Invoice Finance and Equipment Finance build the right funding machine for Computertrans

Every transport business knows managing cashflow is crucial, in an industry where margins are so tight. A decade ago, NSW company Computertrans found a cashflow weapon that has allowed it to grow: partnering with ScotPac.

This NSW business has 110 vehicles on the road and transports and installs high-value freight and equipment, including linac accelerators that deliver radiotherapy treatments for cancer patients. “This will be the biggest year that we’ve had in the medical sector,” says Cheryl Armour, co-founder of the group.

Computertrans uses two ScotPac facilities to help manage cashflow while it grows: a Debtor Finance facility that provides an on-demand line of credit, and an Equipment Financing facility that funds machinery and vehicle purchases. “The ScotPac relationship lets us run our business with confidence,” she says.

Delivering the goods

Cashflow certainty has allowed this NSW family business to adapt to changing markets and grow from a one-truck operation into an industry leader.

When Cheryl Armour says Computertrans is a family business, she means it.

Her son, three nephews and her son-in-law all work in the NSW transportation group. Then there are employees such as her CEO, accounts manager and HR manager, who have all been with Computertrans for more than 15 years. “We really do know the people we employ,” says Cheryl, key principal and co-founder of the business. “They’re all family.”

Founded in 1988 in Sydney, Computertrans has grown from humble beginnings into an enterprise with 57 employees that operates a national network of transport, warehousing and distribution services. The business is best known for transporting and installing high-value, sensitive freight and equipment.

Cheryl says the business happened by chance. Husband Rob had been a truck driver for Grace Express, which was owned by the department store Grace Bros, before all drivers were laid off. “We were left with no alternative but to go out on our own. We started with one truck and at the moment we’re running about 110 vehicles on the road.”

Clearing hurdles to achieve potential

Computertrans has shown its agility and ability to adapt. The business has overcome market changes and the flow-on effects from international and state border closures that have disrupted its clients’ movement of goods during the pandemic.

In recent years, an increasingly cashless society has led to a drop-off in demand for the transportation and installation of ATMs, once a strong niche service for Computertrans. However, the business is growing in other areas, including in the medical sector, where it transports and installs linac accelerators that deliver radiotherapy treatments for cancer patients.

“We could see the ATM decline coming and our biggest sectors now are medical and IT relocations and other special projects,” Cheryl says. “This will be the biggest year we’ve had in the medical sector.”

While Computertrans has a large investment in vehicles and infrastructure, Cheryl says at its core the business is all about people – from technicians, drivers and tradespeople through to administration and management staff. “As a family business, people come first.”

Cashflow pain relieved, opportunity unlocked

Just as Computertrans values family, it recognises the importance of strong partnerships with external advisors. That’s why, since 2011, it has used ScotPac to unlock opportunity in Computertrans by improving the business’s management of cashflow and working capital. “That’s made a real difference to our day-to-day operations.”

Computertrans has two finance facilities with ScotPac. The first is a Debtor Finance facility that provides an on-demand line of credit that is secured by one or more outstanding sales invoices. The second is an Equipment Financing facility that funds the purchase of business equipment, machinery and vehicles. It is ideal for companies seeking flexible financing to expand operations and improve productivity.

Cheryl says there is no doubt ScotPac has eased Computertrans’ cashflow headaches because of their flexible and tailored approach. “We know, for instance, that if it comes to a Friday afternoon and we need $5000 quickly, then ScotPac will forward fund us the money,” she says. “That lets us run our business with confidence.”

Cheryl also appreciates the supportive relationship and consistency of service ScotPac brings to the table. “We’ve been with ScotPac for many years and we’ve always had a good rapport with their team. We’ve only ever had two account managers in 10 years, which means they know our business and if we need something, they just get on to it.”

Evidence of this can be seen in ScotPac’s approach to going the extra mile to support the important relationship Computertrans has with its own clients. It’s a real partnership, focused on success for all parties. “The beauty of having had such a long partnership with ScotPac is that we know each other’s businesses so well and there’s a great amount of mutual trust between us.”

A growth mindset

Computertrans has retired debt in recent years and is focusing on lifting its earnings before interest and tax (EBIT) through a new sales push. “We want to grow the business and target new markets,” Cheryl says. “Our aim is for about 10 per cent year-on-year growth for the next five years.”

One of the tools that will help achieve such a goal is the ScotPac portal which allows Computertrans’ finance team to access real-time business data related to remittances, outstanding invoices and other financial matters. “The portal is really good,” Cheryl says. “You see financial transactions instantly and if we haven’t received a remittance, we can chase it up straight away.”

With ScotPac in their corner, Cheryl says she and her team are confident Computertrans can thrive for another three decades. She says she’d recommend ScotPac to any business looking for a smart solution to support growth and manage working capital.

The Benefits of Equipment Finance

A business can’t succeed without the right tools. If you operate in a competitive market, the right equipment can be vital to long-term probability. But accessing new equipment and technology is an issue for growing companies in every industry. Nearly 1 in 4 Australian businesses state that they are operating with outdated assets.

New equipment can be expensive. The upfront cost of purchasing state of the art equipment can put a strain on the cash flow of any SME.

That’s why many business owners are turning to Equipment Finance or Asset Finance to fund new investments.

What is Equipment Finance?

Equipment Finance is a funding solution designed to help businesses purchase the equipment, machinery, and vehicles they need. An Equipment Finance facility can fund up to 100% of the value of a business asset purchase.

The cost of the asset is then repaid over a fixed term and with a fixed interest rate. Because the funding is secured against the asset’s value, you don’t need to use your home or personal property as collateral.

Depending on the terms of the funding agreement, the business may take ownership of the asset once the final payment has been made.

You can use Equipment Finance to fund a number of assets, including:

- Forklifts

- Vehicles

- Trucks

- Tractors

- Industrial machinery

- Manufacturing equipment

- Technology

If you’re thinking about making a large business purchase, you should consider the benefits that Equipment Finance can provide to your company.

1. Increase Working Capital

The most compelling benefit of Equipment Finance is the increase in working capital it provides. A significant outlay on equipment can leave your business vulnerable to a cash flow shortage.

Rather than making a large upfront payment, you can spread equipment costs over a much more extended period. You can use the equipment to increase your revenue, and repay the cost of the purchase in more affordable instalments.

Equipment Finance allows you to maintain liquidity to invest in other areas of your business and take advantage of new opportunities as they arise.

2. Work With the Best Equipment

Equipment Finance allows businesses to capitalise on new technology and innovative solutions in their industry without stretching their finances. You can utilise the latest equipment to improve operational productivity and efficiency.

According to Ricoh’s report Digital decade: Innovation in 2020 and beyond, 46% of Australian businesses are looking to improve operational effectiveness by spending on innovation, with 44% looking to reduce costs and operational expenditure.

The same report reveals that the most significant barrier to innovation for Australian businesses is a lack of budget.

Equipment Finance helps companies to overcome that barrier and purchase the tools and technology they need. Small and medium-sized businesses can access the equipment they need to compete with larger competitors.

3. Avoid Depreciation

Machinery, vehicles, and many other types of business equipment can suffer from fast depreciation. As the value of the equipment reduces, so does the value of the company’s assets. For example, a new business vehicle can lose up to a third of its value once purchased as the asset becomes second-hand.

If equipment depreciates faster than expected and becomes unusable, it will need to be quickly replaced to avoid disruption to operations. This can create cash flow issues for the business.

Equipment Finance helps to remove that risk as the finance company will usually take responsibility for depreciation. If the equipment fails to last the duration of the agreement, the finance company will usually replace the equipment at no additional expense.

