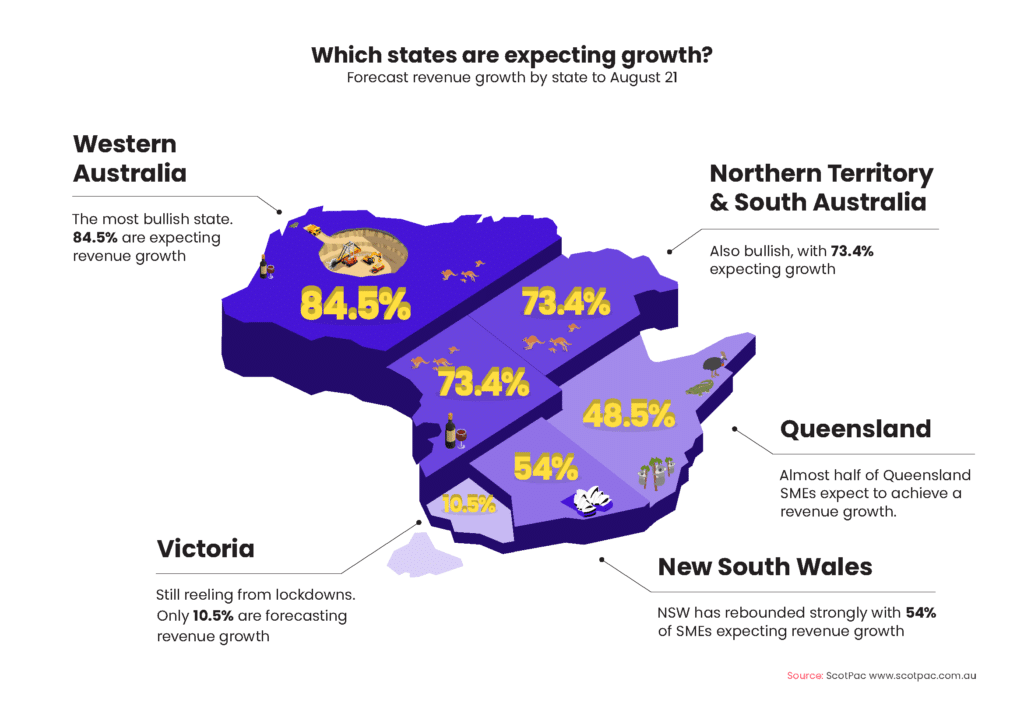

The March 2021 SME Growth Index reveals a record broad distribution range of positive revenue forecasts (from +1.1% to +9.1%) which highlights the fact that states and industries are rebounding at very different rates.

East & Partners analysis of the small businesses at risk of closing or selling shows that twice as many Victorian SMEs are in trouble (58%) relative to Queensland (35%) and NSW (27%).

Victoria has three times as many at-risk businesses as Western Australia (20%) and South Australia and the Northern Territory (18%).

The end of stimulus funding was nominated by a high proportion of these firms as being the trigger point to make them consider exiting or closing.

Victoria

Victoria’s small business sector is still reeling from the impact of lockdowns.

Only one in 10 Victorian SMEs (10.5%) are forecasting revenue growth through to August 2021, but they do expect on average +11.1% growth.

This figure may be less bullish than it appears when considering it comes off the back of poor 2020 revenue growth due to the state’s extended lockdown.

Two-thirds of Victorian SMEs (62.6%) expect revenue to decline, by -6% on average.

More than half of Victoria’s small businesses say without significant improvement in market conditions they will have to either close (30.8%) or sell (27.3%). Fewer than one in five (17.1%) expect they can ride out current market conditions and 24.8% are unsure if they can do so.

NSW

The first state to feel the brunt of the pandemic in early 2020, NSW has rebounded strongly. NSW has 54% of SMEs expecting revenue growth in 2021, by an average +2.7%.

Around a quarter of NSW small businesses (22.9%) expect revenue to decline, by -1.1% on average.

A relatively buoyant number (61.3%) say they are in a position to ride things out if conditions don’t markedly improve.

Only 7.7% say they will close if current conditions continue, while one in five (19.7%) will sell and 11.4% are unsure.

Queensland

Outside of tourism hotspots, Queensland SMEs have been relatively unscathed. It remains to be seen whether this optimism continues given the pre-Easter lockdown in the state (that came after this polling).

Only two in every 100 small businesses in the sunshine state expect revenue to decline over the next six months, forecasting an average decline of -5.8%.

Almost half (48.5%) expect to achieve a revenue increase, a modest +1.3% on average.

A similar proportion (49.3%) expect to survive if current market conditions continue, while 15 in every 100 Queensland SMEs are facing closure and 20 in every 100 may need to sell.

Western Australia

On the back of a buoyant mining and resources industry, the west is the most bullish of the states.

Here, 84.5% of small businesses are expecting positive revenue growth (by, on average, +6.1%) and only 3.6% expect revenue to decline (by a minimal -1%).

This small cohort expecting revenue to decline matches the 4.2% of SMEs in the west who say they will close if the economic outlook doesn’t significantly improve; a further 15.5% will look to sell.

