance.

2. Asset Finance

Being able to access the right tools and equipment is integral to business growth. Around 30% of small business owners say that keeping up with advances in technology is a major concern.

The most significant challenge for businesses looking to invest in new tools and technologies is the lack of capital.

Asset Finance is a growth financing solution designed to help businesses access the funding they need to purchase equipment and machinery. Asset Finance options can include equipment finance, hire purchase, and leasing.

These solutions allow you to spread the cost of an asset over a more extended period, protect working capital, and access the technology and equipment you need to accelerate your growth plans.

Asset Finance works best when it supports new business growth. When new equipment helps you increase capacity and generate more revenue, the additional profits will cover the growth financing cost.

3. Equity Finance

The majority of growth finance solutions are types of debt financing. The lender will provide investment, and the business repays the principal and interest over a set period.

Equity finance is an alternative form of financing where a third-party funding provider invests in the business in exchange for part ownership and a share of future profits.

Equity finance is typically sourced through venture capitalist or angel investors.

Venture capitalists usually invest in innovative and disruptive start-ups that could achieve rapid growth and deliver a significant return on the investment for the venture capitalist’s clients.

Angel investors are also willing to invest in businesses with high growth potential, but they are usually private investors using their own funds. An angel investor can also provide valuable connections and advice to help the business succeed.

If you plan to pursue equity finance, you’ll need to create a compelling pitch to promote your business and be prepared to spend a lot of time networking and seeking potential investors.

4. Bank Financing

Bank financing solutions like loans and overdrafts are some of the most well-known growth finance options. But they can also be some of the most complex and challenging to access.

The flexibility offered by alternative funding solutions has made non-bank lenders increasingly popular. Since 2018, the use of non-bank funding for growth businesses has doubled.

Traditional lenders are generally more conservative and require applicants to meet strict lending criteria.

To qualify for a loan or overdraft, you will usually need to provide financial disclosures, a personal guarantee, and use your home as collateral. The application process is generally much longer than with alternative funding providers, and it can take up to 3 months for you to receive funding.

If you apply for bank financing, take time to explain your business model and try to choose a lender familiar with your industry. It’s vital that your bank understands the capital requirements needed to support growth.

5. Merchant Cash Advance

A merchant cash advance is a funding solution designed to help retailers and other businesses that process a high volume of card payments. The funding provider will analyse your card payment history and provide a cash advance based on the transaction volume value.

The cash advance is repaid as you process more credit and debit card sales. Every time a customer pays using a card, a percentage of the sales value is automatically deducted by the financing provider.

A merchant cash advance can be beneficial for certain businesses that suffer from seasonal sales cycles, but it can also be an expensive way to fund growth plans.

Read our guide, The Pros and Cons of a Merchant Cash Advance, to see if this growth financing type is right for your business.

6. Crowdfunding

Crowdfunding allows businesses to seek growth financing from multiple small investors instead of a single provider.

While this form of funding has grown in popularity, it can be challenging for businesses to raise enough capital to support their growth plans using crowdfunding alone.

If you have an exciting and innovative product or service that will appeal to a large audience, you can use online crowdfunding platforms to seek investors.

It’s important you understand the terms and conditions of the crowdfunding platform you choose to use. Some platforms require you to reach your full funding goal before you can withdraw the money raised, and withdrawals can also be subject to processing fees.

Which Growth Financing Option Is Right for Your Business

Growth financing can provide the capital you need to increase revenue and expand your business. Managing your funding sources and ensuring you can access capital when you need it is vital to sustainable business growth.

If you are looking to finance growth at your business, give us a call and speak on our friendly team of growth finance experts. We’ll help you understand your options and advise you on the best funding solution for your business’s unique needs.

Small business-friendly Budget gives SMEs great opportunity to invest in their own growth so recovery momentum continues

Media release

Australia’s largest non-bank small business lender has welcomed Federal Budget 2021 initiatives that “give SMEs a great chance to continue to rebound from the pandemic”.

ScotPac CEO Jon Sutton said this is a budget which should create an environment that helps SMEs continue to rebound.

“There are positive initiatives to support the small business sector, and the focus on boosting consumer confidence should also help businesses,” Mr Sutton said.

“This is a small business-friendly budget that should give SMEs the confidence to invest in their own growth, as the economic recovery gathers momentum.

“What this means is it’s time for SMEs to really think about their business plans, about restructuring and about how they’ll fund their continued recovery.”

Small business wins

Mr Sutton said Budget 2021 initiatives that the small business sector will appreciate include:

- The extended instant asset write-off is good for businesses, it allows them to buy the vital equipment needed to continue growing. We’ve seen with our own clients around Australia the positive impact this can have. While it has been extended until June 2023, it should be made a permanent fixture.