Some Equipment Finance solutions can also provide tax benefits. When equipment is leased rather than bought outright, it’s categorised as a monthly expense and not as an asset on the company’s balance sheet.

4. Protect Available Lines of Credit

Traditional banks and finance providers require borrowers to meet strict lending criteria, including property security. For many businesses, that means loans and overdrafts are out of reach.

Even for businesses that do qualify for these funding options, using a loan or overdraft to cover an equipment purchase removes these lines of credit for any future borrowing needs.

By utilising an Equipment Finance facility, businesses can keep these lines of credit open rather than using them on a depreciating asset. Should the company want to fund expansion or capitalise on an opportunity in the future, they will still have the option of applying for other types of business funding.

Equipment Finance is a flexible funding solution that can sit alongside a bank loan or other financing arrangement.

5. Fast Application Process

This type of funding is much more accessible than a loan from a bank or traditional business lender.

If your business has a strong credit rating and the equipment is likely to hold its value, funding can be put in place in as little as 24 hours. For high-value equipment purchases, it may take a little longer to collect the necessary information and secure financing.

Even for businesses that lack a long trading history or strong credit rating, Equipment Finance can still provide the funding you need.

6. Scalable Funding

Equipment Finance is a scalable funding solution that is well suited to startups and growing businesses. If you need new equipment to scale up your operations, Equipment Finance can provide the tools and machinery you need without tying up your capital and disrupting growth plans.

For example, if you need to increase logistics capacity to take on new customers, you can quickly upgrade or add to your fleet of vehicles. As your business grows and requires increased investment, you can quickly secure funding and add new equipment to your business operations.

ScotPac Equipment Finance

When a business has the equipment it needs, it can be more productive, make more sales, and generate more revenue.

We help businesses to get the equipment they need to grow. There’s no property security required, and our Equipment Finance solutions can be customised to your business’s exact needs. You can fund the purchase of new and second-hand equipment from domestic and overseas suppliers.

If you’re thinking of purchasing new or second-hand equipment, use our handy enquiry form to apply now or call our business finance experts to see how an Equipment Finance solution can help you.

What Does Cash Flow From Financing Activities Mean?

Cash flow from financing activities is a section of a business’s cash flow statement. It details the cash flowing in and out of the company as a result of financing activities.

If you apply for funding or seek investment, the financier will use your cash flow statement and cash flow from financing activities to determine your business’s financial health.

It’s important to know what cash flow from financing is and how it impacts your ability to get funding.

Cash Flow Statement

The cash flow statement is one of three important financial reports that a company must generate regularly. The other primary reports are the income statement and the balance sheet.

With accrual accounting, income and expenses are reported as soon as invoices are raised, and bills are received. Companies using the accrual accounting method create regular cash flow statements to keep track of cash movement in a specified period, such as the previous month or quarter.

Cash Flow Types

The cash flow statement groups cash flows in and out of the business into three categories:

Cash Flow from Operating Activities

Cash flow from operating activities is the cash flow for everyday primary business operations. It includes any transactions related to net income or expenses resulting from operations.

Cash Flow from Investing Activities

This category relates to income and expenses from the company’s investments into capital assets. The purchase and sale of equipment, machinery, and property fall into cash flow from investing activities.

Cash Flow from Financing Activities

Cash flow from financing activities covers income and outgoings resulting from debt and equity financing, including dividends to shareholders and loan repayments.

The three cash flow types cover all of the money flowing in and out of the business over a set period. Categorising cash flow types helps business owners and potential investors gain a clearer picture of cash moving through the company.

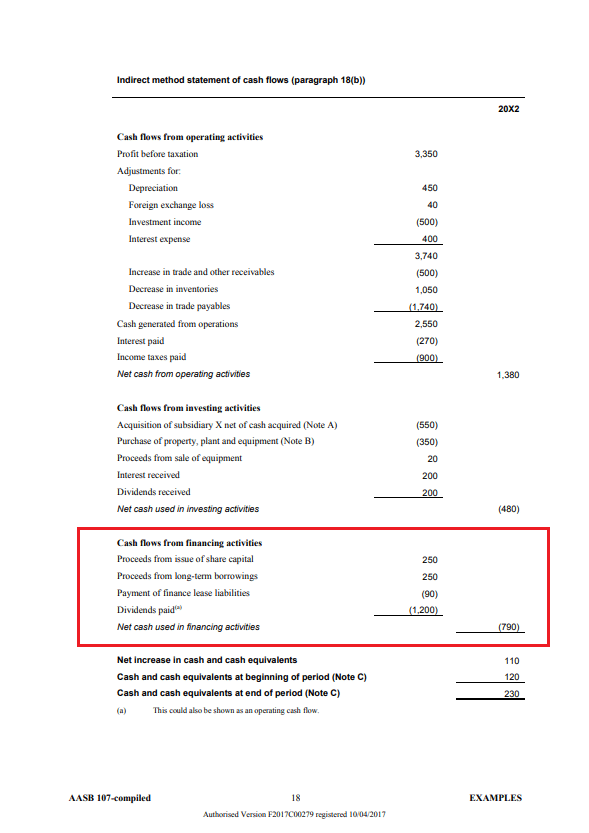

Sample Cash Flow from Financing Activities Section

Below is an example cash flow statement from the Australian Accounting Standards Board. The cash flow from financing section is highlighted with the total net balance of cash flow from financing activities recorded at the bottom of the section.

In the example cash flow statement, the sample company had a negative cash flow from financing activities. The majority of the outflow of cash from financing activities relates to dividends paid.

What is a Financing Activity?

Financing activities are transactions that involve the flow of cash between a company and its source of finance. Cash flow financing activities can include:

- Borrowing and repaying short-term loans

- Borrowing and repaying long-term loans and liabilities

- Issuing or reacquiring its shares of common and preferred stock

- Paying cash dividends to shareholders

If a company borrows money for short or long-term periods or receives cash for bonds or shares, all proceeds are recorded as positive amounts in the cash flow from financing activities section. The positive transaction shows that cash has been received and therefore increased the company’s cash balance.

If a company repays short or long-term loans, purchases shares or pays dividends, the negative transaction is recorded in cash flow from financing activities. The transaction shows the reduced cash balance of the company.

Cash Flow from Financing Activities Formula

To calculate the total net cash flow from financing activities on the cash flow statement, accountants and chief financial officers use the following formula:

CED − (CD + RP) = Net Cash Flow From Financing Activities

CED = Cash inflows from issuing equity or debt

CD = Cash paid as dividends

RP = Repurchase of debt and equity

How to Calculate Cash Flow From Financing Activities in 5 Steps

Step 1: Add together the cash inflows generated from the issuing of debt and equity (CED).

Step 2: Add together total cash paid as dividends (CD)

Step 3: Add together all cash outflows incurred by repayment of debt and repurchase of equity (RP).

Step 4: Add together the cash outflows (CD + RP).

Step 5: Subtract the cash outflows (CD + RP) from the cash inflows (CED) to calculate the net cash flow from financing activities.

Here’s an example of how the cash flow from financing activities works for a sample company:

| Cash Inflows | Cash Outflows | Net Cash Flow From Financing Activities | |

| Repurchase shares | $100,000 | ||

| Proceeds from long-term debt | $1,200,000 | ||

| Payments to service long-term debt | $200,000 | ||

| Payment of dividends | $150,000 | ||

| Total | $1,200,000 | $450,000 | $750,000 |

In the above example, the net cash flow from financing activities totals $750,000.

Determining a Healthy Cash Flow from Financing Activities Amount

There is no set amount that determines if a company’s cash flow from financing activities is healthy.