A robust number of WA businesses (74.4%) expect to survive if current market conditions continue.

South Australia and Northern Territory

SMEs in South Australia and the Northern Territory are also bullish, with 73.4% expecting growth (by +3.2% on average) and 8.9% bracing for decline (by -2.3%).

Fewer than one in five businesses in SA and NT believe they will have to close (12.7%) or sell (5.1%) if trading conditions don’t significantly improve.

Almost two-thirds (62%) anticipate they could continue in business under current market conditions.

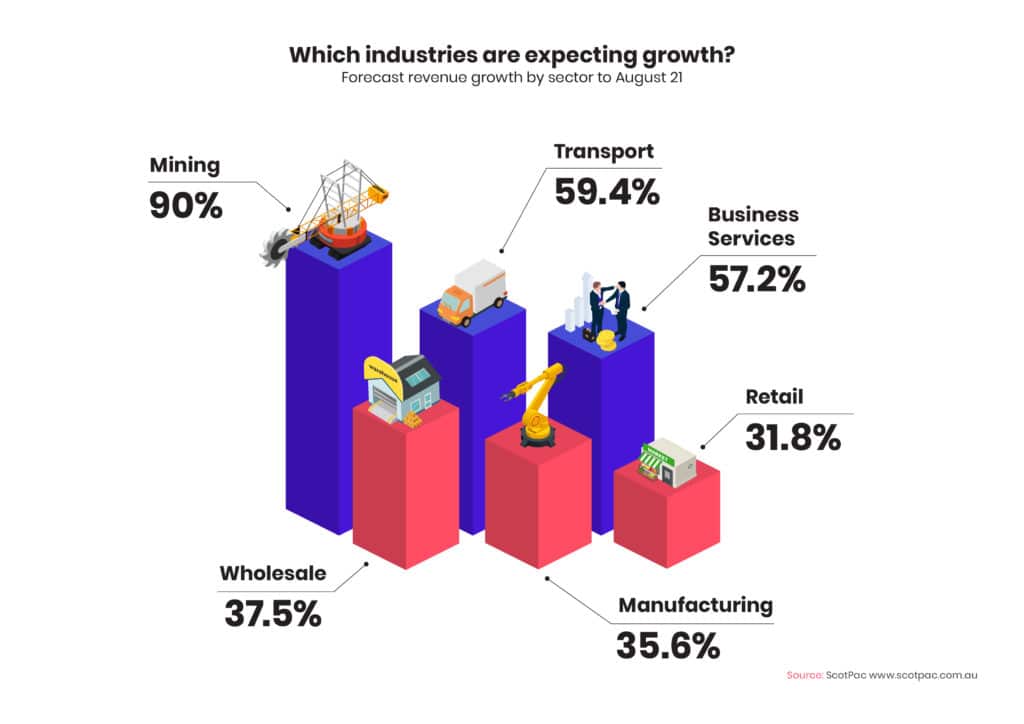

Industry variations in revenue and business stability

The SME Growth Index looks at six major industry sectors – mining, manufacturing, wholesale, retail, transport and business services.

Sector analysis shows that even if business conditions don’t markedly improve, a vast majority of SME respondents in the mining, business services and transport sectors believe they could ride out current conditions without having to sell or close.

This confidence was expressed by 85.6% of mining enterprises, 82.1% of business services SMEs and 72.3% of transport businesses.

In contrast, more than one in three retailers (36.3%) say they will close without conditions significantly improving, one in three (33.1%) say they will sell and a large cohort (22.9%) remain unsure. Only a small number of retailers (7.6%) are confident they will not have to close or sell.

Manufacturing is evenly poised: one in three (36.6%) are confident they can survive; 18.8% are looking at closing, 27.2% selling and 17.3% are unsure whether they’ll be able to ride out current conditions.

A more robust 43.8% of wholesalers believe they can survive if current conditions continue, with 13.3% expecting to close, 25.8% to sell and 17.2% unsure of their future.

Industry sector revenue forecasts were:

Mining: 90% of mining SMEs expect revenue growth (by a bullish average of +8.5%), only 5.6% are forecasting a decline (by an average of just -0.4%).

Transport: 59.4% expect revenue growth (average +3.6%), 9.9% anticipate a decline (of -2%) and 30.7% are forecasting revenue to remain unchanged.

Business services: 57.2% forecast an uptick in revenue (by +5.5%), 8.7% forecast decline (by -0.7%) and 34.1% expect no change.

Manufacturing: this small business sector is evenly poised, with 35.6% forecasting revenue growth (by a reasonably flat +1.1%), 32.7% expecting revenue decline (by -3.9%) and 31.7% anticipating no change.

Wholesale: this sector also has a relatively even sentiment balance, with 37.5% forecasting growth (by +2.1%), 28.9% forecasting decline (by -2.2%) and 33.6% expecting no revenue change.

Retail: this is the only industry where more small businesses are expecting revenue to decline rather than grow. There are 31.8% forecasting revenue growth (of +1.8% average), 38.9% predicting a decline (-5.3% average) and 29.3% anticipating unchanged revenue.