- $225m craft brewer excise relief. It is great to see an initiative that allows Australia’s burgeoning craft brewing industry to thrive. ScotPac supports a number of craft brewers so we know the massive impact excise duty has on their cashflow.

- $250m regional infrastructure spending. Investment in infrastructure is vital ($15.2 billion in new funding over 10 years for infrastructure projects nationally), and while there was a regional boost in spending it would be good to see more. Interest rates are so low that now is the time for the government to really accelerate investment in infrastructure – not just in the capital cities but also in regional Australia to allow communities to thrive and decentralisation to continue.

- Shielding SMEs from debt recovery action, plus further action on insolvency reforms. It is a positive move to allow the Administrative Appeals Tribunal to pause or modify ATO debt recovery actions against taxes owed by small businesses. Now businesses must play their part – to fully recover from the pandemic and take advantage of market opportunities, especially if your business has creditor debt, business owners need to think about how their future structure. ScotPac has been at the forefront of allowing businesses to restructure and invest in growth for decades, but in particular during the past six months during recovery from the recession.

- Extension for another year of the loss carry-back provisions for SMEs, with 2022-23 losses able to be written off against a 2018-2019 profit, a boost for solid businesses who took a hit during the pandemic year.

What else the SME sector needs

- The move to encourage the states to streamline payroll tax will be welcomed by small businesses, as it’s a handbrake on hiring. Mr Sutton said, “I’d say go further and abolish it. We’d encourage the National Cabinet to make this a priority for discussion, as this would be an initiative in support of business growth and economic prosperity”.

- The Budget has laid the groundwork, now small businesses can play an important role in guiding Australia out of the pandemic-induced economic downturn. To do this, SMEs need to start investing in their own growth, which many put on hold during the pandemic.

There are some early positive signs of recovery – ScotPac’s SME Growth Index recorded an eight-point increase in the number of businesses expecting positive growth in the first half of 2021.

Despite these promising signs, the research shows that small business owners are still hesitant to invest in their own growth and are “fence-sitting” waiting to see what the Government and the economy does.

“It is crucial that business owners have the confidence to grow. Until they are comfortable to invest in their own growth, it will remain difficult for the Australian economy to take off,” Mr Sutton said.

“I’m hopeful that this small business-friendly 2021 Federal Budget will give business owners the confidence to act and provide the impetus for a small business-led national recovery.”

ScotPac is Australia and New Zealand’s largest non-bank business lender, providing funding to small, medium and large businesses from start-ups to enterprises exceeding $1 billion revenues. For more than 30 years ScotPac has helped thousands of business owners succeed, by unlocking the value from their business assets. Whether it is purchasing stock, investing in vehicles and equipment, improving cash flow or accessing additional working capital, ScotPac can help.

For more information contact:

Kathryn Britt

Director, Cicero Communications

[email protected]

0414 661 616

Short-Term Asset Finance Options to Help You Grow

A growing business needs to invest in assets to stay competitive and achieve its goals. But buying new equipment and machinery can strain your cash flow and tie up funds that could be used to accelerate growth.

Short-term Asset Finance can help you get the funding you need without tying you down to a lengthy repayment commitment. More and more Australian SMEs are turning to Asset Finance and other alternative lending solutions to support growth.

In our latest SME Growth Index, 27.4% of business owners told us they intended to fund growth using non-bank financing. Growth financing from main banks has halved since 2014, dropping to an all-time low.

Whether you need quick funding to replace old equipment or a cash injection to support your expansion plans, a flexible Asset Finance facility can provide the financial support you need.

What Is Asset Finance?

Asset Finance is an umbrella term that covers a broad range of funding solutions. A funding facility can help you obtain the assets your business needs to grow without meeting the high upfront cost of purchasing equipment outright. You can spread the investment cost over a more extended period to take the pressure off your cash flow.

This type of funding is helpful for businesses that have an opportunity to expand and grow but don’t have the liquidity to capitalise.

Asset Finance can also help businesses release capital tied up in machinery, equipment, and other assets that the company already owns. The asset provides security for the funding.

Read our guide How Asset Finance Works to see how asset finance could help you get more out of your business assets.

What Is Short-Term Asset Finance?

Short-term Asset Finance solutions are designed to help businesses quickly access the capital and equipment they need to grow and be competitive. Funding facilities typically have shorter terms compared to traditional funding options.

A traditional bank loan term ranges from 3-10 years. Strict lending criteria means that traditional funding is out of reach for many SMEs, and it can take up to 90 days for approval.

Short-term Asset Finance solutions are much more flexible, with terms ranging from 24-60 months and funding approved in as little as 24 hours.

There are two main categories of short-term Asset Finance: Equipment Finance and Asset Refinancing.

Short-Term Asset Finance Options

Equipment Finance

Purchasing equipment and machinery upfront can be risky, with the potential for cash flow problems. For many businesses, making a large upfront payment is not possible. Equipment Finance solutions help companies to get the equipment and tools they need to grow.