In general, investors and potential lenders are interested in how financing activities compare to operating activities.

A low or negative net cash flow from financing activities can indicate that your business is paying off its debts. But if your cash flow from operating activities shows a low figure, this can also suggest that you may struggle to continue servicing your debts.

If the bulk of your cash inflows is generated through debt, it may be an indication that your business is struggling to generate enough revenue.

Ideally, the cash flow from operating activities should be the primary source of cash inflows, with financing activities used to supplement growth or cover large one-off business expenditures.

Invoice Finance and Cash Flow From Financing

Invoice Finance is a form of accounts receivable financing that allows a business to convert its unpaid invoices into a source of immediate funding. Rather than waiting 30+ days for a customer pay, a company can use invoice finance to get up to 95% of the outstanding invoice value upfront as a cash advance. When the customer pays the invoice, the company receives the remaining invoice balance less fees.

Because the capital is not sourced by the sale of equity or through lending, cash inflows from invoice finance are considered an off-balance sheet form of funding and categorised as cash flow from operations. This allows a business to improve its leverage ratio and secure additional financing without breaching the terms of its existing loans of financing obligations.

If you’d like to find out more about accounts receivable financing, read our post ‘What is Invoice Finance?’.

While accounts receivable financing is not categorised as cash flow from financing, businesses are often required to disclose the funding arrangement as a footnote on their cash flow statement.

ScotPac Business Finance

If you’re trying to secure funding, it’s important that you keep your records up to date and accurate so that potential investors and lenders can evaluate your business’s financial health. Cash flow from financing is one of the areas they might use to determine your eligibility for finance.

We believe that every business should be able to access the funding it needs to grow. If you’ve been rejected by a traditional lender, there are still plenty of ways you can secure the financing you need. Give us a call, and we’ll guide you through your options so you can choose the funding solution that’s right for your business.

7 Reasons to Consider Debtor Finance

A business can be profitable and have a full sales ledger, but if capital is tied up in its accounts receivable, there’s no money to pay suppliers, cover overheads, and fulfil new orders.

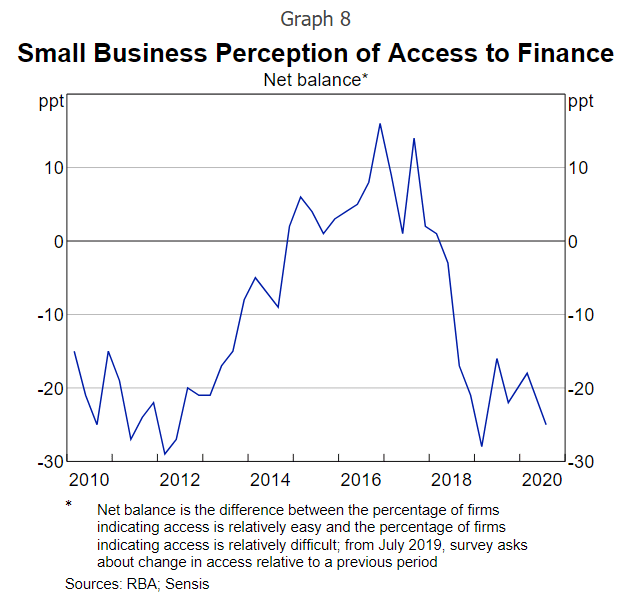

Australian businesses have traditionally turned to bank loans and overdrafts to support working capital and cover cash flow gaps. But accessing these types of funding is increasingly difficult.

Image Source: Reserve Bank of Australia

Debtor finance is a flexible and more accessible source of funding that can provide the financial backing needed to support long-term growth.

What is Debtor Finance?

Debtor Finance is a type of business finance that enables companies to unlock the capital tied up in their accounts receivable. If a business offers net payment terms to its customers, it can take 30+ days after an invoice is raised for payment to be received.

With debtor finance, the business can use its outstanding sales invoice to get paid faster and smooth over cash flow gaps. A cash advance or line of credit is secured against the unpaid invoice.

Read our guide How Does Debtor Finance Work to find out how you can turn your outstanding invoices into a source of readily available funding.

There are several reasons why a business might need to unlock the capital tied up in its accounts receivable and increase liquidity.

1. Raising Capital for New Businesses

Raising capital is a pressing challenge for any new business. Securing finance can be particularly difficult for business owners who lack the personal assets required to meet traditional banks and finance providers’ strict lending criteria.

Debtor finance is a much more accessible form of funding. There’s no property security requirement, and it’s accessible to companies without a long trading history. Because the financing is secured against your accounts receivable, the finance provider is more interested in your customers’ creditworthiness.

If your new business doesn’t qualify for a traditional bank loan or overdraft, a debtor finance facility can be a quick and accessible way to raise funds.

2. Funding Rapid Growth

Periods of growth are an exciting time for a business owner, but they also pose financial challenges. As sales orders increase, so do the costs associated with processing those orders.

If your business offers extended payment terms to its customers, an influx of sales can leave you vulnerable to cash flow gaps and a shortage of working capital. While waiting to receive payment from your customers, your business will still need to pay suppliers and cover overheads to process new orders.

Debtor finance allows you to get paid for your goods and services faster. The funding facility limit increases in line with the sales invoices you raise to support your growth and allow you to capitalise on new opportunities.

Because the funding facility is linked to your accounts receivable, you will always have enough cash at hand to cover your working capital requirements.

3. Management Buyouts

Traditional sources of financing are often unsuited to the funding needs for a management buyout. Loans and overdrafts are typically secured against private property, so they can be hard to access and can also put your home at risk.

Venture capital is a potential source of funding, but it can be challenging to find investors in the time frame needed to complete the buyout. Some business owners also prefer not to hand over a significant stake of their business to an outside financier.

Debtor finance can supplement other sources of funding to raise the capital needed to buy out existing shareholders. By utilising the money tied up in the company’s accounts receivable, a debtor finance facility can provide the funding required to complete a management buyout without the need for significant personal investment.

4. Trading and Cash Flow Difficulties

Extended payment terms and slow-paying customers can restrict cash flow and slow down the growth of a business. With working capital tied up in outstanding invoices, a company can struggle to pay suppliers and trade as usual.

A debtor finance facility can provide the liquidity needed to overcome trading difficulties, pay suppliers, and get the business moving again. The longer that a company is unable to trade, the more revenue lost.

By unlocking the capital tied up in accounts receivable, business owners can take back control of their cash flow and take advantage of opportunities that they would otherwise be unable to capitalise on.

5. Loss of Major Customer to Insolvency or Competition

Losing a major customer due to insolvency or competition can be severely detrimental to cash flow. Unfortunately, it’s something that most business owners will go through at some point during the life of their company.

The best way to deal with the loss of a client is to focus on marketing and lead generation to gain new customers. But these activities require time and resources.

Debtor finance can be an effective way to increase liquidity and provide additional cash flow to support your sales volume recovery. You can access the capital tied up in your unpaid invoices and quickly reinvest in your business to recover from the loss of a customer.

6. Seasonal Sales

A seasonal sales cycle introduces unique challenges that need to be overcome to achieve sustainable long-term growth. Annual revenue can depend on a small window of peak sales. Inventory and cash flow management need to be just right, or you can easily lose the bulk of your yearly profits.

Seasonal businesses need enough liquidity to increase stock levels before peak seasons and cover slower periods where less money is flowing into the business.

A debtor finance facility can be an effective funding solution for businesses with seasonal sales cycles. You can access funding to help cover your costs during slow seasons and quickly access your sales revenue during peak seasons to reinvest and take advantage of the increased trade.

If your business suffers from seasonal sales, consider creating a cash flow forecast to help predict your working capital needs to fully capitalise on your peak season.

7. Import and Export

Import and export businesses often find cash flow put under pressure. Without third-party funding, many companies would find it impossible to trade internationally. According to the World Trade Organization, up to 90% of global trade relies on trade finance.

Trade Finance is a funding solution that utilises debtor finance to support the working capital needs of both importers and exporters.

For an import business, debtor finance can bridge the gap between paying an overseas supplier and receiving payment from customers once the goods are received and sold. Importers can also use additional funding to increase their purchasing power and negotiate better terms with international suppliers.

For exporters, a debtor finance facility can be used to unlock capital tied up in the manufacturing and shipping of goods. Rather than waiting for goods to arrive at the destination country before receiving payment, exporters can get paid as soon as they have raised an invoice.

ScotPac Debtor Finance

There are plenty of reasons why your business could benefit from a debtor finance facility. Unlike an overdraft or loan, you don’t need to use your property as security, and the amount of credit you can access increases in line with your sales.

A funding facility can sit alongside your existing financing arrangements, and you don’t need to take on further long-term debt to ease short-term cash flow gaps.

If you’d like to find out more about debtor finance or alternative business funding options, contact our friendly team of financial advisors today. We’ll help you find a funding solution that’s right for your business.

What is Accounts Receivable?

Keeping track of money owed is important for your business’s working capital and long-term financial health. Even a profitable company with a full order book can suffer from cash flow issues if its late-paying customers go unnoticed.

Effective accounts receivable management is vital for avoiding cash flow disruption due to late payments. According to the illion’s September 2020 Late Payments Report, Australian businesses received payment 11 days late on average, with a 20% increase in the number of late payments compared to 2019.

With payment times increasing nationally, it’s more important than ever to understand accounts receivable and how it affects your business.

Accounts Receivable Explained

Accounts receivable refers to the money owed to a business by its debtors. It’s the balance your customers owe for goods and services you have provided but have not yet been paid for.

Once you have fulfilled an order and raised an invoice, the funds owed to your business are categorised as accounts receivable until the invoice is settled.

The opposite of accounts receivable is accounts payable. When a third-party does work or supplies goods to your business and raises an invoice, the funds owed to the seller become part of your accounts payable.

Accounts Receivable Example

A Melbourne wholesaler receives an order from a Sydney-based retailer for $3,000 of goods. The wholesaler processes the order, ships the goods to the retailer, and raises an invoice for $3,000 on net 30 payment terms.

Once the Melbourne wholesaler processes the order and raises the invoice, it reduces its inventory value and increases its accounts receivable by $3,000.

The retailer pays their invoice promptly within 30 days. On receipt of payment, the wholesaler adds $3,000 to its cash balance and reduces its accounts receivable by $3,000.

What Is Ageing of Accounts Receivables?

Ageing of accounts receivable is a financial management technique used to evaluate the accounts receivable of a business. It’s a useful tool to ensure more efficient debtor management and payment collections.

Businesses typically supply goods and services to other companies on pre-agreed net payment terms of 30-120 days, depending on the terms of the arrangement. If the due date passes and the customer has not paid, the invoice becomes ‘aged’ – the invoice ages by the number of days since it was initially due.

The ageing method catalogues receivables based on when an invoice has been issued, when it is due to be paid, and the number of days it is overdue. It helps you to determine which customers to send to collections and who should receive follow-up invoices.

Ageing of account receivable is usually detailed in an ageing report. The ageing report will show each invoice by date and number. You can use this information to avoid overextending with customers that struggle to pay on time and make accurate predictions about money flows into your business.

What Does an Ageing Report Do?

An ageing report shows you how much money is owed to your business at any given time. The report will highlight:

- How much each customer owes you

- Which customers owe the most

- How long each customer has owed you

Highlighting this information will help you understand which accounts need to be prioritised and collected first. Generally, the longer an invoice is left unsettled, the less likely you are to receive full payment of the sum owed. That’s why an ageing report is an important tool for managing your accounts receivable.

Using an ageing report to manage your accounts receivables will also help you to evaluate:

Credit Risk

You can use your ageing accounts receivable reports to ascertain which of your customers pose a significant risk of non-payment. If a customer currently owes a large sum to your business or has a history of failing to settle invoices on time, you should consider restricting future credit.

Collection Practices

If your ageing report reveals a significant number of older receivables that have yet to be paid, it may be an indication that your collection practices need to be improved. Many business owners struggle to find the time to chase invoice payments, with Australian small businesses spending an average of 12 days per year chasing outstanding invoices.

Bad Debt Allowance

Your accounts receivable ageing reports will help you to manage your bad debt allowance. If the recovery of a customer’s debt is no longer possible, it can be written off as bad debt and used to reduce your taxable income.

You can find out more about bad debt allowances on the Australian Taxation Office website.

Debt Factoring

If you apply for a debt factoring solution, your accounts receivable ageing report will be used by the finance company to determine which of your sales invoices will qualify for financing. Generally, a finance provider will only fund recent invoices issued to customers with a stable credit rating and timely payments history.

Ageing reports give you a comprehensive overview of your invoicing and collection processes. They provide the information you need to manage your cash flow effectively, create credit policies, and plan future expenditure.

Is Accounts Receivable an Asset?

Accounts receivable are classified as an asset. Although your business is yet to receive payment, receivables are the outstanding value owed to your business.

All accounts receivable should be recorded in the “current asset” section of your company balance sheet. If you have to wait a year or more to receive payment, a receivable is considered a long-term asset.

What Is Accounts Receivable Financing?

Accounts receivable financing is a form of business funding secured against the value of outstanding invoices. This type of finance helps businesses overcome cash flow gaps caused by late-paying customers and extended payment terms.

In a typical business transaction, the goods or services supplier will fulfil the order and raise an invoice. The customer will then typically take 30+ days to settle the invoice. For the supplier, the value of the invoice is tied up in the accounts receivable until the customer pays.

Accounts receivable financing allows the supplier to unlock the outstanding invoice’s value and get paid faster for the goods and services they have already sold. These funds can be used to manage day-to-day cash flow, cover operational expenses, and purchase new inventory and raw materials needed to take on new orders.

Unlike a traditional bank loan, the accounts receivable finance provider is interested in the debtor’s creditworthiness, the invoice’s age, and the sum owed. You don’t need to use any property as collateral, and funding can be secured much faster than traditional financing methods.

Read our case study to see how accounts receivable financing helped Queensland-based family business Mantis Building Services become a labour-hire power player.

Types of Accounts Receivable Financing in Australia

Invoice Factoring

Invoice Factoring is a funding solution where your business sells its outstanding invoices to a finance company. Once the invoice is accepted for factoring, the finance company will take on the responsibility of collecting payment from the debtor.

You can receive up to 95% of the value of your unpaid invoices as a cash advance. When the finance company collects payment, you will receive the remaining balance of the invoice less factoring fees.

Invoice Factoring can be a good solution for businesses that encounter cash flow gaps due to extended payment terms and lack dedicated accounts and collections departments. The finance company will take responsibility for credit control and collections. They can credit check customers, chase payments and liaise with them on your behalf.

Typically, factoring is used by small businesses and start-ups who need regular and quick access to funding to support sustainable growth.

Invoice Discounting

Invoice Discounting shares some similarities with invoice factoring. You can use your accounts receivable as collateral to access immediate funding. Once an invoice is accepted for discounting, you can receive up to 85% of the invoice value upfront. Once your customer pays the invoice, you receive the remaining balance less fees.