Hire Purchase

Hire purchase allows you to buy the asset you need and spread the cost over a series of repayments. The asset belongs to the business and appears on its balance sheet. Because your company owns the asset, you will be responsible for any maintenance costs.

The asset acts as collateral for the funding facility, so you don’t need to provide any additional security. You will take full ownership of the asset once the final repayment is made.

Leasing

With a leasing arrangement, the finance company will purchase the asset you need and charge a monthly leasing fee. You can use the asset immediately without having to make a large upfront payment.

At the end of the contract term, you can continue to lease the asset, return it to the finance company, or purchase the asset outright for a nominal fee.

Leasing can be an effective solution for businesses that need to replace or upgrade equipment quickly. This form of short-term asset funding can also provide tax advantages. The asset will appear on the finance company’s balance sheet, and the repayments will be regarded as expenses that reduce your taxable income.

Chattel Mortgage

A chattel mortgage is a financing solution that allows you to use the asset’s value as collateral to secure funding. You can access the equipment you need without the cost of an expensive upfront payment.

The finance company will provide funding, and you make regular repayments over a set term. At the end of the contract, your business will take full ownership of the asset. Some funding facilities allow you to make lower monthly repayments with a balloon payment at the end of the term.

Your business is classified as the owner, and the asset is listed on your balance sheet. This means you can claim tax deductions up to the ATO’s depreciation limit.

Asset Refinancing

Asset Refinancing is a funding solution that helps businesses to unlock the capital they have tied up in the assets they already own. If your company owns expensive machinery, vehicles, or equipment, Asset Refinancing allows you to release capital that can be used to support your growth plans.

Because the financing is secured against existing assets, the amount of funding you can access depends on the value of the assets you want to refinance. If you purchased the asset more than three months prior, a panel valuer will need to conduct a valuation to determine the amount of funding you can access.

Buybacks

Asset Refinancing isn’t just for established companies with lots of existing assets. Many growing businesses suffer from cash flow shortages after putting all of their available capital into purchasing a new asset.

A buyback funding solution can help you to quickly raise capital and maintain the use of the asset. The finance company will provide an immediate lump sum payment secured against the value of the asset. If you purchased the asset less than three months prior, you only need to submit the original invoice and proof of payment to secure funding.

The business will make regular repayments and take back full ownership of the asset at the end of the contract term.

How ScotPac Clients Have Benefited From Short Term Asset Finance

Our fast and straightforward Asset Finance solutions have supported the growth of Australian SMEs for over 30 years. We can help you take back control of your cash flow and get the equipment and machinery you need to grow.

Computertrans – Fuelling Growth with Equipment Finance

Equipment Finance has helped NSW transport company Computertrans to increase its fleet of 110 vehicles and achieve sustainable growth over the last decade. The company is an industry leader in the transportation and installation of high-value medical equipment and freight.

Computertrans uses an Equipment Finance facility with ScotPac to fund the purchase of new vehicles, machinery, and equipment. The Asset Finance facility has helped Computertrans fuel its growth plans and maintain its competitive edge with state of the art equipment.

Read more about Computertrans success story.

Short-Term Asset Finance with ScotPac

Our flexible funding solutions help businesses of all sizes unlock the true value of their assets and get the equipment and machinery they need to succeed.

We believe that every business should be given the opportunity to grow.

If you’re interested in how short term Asset Finance can help your business succeed, speak to one of our friendly team of Asset Finance specialists today. Alternatively, you can use our simple online application form, and we’ll get back to you shortly to answer your questions and help you find a funding solution that allows your business to flourish.

The Road to Recovery: Ovato webinar summary

As part of our Road to Recovery series, we explore how ScotPac funded the complex turnaround and restructure of Ovato, a 150 year old printing and distribution company.

Ovato found themselves in a perfect storm with declining revenue from its traditional print market, disruption caused by the COVID-19 pandemic and ongoing losses incurred by the group over the past few years.

This resulted in excess capacity in Ovato’s print operations, mainly in staff numbers and physical print sites. The business faced additional challenges in onerous leases, high costs of redundancy entitlements and significant level of maturing debt, leading them to implement a restructure to recapitalize the business.

ScotPac Business Finance played a critical role in refinancing two major secured creditors and provided circa $70M in Invoice Finance and Asset Finance.

The benefit of using working capital solutions from ScotPac is that we take real time to understand how a business works. We dive deep in to operations to make sure we’re not missing any opportunities to provide a business with access to capital using their business assets as security. We also look forward rather than backwards, being a secured lender we focus on the value of the assets and provide the facilities against these. Ovato’s turnaround also involved the negotiated alignment of 10+ stakeholders including 333 Capital and Ashurst, as we all worked with trade creditors, insurers, banks and ASIC to make this restructure a success.