The significant difference between discounting and factoring is the collection of the outstanding invoice. With discounting, your company remains responsible for the collection of all receivables. Your customers will typically be unaware of your relationship with the finance company.

Due to the collections and account management remaining in-house, Invoice Discounting is generally better suited to larger companies with an established collections process.

Read our guide Invoice Discounting vs Factoring to find out more about the different invoice finance types and find out which is better suited for your business.

Selective Invoice Finance

Selective Invoice Finance is a flexible form of accounts receivable financing that allows businesses to choose which invoices they want to submit for funding.

Invoice factoring is typically a full-service where the whole sales ledger is used to secure financing. Selective Invoice Finance is a flexible form of funding that can be an effective solution for businesses that suffer from seasonal sales fluctuations or need to raise capital for an unexpected expense quickly.

ScotPac Accounts Receivable Financing

We help businesses unlock the value of their assets and get the funding they need to grow. If you’d like to hear how Invoice Finance could help your business, contact our team of expert business finance advisors or fill out the form below, and we’ll get back to you shortly.

What Small Business Directors Need to Know About New Insolvency Rules

With the door closed on 2020, directors no longer have the protection of the “COVID Safe Harbour” insolvency rules put in place to deal with the impact of the pandemic.

These rules, which absolved directors from personal liability if their businesses traded while insolvent, have been replaced by legislation that includes a new, streamlined SME restructuring process that came into force on January 1.

What’s changing?

- As of January 1st, directors no longer have the protection of COVID Safe Harbour. This means if a company with debts and due payable is not able to pay, they are technically insolvent, and its directors are at risk for debts incurred by the company.

Why it changing?

- To make restructuring a less complex and less expensive process for many businesses. However, SMEs should be aware this will very likely have a negative impact on cashflow.

What do company directors need to do?

- Talk to a professional about the consequence of restructuring

- Be aware of the potential cash flow impact

- Find funding that will assist in this situation

- Put the funding in place now – before you need it

The role of trusted advisors

Accountants

An accountant will record and review your overall financial situation and provide recommendations for improving the health of your financial books. They will have relationships with banks and alternative finance providers and be able to connect you with the right solution for your business

Finance brokers

A finance broker will help to review your current finance options and identity new funding opportunities to assist in business growth or refinancing.

Insolvency practitioner

An insolvency practitioner will help in complex situations or when companies are facing acute financial stress. A solution may involve a company restructure, in which an insolvency practitioner will look for a finance provider who can help turn the business around.

Finance providers

A finance provider can directly help you find the right funding solution for your business, taking in to account your company size and stage in the business life cycle. This could be a bank, a fintech or an alternative financier like ScotPac.

What’s the solution?

- Having a funding solution in place will give businesses the best chance of turnaround success. There are many restructuring solutions available that can be established quickly and without red tape. Funding such as Invoice Finance will be in demand as this type of finance provides business owners with quick access to cash flow, using outstanding sales invoices as security instead of the family home.

- Our FactorONE product is a lending solution suited for this environment, providing access to funds within 48 hours and a low-document application process with no property security required.

- We have the ability to lend higher limits (over $2 million) and SME borrowers have the security of the trust and reliability that comes with ScotPac having funded the small business sector for more than 30 years.

We’re all willing 2021 to be a kinder year to the small business sector than 2020. However things pan out, it’s important for SME directors to be prepared.

Even if a small business is not at the crisis point now, acting now to get in place a suitable style of funding means it is ready to draw down from, if and when the need for restructuring arises.

What is Business Finance?

Whether you need a large lump sum to fund your expansion plans or regular access to credit to help you manage cash flow, being able to raise capital is key to business growth.

If you don’t have the resources to self-fund your business plans, you’ll need to look at third-party funding sources. That’s where business finance comes in.

Types of Business Finance

Business finance is an umbrella term that covers a wide range of financing solutions. The majority of these funding sources fall into two categories: debt finance and equity finance.

You may find that a combination of debt and equity finance can provide the short-term and long-term funding you need to accomplish your business goals.

What is Debt Finance?

Debt finance is a broad category that typically involves a lender providing funds that you later repay plus interest and fees. For traditional debt finance solutions like a bank loan, you will need to provide collateral to secure funding.

There are more flexible alternatives such as invoice finance that don’t require you to use your home as security.

Types of Debt Finance

There are a wide range of debt finance solutions that can be tailored to your business needs and circumstances.

Loans

Traditional loans are one of the most well-known forms of debt finance. You receive a lump sum from the lender and repay the principal plus interest and fees over the loan term. Loans are best used for significant business purchases and are usually only accessible to businesses with a long trading history and good credit rating.

Lines Of Credit

A line of credit is more flexible than a traditional business loan. The lender will set a credit limit that you can draw against as and when you need. You will usually be charged interest and a monthly fee for the facility. As you make repayments, the funds become available for use again.

For manufacturing and import/export businesses, a line of credit can sometimes be combined with an invoice finance facility to provide funding for cash flow gaps of up to 180 days.

Read more about Trade Finance Solutions.

Business Credit Cards

A business credit card works in the same way as a personal credit card. You apply for the card, and the lender sets a credit limit. You can use funds up to the credit limit and make monthly repayments on the principal and interest. Some card providers also charge a flat monthly or yearly fee.

Invoice Finance

Invoice finance is a flexible type of business finance that allows you to turn your accounts receivable into a source of fast funding. You can get an advance of up to 95% of your outstanding invoice value.

There are two main types of invoice finance: invoice discounting and factoring. In simple terms, discounting uses your unpaid invoices to access a revolving line of credit based on your outstanding invoices’ value.

Factoring works in a similar way, but the finance company takes over the collection of the unpaid invoice.

You can find out more about factoring and discounting in our blog post Invoice Discounting vs Factoring.

Invoice finance can be a good option if your business is cash hungry and has a lot of capital tied up in unpaid invoices.

Equipment Finance

If you are looking to purchase new or second-hand machinery or vehicles for your business, equipment finance can be an efficient way to spread the cost over a longer period. You can use the asset you intend to purchase as collateral for the finance.

An equipment finance facility usually involves the lender purchasing the asset for your business. You then make regular repayments on the principal and interest. Depending on the agreement’s terms, you may own the asset after your final payment, or you may be offered to buy the asset for a nominal fee.

Debt Finance Pros & Cons

Pro – Keep Full Control of Your Business

You don’t need to give up any equity or have anyone else involved in the decision making at your business. All profits generated are yours and don’t need to be shared with a third party.

Pro – Wide Range of Solutions

Debt finance can be beneficial at every stage of your business journey. You can secure a lump sum to fuel expansion or a flexible revolving line of credit to support working capital as you grow.

Pro – Tax-Deductible

The repayments on debt finance can be used as a deduction on your tax return to reduce your taxable income.

Pro – Easier to Access

In comparison to equity finance, debt finance solutions are much easier and faster to access.

Con – Hard to Qualify for a Business Loan

Banks have strict lending criteria that make traditional loans out of reach for many small businesses. According to the Reserve Bank of Australia, 90% of loans to SMEs are secured, compared to around two thirds of large business loans.

If you don’t qualify for a business loan, an invoice finance or equipment finance facility could provide the funding you need.

Con – Cost

There are always fees involved with debt finance. Even if your business has a long trading history and strong credit rating, you’ll need to pay interest and fees on the money borrowed.

Con – Restrictions on How You Can Spend the Money

If you qualify for a business loan, the lender may place restrictions on how you can spend the money. Invoice finance and other alternative debt finance solutions don’t impose these restrictions.

What is Equity Finance?

Equity finance is when you reach a funding agreement with a third-party investor, rather than a lender. In exchange for providing funding, the investor will take shares or part ownership in your business. As the company makes sales and brings in revenue, you will need to share your profits with the investor.

Types Of Equity Finance

While equity finance isn’t as varied and flexible as debt finance, there are several options you can pursue to raise capital.

Venture Capitalists

Venture capitalists are investment companies willing to provide funding for equity in growing companies that can deliver high returns. Most venture capitalists look for innovative startups that have the potential to disrupt an industry or become a nationwide business.

On average, venture capitalists invest $7M in a company. For the majority of small to mid-sized businesses, this type of finance is very hard to access.

Angel Investors

Angel investors have some similarities to venture capitalists. Both are willing to invest in growing businesses in exchange for equity. The main differences are that angel investors tend to work alone and use their own money to fund their investments.

The amount they are willing to invest is much lower than venture capitalists on average. To find an angel investor, you need to put together a detailed business plan and network to find high net worth individuals willing to invest in your business.

Crowdfunding

This form of equity finance has grown in popularity over the last decade. There are plenty of online platforms that allow businesses and potential investors to connect. Innovative startups and tech companies tend to do well with crowdfunding, with Oculus VR and MVMT Watches two noticeable examples of successful companies that started with crowdfunding investment.

As with all types of equity finance, you will need to exchange shares or part-ownership of your business.

Equity Finance Pros & Cons

Pro – Less Risk

The investor takes on most of the risk with equity finance. They will only receive a return on their investment when your business grows and generates more profit.

Pro – Less Initial Costs

There are no fees or interest payments with equity finance. You can invest the money into your business without worrying about paying it back. However, you will need to share your future profits with the investor.

Pro – Access Experience and Expertise

Finding the right investor can provide much more than capital investment. You can leverage their industry knowledge, connections, and experience to fast track your business growth.

Con – Shared Profits and Ownership

When you give away shares or part-ownership in your business, you need to split your future profits and surrender some of your control over decision making.

Con – Hard to Find

It can be very challenging for the average business to find an investor. You’ll need to prepare a detailed business plan and pitch, and be willing to look for potential investors continuously. If you need a short-term cash flow solution, debt finance is a much more suitable option.

Which Type of Business Finance is Right for Your Business?

If you need to raise capital urgently, debt finance is much more accessible. You can be approved for an invoice finance facility and receive a cash advance in as little as 24 hours. Depending on your credit rating and trading history, a traditional business loan or equipment finance can be a good solution for your long-term funding needs.

Generally, equity finance is a long-term funding solution that is harder to access. Be prepared for a long process of finding the right people to invest in your business. If you plan to grow to a national level and you’re willing to share ownership and profits, equity finance may be a good option.

ScotPac Business Finance

As with any business decision, it’s always a good idea to explore your different options before committing to a financing solution. Here at ScotPac, we offer a range of debt finance solutions to help you access the fund you need.

Every business is different, and we’re here to guide you through your options and find the best solution for you. Give us a call and speak to one of our business finance experts today.

What is Invoice Finance?

Last updated on 26th November 2024.

Business lending, including funding solutions like Invoice Finance, has increased by almost 9% in Australia in 2024. For small and medium sized enterprises, this growth has surged by over 15.4% compared to the previous year!

With cash flow management and access to necessary working capital one of the most challenging obstacles preventing businesses from growing, Invoice Finance can be a uniquely suitable solution.

But what is Invoice Finance?

Invoice Finance is an increasingly common finance solution for SMEs looking to enhance their cash flow and increase access to working capital.

In short, this financial tool allows businesses to access funds tied up in outstanding invoices, offering a lifeline during times of cash flow constraints especially when it comes to meeting short term liquidity needs.

Understanding Invoice Finance

Invoice Finance is sometimes referred to as debtor finance or accounts receivable financing.

This category of business funding solutions allows businesses to access credit upfront by using outstanding customer invoices as collateral, rather than traditional assets like property.

Notably, Australian companies are paid 26.4 days late on average. This figure demonstrates the significant challenge faced by businesses, particularly SMEs, in managing cash flow and maintaining operational stability when faced with such long payment terms, plus less-than punctual customers.

How Invoice Finance Works

1. Application

To arrange Invoice Finance, a business must apply by submitting relevant financial information and details of outstanding invoices.

2. Approval

The application is then assessed by the lender and once approved, the finance provider will advance a percentage of the invoice value – most often somewhere between 80% and 95%.

3. Collection

The outstanding invoices then need to be paid. So either the finance provider or the business (see the types of Invoice Finance below) will ensure the debt is collected.

4. Final Payment

Once the customer pays the invoice, the remaining balance of its value is released to the business, minus any fees.

Why should you consider Invoice Finance?

Invoice Finance allows small and medium sized businesses to access future cash flow today. This access to working capital can help better manage cash flow, fund expansion or contracts, pay overhead and other expenditure costs, or consolidate other debt.

But Invoice Finance also offers some unique benefits.

Improved Cash Flow

Invoice Finance enables businesses to utilise its unpaid invoices and leverage them for immediate working capital. By improving cash flow and ensuring reliability in incoming cash businesses can better meet short-term obligations such as payroll, supplier payments, and operational costs.

Flexibility

Unlike traditional bank loans, Invoice Finance does not require fixed repayment schedules. The ‘repayments’ come in the form of the business’s customers settling their invoices. Plus, at ScotPac, we offer $10,000 – $150 million facility options so you can find a solution that will grow and scale with your business.

No Collateral

With Invoice Finance, the outstanding invoices serve as the security for the finance provider so you, as a business owner, do not need to put up any personal property or asset as collateral.

Understanding the Cost of Invoice Finance

The main cost of Invoice Finance comes in the form of fees. These fees vary by provider but typically include discount fees and interest charges based on the financed amount.

Additional fees, such as administrative or credit check fees can also apply. So it is important that you understand all associated costs with your finance provider when assessing whether Invoice Finance is right for you.

Types of Invoice Finance

Invoice financing generally falls into three categories:

- Invoice Factoring

- Invoice Discounting

- Selective Invoice Finance

What is Invoice Factoring?

With Invoice Factoring, a business basically sells its outstanding invoices to the finance provider who is then responsible for managing the collections and settling the accounts.

For this reason, Invoice Factoring is best for SMEs without an independent collections team or wanting to outsource accounts receivable services.

What is Invoice Discounting?

With Invoice Discounting, your business can access the line of credit but still retains control over collections. Larger businesses with more established and capable collections department may favour this type of Invoice Finance as it comes with more favourable terms and allows for more confidentiality with customers.

What is Selective Invoice Finance?

This flexible form of Invoice Finance allows for only specific invoices being used as collateral and thus being financed rather than all outstanding ones. Another term for Selective Invoice Finance is spot factoring. SMEs with a small number of customers but with high value invoices generally favour Selective Invoice Finance.

Is Invoice Finance Right for Your Business?

Determining whether invoice finance is suitable for your business will depend on certain factors, your business objectives and general needs. Here are some factors to consider:

1. Cash Flow Needs

If your business frequently faces cash flow gaps due to delayed payments, Invoice Finance can provide immediate and reliable financial relief.

2. Customer Base

Companies with reliable and long-term customers who pay on time (meaning by the end of the favourable payment terms) are ideal potential beneficiaries for this type of financing.

3. Business Growth Goals

If you plan to reinvest your profit into further business growth opportunities but lack immediate capital, invoice financing can serve as an advantageous and strategic funding source.

Maintaining Customer Relationships

Different types of Invoice Finance offer different levels of customer confidentiality. If maintaining confidentiality is critical for your business and you have the debt collection capacity to ensure payment on the outstanding invoices, there is the option to do so.