The result of this well engineered restructure will allow one of Australia’s largest printing groups to return to profitability, but also resulted in saving 900 jobs. No matter the size of a company, our aim is to give business owners and their employees the best chance of success. We hope to continue partnering with any businesses in need of a turnaround solution, so we can make the same positive impact in their lives as we did with the employees and partners of Ovato.

Watch the webinar recording here.

Pandemic prompted owners to find different ways to fund businesses

News editors: CEO interview, infographics and research data available on request

MEDIA RELEASE

SMEs turn towards non-bank lenders to fund growth

A poll of Australian small businesses shows that almost half (46%) introduced new funding options in 2020 to deal with the pandemic and its aftermath.

ScotPac’s SME Growth Index is Australia’s longest-running in-depth research on small business growth prospects, with 1253 small business owners polled this round.

ScotPac CEO Jon Sutton said the research provides a snapshot of the small business mindset and experience during COVID-19 and its aftermath, with results showing SMEs were willing to look beyond traditional funding methods in order to keep their businesses functioning.

Why SMEs sought new funding methods

Of the 46% of SMEs who had introduced new funding options in 2020 (with 54% sticking to their existing style of funding), their most common reasons for trying new funding methods were:

- 31% wanted to develop new products and services to diversity revenue

- 24% needed funding to buy new or replacement equipment or machinery

- 21% felt the need for increased cash reserves

- 20% had to refinance existing loans

- 5% found traditional bank funding was unable to meet their business needs

- 7% could not rely on equity in their home to fund business requirements

How SMEs plan to fund 2021 growth

When asked how they would fund new growth for the next six months, nine out of 10 SMEs will rely on their own funds, while one in five will seek new equity. Researchers East & Partners’ analysis is that small business’ growth opportunities are being curtailed by this reliance on their own funds or traditional bank loans, when options such as invoice finance would allow businesses to access additional capital without taking on debt or having to make loan repayments.

Mr Sutton said a new high (28.3%) of SMEs plan to borrow from a non-bank lender to fund growth.

Despite a deluge of government stimulus measures linked to bank lending, intention to use banks to fund growth was at a record low for the Index (with 16.8% of SMEs intending to use their main bank and 12.3% turning to other banks).

“Small business owners are time-poor and often don’t have or make time to research something new, even when it might be a product that better suits their style of business,” Mr Sutton said.

“I think it is a positive for Australia’s growing non-bank sector that in 2020 so many business owners tried new options, such as invoice finance.

“Having tried new styles of funding that might allow more flexibility and support better cashflow, business owners might think twice about traditional funding in which they have to take on more debt and potentially have to use their personal property as security.”

Growth businesses look to non-bank options

Non-bank borrowing intention was particularly clear when only enterprises who identified as growth businesses are considered – 24% of growing enterprises intend to fuel growth by using non-bank funding, compared to 16% who planned to take out a loan from their main bank.

Mr Sutton said this SME sentiment was reflected in the low uptake of bank loan initiatives in 2020 and 2021, with business owners reluctant to simply add more debt on to already over-leveraged balance sheets.

“This SME sentiment is understandable, however, the result will likely be that many businesses who need an injection of funds just kick the can further down the road, instead of sourcing more appropriate business funding solutions.

“Some parts of the SME sector, depending on the state they are based in and their industry sector, are anxious about the end of JobKeeper so they should be mindful of funding and talk to professional advisers about the best way forward.”

Mr Sutton said options such as invoice finance, which uses a business’ unpaid invoices to secure a line of credit that grows in line with a business, allow business owners to have more control over their cashflow.

“Cash is always king but no more so than during the pandemic. One in four small businesses said they had cash flow issues after being rejected from a loan, and a similar number had cash flow issues because their credit lines were reduced in 2020,” Mr Sutton said.

“Small businesses are in need of funding methods that smooth out cash flow gaps and allow them to take on new opportunities.”

ScotPac partnered with ASBFEO to create the Business Funding Guide for small businesses and their trusted advisers (such as accountants, brokers and bookkeepers). Download this free guide.

SME Growth Index: Twice a year since 2014 market analysts East & Partners conduct this research, Australia’s longest-running in-depth research on small business growth prospects. In Jan-Feb 2021, a representative national sample of 1253 $1-20m revenue businesses were surveyed and interviewed.

ScotPac is Australia and New Zealand’s largest non-bank business lender, providing funding to small, medium and large businesses from start-ups to enterprises exceeding $1 billion revenues. For more than 30 years ScotPac has helped thousands of business owners succeed, by unlocking the value from their business assets. Whether it is purchasing stock, investing in vehicles and equipment, improving cash flow or accessing additional working capital, ScotPac can help.

For more information contact:

Kathryn Britt

Director, Cicero Communications

[email protected]

0414 661 616