However, even when the funding arrangement is known, it can actually enhance customer relationships by ensuring timely payments and enabling businesses to offer more favourable payment terms. To ensure ongoing positive relationships, maintain open lines of communication and deliver high-quality goods/services to preserve customer satisfaction and secure future business opportunities.

What Happens if My Customer Doesn’t Pay the Invoice?

The responsibility for bad debt will mostly depend on the terms of your financing arrangement.

In most cases, your business will be responsible for any costs associated with any unpaid invoices. However, there are ways to mitigate this risk. Your finance provider will conduct due diligence before approving invoices for funding and Bad Debt Protection can safeguard your business against the risks associated with customer non-payment.

Invoice Finance vs Unsecured Business Loans

Like Invoice Finance, an unsecured Business Loan doesn’t require collateral. However, unsecured loans differ in that they provide a business with a one-off lump sum of working capital which is then repaid over a specified term in the form of regular repayments plus interest.

There are some key differences between Invoice Finance and unsecured Business Loans. For one, loans tend to require stricter eligibility criteria to be met. It is not uncommon, in the absence of security in the form of assets, for unsecured loans to require a personal guarantee.

Invoice Finance is far more flexible and does not have fixed repayment. In general, it is a more accessible form of funding for start-ups and SMEs who may not be able to qualify for a loan.

Find out more about Invoice Finance with ScotPac today

Invoice Finance can help you transform your outstanding invoices into instant funding with a range of flexible options. Our dedicated team of lending specialists will work with you to set up a tailored financial facility.

At ScotPac, we prioritise the growth of our clients and ensure their success remains at the heart of everything we do. That’s why we’re proud to say our clients grow at a rate three times faster than the average Australian business.

To discuss how Invoice Finance could benefit your business, get in touch with our team today.

Types of Business Finance

Article updated 30/10/2024

Business cash flow and profit are not the same. Many successful companies and small business owners need funding to support working capital and fuel growth plans.

56% of businesses across the US, Canada, the UK, Australia and New Zealand experience cash-flow related pressure. That’s why maintaining sufficient cash flow and access to working capital is essential for ensuring sustainable business success.

Here’s a rundown of funding and finance options you can explore when looking for additional working capital.

Debt Finance or Equity Finance

There are two main types of business finance funding: Debt Finance and Equity Finance.

Debt Finance

With debt finance, a business receives funding from a third-party source and repays the money borrowed, plus interest and fees.

Equity Finance

With equity finance, a third party provides funding in exchange for part ownership or shares in the business.

Types of Finance: Debt Finance

Debt financing is the most common type of business finance and encompasses traditional and alternative funding sources. You don’t need to offer any equity in exchange for funding with debt finance, but you will typically need to repay the sum borrowed, plus interest.

Invoice Finance

Invoice Finance is a flexible funding solution that allows a business to turn its outstanding sales invoices into readily available funding. Instead of waiting 30+ days for your customers to pay, you can use this solution to receive up to 985% of the invoice value as a cash advance.

Unlike a bank loan, you don’t need to use your home as collateral.

This type of funding is available to businesses that sell to other businesses and raise sales invoices for their goods and services.

Trade Finance

Trade Finance is a business finance solution that helps importers and exporters cover cash flow gaps and mitigate the risks involved with international trade. It can also be used for domestic trade, along with other solutions like supply chain finance.

By using a third party to finance a transaction, the supplier can be sure they will be paid once the goods are shipped, and the buyer has protections to ensure they will receive the goods.

Buyers can use trade finance to cover cash gaps caused by having to wait for shipments and use the funding to negotiate early payment and bulk buying discounts. Suppliers can release the money tied up in goods sold and speed up cash cycles.

For a more detailed look at this type of funding, read our blog post How Trade Finance Works.

Asset Finance

Asset Finance is a type of finance that helps a business fund the purchase of high-value assets, including new and second-hand machinery, equipment, and vehicles.

This form of financing typically involves hire purchasing, finance leasing, and operating leasing. Unlike a traditional loan, the asset the business wants to purchase acts as collateral for funding, so there is no need for property security. The business makes regular repayments over a set period to pay back the principal and interest.

Business Loans

Business loans from non-bank lenders, such as ScotPac, offer a flexible financing alternative for businesses of all sizes. These loans typically range from $10,000 to $500,000 and are designed to cater to various business needs with a more streamlined application process, online platform, and faster funding approval.

Non-bank lenders also tend to have fewer documentation requirements and quicker approval times compared to traditional banks, which reduces both the administrative burden and the difficulty of meeting loan-related eligibility criteria.

Bank Loans

A bank loan can provide a large lump sum to fund the expansion of a business with a strong credit rating. The principal, plus interest, is repaid over a set period through regular repayments.

Bank loans are a very rigid type of business finance that is often out of reach for small businesses. The application process can last several months, and strict lending criteria mean you will need to submit a detailed business plan, provide collateral, and have a strong financial track record.

Business Credit Cards

Business credit cards can support working capital and cover small everyday business expenses. More accessible than a bank loan, credit card interest rates and fees can be expensive and quickly add up if you don’t clear your balance each month.

Line of Credit

A line of credit allows a business to pay for everyday expenses, cover emergency costs, and fund expansion. It works similarly to a business credit card or overdraft.

You can draw down on the available credit whenever you need. As you take out funds and make repayments, the available credit limit increases and decreases accordingly.

This type of business finance is often used alongside an Invoice Finance facility. You draw funds as and when you need them and make repayments when you raise and submit a new invoice to the lending company.

Merchant Cash Advance

A merchant cash advance is a financing solution for businesses that process significant volumes of customer card payments. The amount you can borrow is determined by the value of the card payments processed at your business.

Once funding is in place, every time you process a card payment, a percentage of the payment value is automatically used to repay the principal and interest on the sum owed. The amount you repay in a month depends on the value of the card payments you process.

This type of funding can help businesses with seasonal sales cycles, but there are many pros and cons to a merchant cash advance and interest rates are usually higher than other types of financing.

Types of Finance: Equity Finance

Equity financing covers a smaller range of funding solutions. With equity finance, you will need to give up a stake in your business in exchange for funding. There are no repayments or interest, but you will need to share some control and profits with your investors.

Crowdfunding

Crowdfunding has become a popular way for start-ups and innovative companies to seek funding. As a business owner, you don’t need to have a strong credit rating or collateral to secure financing, but you will need to create a strong promotional campaign to attract potential investors.

Crowdfunding is a long-term funding solution. You’ll need to have a compelling pitch and be willing to dedicate significant time and effort to promote your business.

Venture Capital

Venture capital is a possible funding source for businesses with high growth potential looking to raise finance. You’ll need a scalable business plan and have achieved some success already to appeal to investors. Before venture capitalists (or other financial institutions) are willing to invest, they’ll want to audit your business, so you’ll need to keep your accounts and business plan up to date.

This type of equity financing is out of reach for small businesses, with venture capitalists looking to invest significant sums of money in companies with a high chance of producing a large return.

Angel Investors

This type of equity finance has some similarities to venture capital. Essentially, you offer shares or part-ownership in your business in exchange for funding. You’ll need a detailed business plan, up to date accounts, and growth potential to attract potential investors.

Angel investors typically work alone and use their own money to fund investments. Alongside funding, an angel investor can offer experience, connections, and advice to help you grow your business.

Finding an angel investor can be challenging. You’ll need to attend events, explore mutual connections, and expand your network to increase the chances of finding an investor.

Family and Friends

Mixing business with personal life can create problems, but friends and family may be able to offer financial support to help you grow your business. Many of the most successful companies, including Amazon, were started with a loan from a family member.

If you do seek funding from friends and family, be clear about the terms of the financing. Put together a basic contract outlining the share of equity or repayment terms.

Determining the Types of Finance You Need to Improve Business Cash Flow

When you’re determining which of type of business finance is right for your business, ask yourself the following questions:

- How much capital do I need?

- How quickly do I need funding?

- What types of funding will I qualify for?

- How much can I afford to repay per month?

If you require business financing to cover cash flow gaps as your business grows, a flexible Invoice Finance facility could be a good solution. Alternatively, you may consider a Business Loan or Asset Finance to source the capital you need. the capital you need.

Are you seeking Business Funding?

Most finance companies offer at least some of the previously mentioned types of business finance. If you need assistance identifying the right business finance option for your circumstances, ScotPac is here to provide expert advice.

Speak to one of our lending specialists today to explore different business finance options and find the one best suited for your business.

Invoice Discounting vs Factoring?

Updated 12th July 2023

Small and medium-sized enterprises (SMEs) across Australia face various challenges in securing funding from traditional lenders. From financial criteria to extended payment times, there have been a variety of factors that have contributed to a 2.9-fold increase in the time taken to receive payments compared to the previous year.

Unlocking Capital with Invoice Discounting and Invoice Factoring

Invoice finance, which includes both invoice discounting and invoice factoring, allows businesses to access a valuable funding facility.

Instead of waiting for delayed and outstanding invoices from customers/clients to be settled, which can take up to 30 days or more, invoice finance unlocks the owed capital through a third party – a financial institution – and allows immediate payment and eased cash flow.

Who uses Invoice Finance?

Invoice finance is a beneficial funding solution for businesses that engage in business-to-business transactions and provide extended payment terms.

If your company faces challenges with accessing reliable working capital due to the delay between invoicing and receiving payment, invoice finance can provide a viable remedy.

Invoice finance facilities prove particularly beneficial for businesses operating in various sectors such as:

1. Manufacturing

Manufacturers often face cash flow challenges caused by delayed payments from buyers. Invoice finance ensures a steady flow of funds, allowing manufacturers to meet operational requirements without interruption.

2. Transport

Transportation businesses often experience uneven cash flow due to payment delays from clients. Invoice finance provides immediate access to working capital, enabling transport companies to cover expenses and invest in more growth.

3. Storage

Storage facility providers require consistent cash flow to maintain operations and manage overhead costs. Invoice finance ensures timely access to funds, enabling storage businesses to sustain their operations efficiently.

4. Wholesale Trade

Wholesale traders often face cash flow challenges caused by the waiting for payment from retailers or distributors. Invoice finance alleviates this delay, providing wholesalers with the necessary funds to continue operating smoothly.

5. Recruitment and Staffing

Recruitment agencies and staffing firms frequently encounter delays in receiving payment for their services. Invoice finance eliminates the wait, empowering these businesses to pay their employees and pursue new opportunities without hindrance.

What is Invoice Discounting and Invoice Factoring

Both invoice discounting and factoring leverage outstanding invoices to help small and medium businesses relieve their cash flow issues. Nevertheless, there are crucial differences between the two.

Invoice Discounting

Invoice discounting involves a finance company providing up to 85% of the invoice value upfront as a cash advance. When your customer pays the invoice, you receive the remaining balance less fees that are owed to the financial institution.

Invoice discounting allows businesses to retain ownership of the invoices due to them while still receiving a percentage of the total value as an upfront payment from the financial institution.

The responsibility to continue collecting payment from the owing customers or clients remains on the business itself, with the balance of capital released by the financial institution provided once all the invoices are duly settled.

Invoice Factoring

Invoice factoring is a funding facility where companies effectively sell their accounts receivable for up to 95% of the value of unpaid invoices upfront.

Once the invoices are submitted for factoring, the finance company takes on the responsibility of collecting payment from your customer. When your customers settle their accounts, you then receive the remaining balance of the invoice less fees for the services provided.

In contrast to discounting, a factoring arrangement is when a business sells its invoices to the financial institution. Again, an immediate payment is provided to the business in exchange and as per the agreed terms.

In this case, however, the financial institution now assumes responsibility for collecting payments from the customers or clients who owe money.

Which is better: Invoice Factoring vs Discounting?

Both types of invoice finance are valuable ways for businesses to quickly and easily access advanced payment. The pros and cons of each, however, may make one more suitable for your business than the other.

For a more detailed look at how these two financing solutions work, read our guide on How Does Debtor Finance Work.

Invoice Factoring: The Pros

1. Greater Accessibility

Invoice factoring is particularly accessible for small businesses and organisations without dedicated accounts and collections departments. The reason for this is because responsibility for debt collection shifts over to the third party.

On the other hand, invoice discounting leaves the onus of settling the outstanding invoices with the business. Therefore, qualifying for invoice discounting will normally require a reliable track record of timely invoice collection and/or an internal accounts department.

2. Higher Upfront Payment

Factoring typically offers a higher upfront payment. Businesses can often receive up to 95% of the value of their invoices immediately.

In comparison, discounting provides around 85% of the invoices’ value upfront. The remaining balance (less fees) is released once the invoices are all settled.

3. Requires Less Time and Effort

With your financial facility provider handling all credit control and payment chasing, your business is able to focus on operational management and growth of your business.

Considering that Australian businesses spend as much as 8 hours per week chasing payments (totalling 52 working days per year) that’s quite a significant time-saving.

4. Less Approval Criteria

An end-to-end invoice factoring solution covers your accounts receivables completely. This gives you protection against overextending with customers that may be unable to pay. Part of the discounting application process is credit checks on your clients. This helps you by making it more likely that future business will be done with customers who pay on time.

Invoice Discounting: The Pros

1. Greater Confidentiality

With an invoice discounting facility your accounts receivable are not sold to the finance company. While your business will still need to handle the payment collection, your customers or clients won’t know anything about the invoice finance arrangements.

Factoring, in contrast, involves the selling of your outstanding invoices and the financial institution will be collecting payment directly. Consequently, your business won’t have the same level of confidentiality.

2. Lower Cost

Invoice discounting generally incurs lower costs compared to factoring. Because factoring includes additional accounts management as well as the capital advance, there are higher costs and more criteria required to obtain approval.

Invoice discounting facilities, by leaving the responsibility (and ownership) of the outstanding invoices with the business, don’t have to cover the costs of these additional services.

3. Build Customer Relationships

With the business itself responsible for collections and accounts, you may find it easier to build positive relationships with customers. Introducing a third-party – such as a lending financial institution – can complicate things, especially if you don’t choose a reputable finance company.

4. Better Future Proof Large Businesses

Discounting is typically highly beneficial for larger, more established and growing companies with an in-house collections team or one that is looking to build a team adept at settling outstanding invoices.

Which type of invoice finance is right for you?

Both types of invoice finance can help an SME to improve cash flow and better manage access to much-needed working capital. Whether you’re needing to speed up the cash cycle or reinvest in growth, both factoring and discounting can be viable options.

The right solution for your business in particular will depend on your unique circumstances, your business objectives and your needs.

Considering the pros and cons of each type, we recommend getting in touch with our lending specialists at ScotPac. They’ll be able to provide tailored expert advice as to which solution suits your business best.

Invoice Finance Case Study: Strait Brands

Strait Brands, a premium Tasmanian gin and vodka producer, approached our team here at ScotPac for funding solutions to support their national and overseas expansion plans.

Through flexible and tailored invoice finance arrangements arranged by our experts, Strait Brands effectively managed their cash flow effectively and overcame the financial burden of excise duty commitments.